Market Analysis – January 10

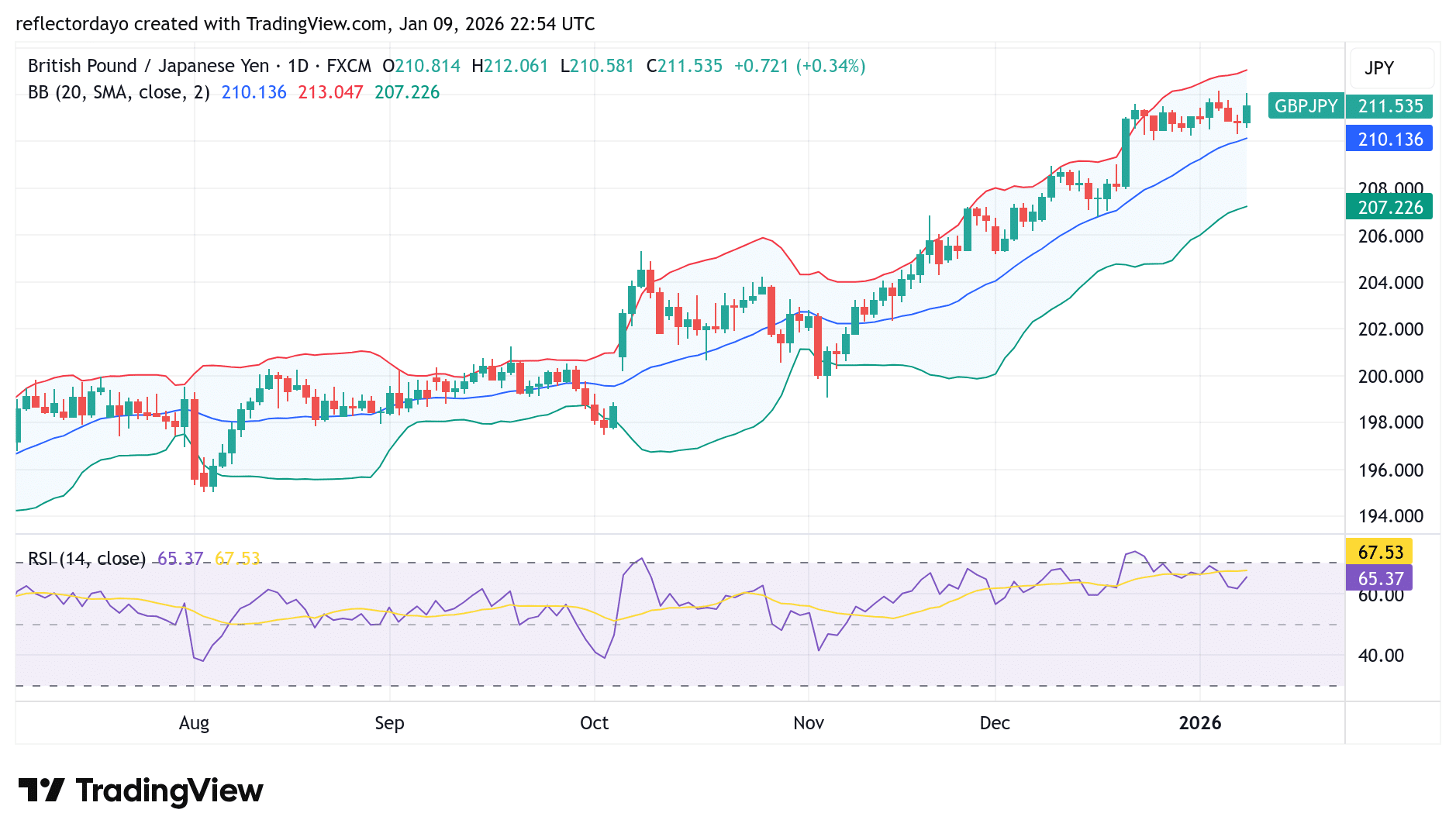

The GBP/JPY pair is trading with a mild bullish bias as renewed geopolitical and trade-related tensions in Asia weigh on the Japanese Yen. Ongoing frictions between Japan and China, coupled with China’s expansion of export restrictions, have heightened concerns over regional trade flows and supply-chain stability, weakening demand for the Yen. At the same time, wide interest-rate differentials continue to favor the Pound, offering underlying support to GBP/JPY and helping the pair edge higher despite broader market caution.

GBP/JPY Key Levels

Supply Levels: 212 , 214, 216

Demand Levels: 208, 207, 206

GBP/JPY Tests the 212 Level

In recent trading sessions, the GBP/JPY pair has gained notable upward traction, with price action briefly testing the 212 level during the session. The market established a firm support base around the 210 level, from which bulls renewed their attempt to challenge the 212 resistance. This move was followed by a period of profit-taking, leading to a modest pullback.

The 212 level has now emerged as a key resistance zone, having previously capped bullish advances. Despite the rejection, bulls have managed to keep the price hovering near the 211 level, suggesting that bullish sentiment remains strong and that buyers continue to maintain control of the market structure.

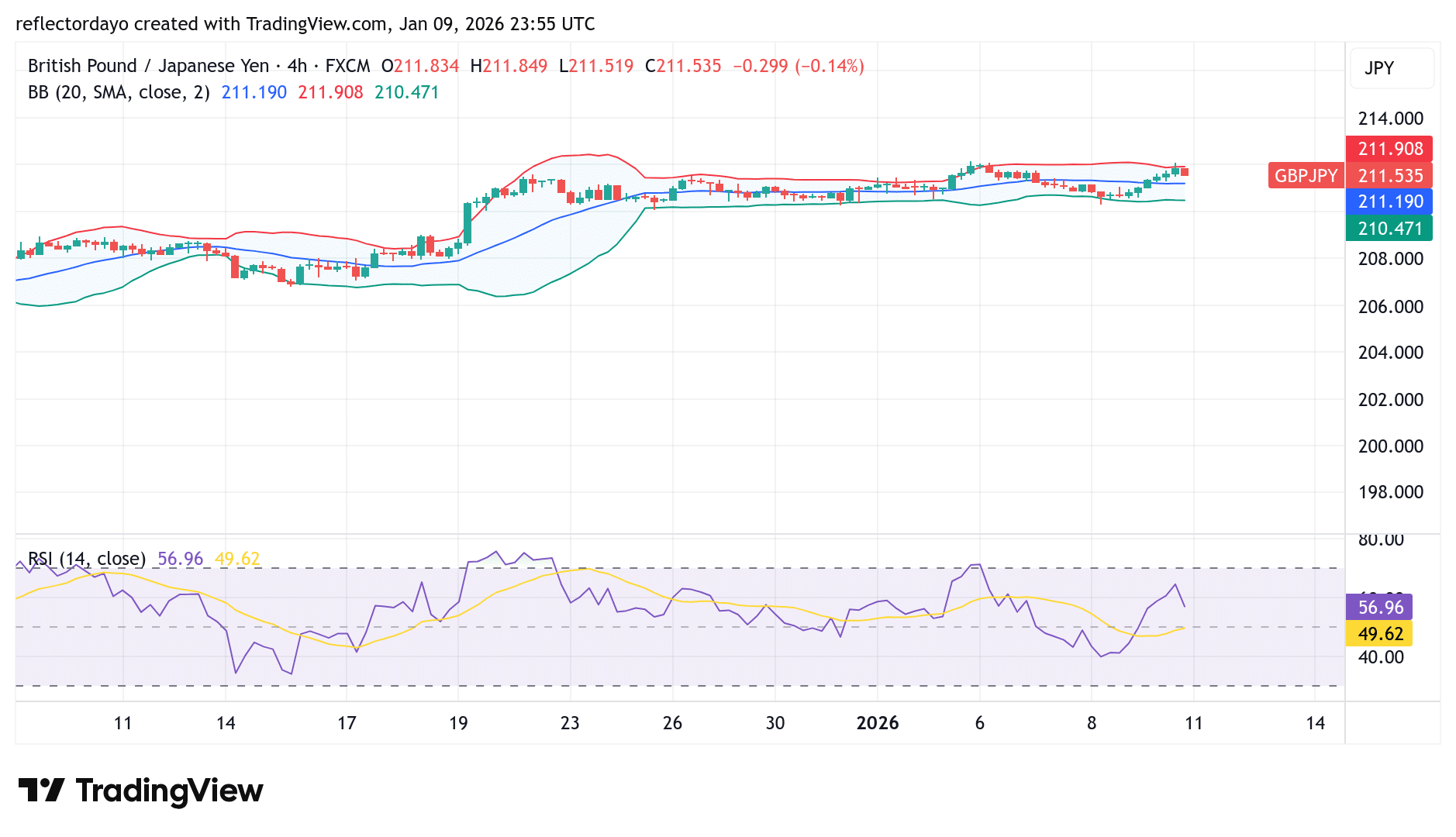

GBP/JPY Short-Term Trend: Ascending Price Channel

From the perspective of the 4-hour chart, price action is currently consolidating at higher levels, reflecting sustained bullish momentum. The ascending price channel has now established the 210 level as key support, while 212 serves as immediate resistance. This structure highlights a clear improvement in bullish sentiment. Given the bulls’ recent performance and their ability to defend higher lows, the market may be positioning for a potential breakout above the 212 resistance level.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.