EURUSD Price Analysis – April 26

As the third week of gains progresses, and Friday’s close above the daily cloud top adds to the optimistic sentiment, the pair retains a strong buying tone floating around a two-month high at 1.2116 at the time of writing. Another positive trend is the loosening of sanctions in Italy and France on Monday.

Key Levels

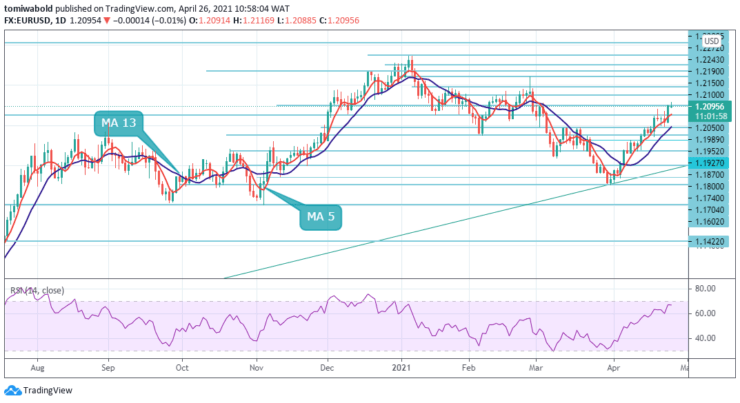

Resistance Levels: 1.2243, 1.2190, 1.2150

Support Levels: 1.2050, 1.1989, 1.1952

The EURUSD has driven up for the 2nd day in a row, reaching a two-month high of 1.2116 at the time of writing, with an eye on the 1.2150 marks. In the meantime, the EURUSD’s advance is slowing as it approaches resistance at 1.2150. On the chart, we can still see the next key resistance of Feb. 26 waiting to be tested which may indicate further room for an upside run.

In the event of an abrupt pullback, the price is likely to stall near moving average 5 and the 1.2050 level of support for the time being. A close below this mark, however, could bring the March 31 lows of 1.1704 into play in the long run. If the current bullish trend persists, the EURUSD may need to break out above the 1.2190 level to confirm further gains.

The EURUSD is trading forward moderately bullish on the 4-hour chart, with the 5 moving average ahead of the moving average 13 upwards. Beyond its middle points, the RSI stays focused to the north. A current bullish trend could target a 61.8 percent projection from 1.0635 to 1.2150 levels from 1.1602 to 1.2190 levels shortly.

On the 4-hour chart, the price recovery from the 1.1952 low shows the direction of least resistance to the upside. So far, a decisive break over the 1.2200 marks appears to be in the subsequent sessions. The currency pair is currently trading around the 1.2100 marks, having reached a peak of 1.2116 in the Asian session.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.