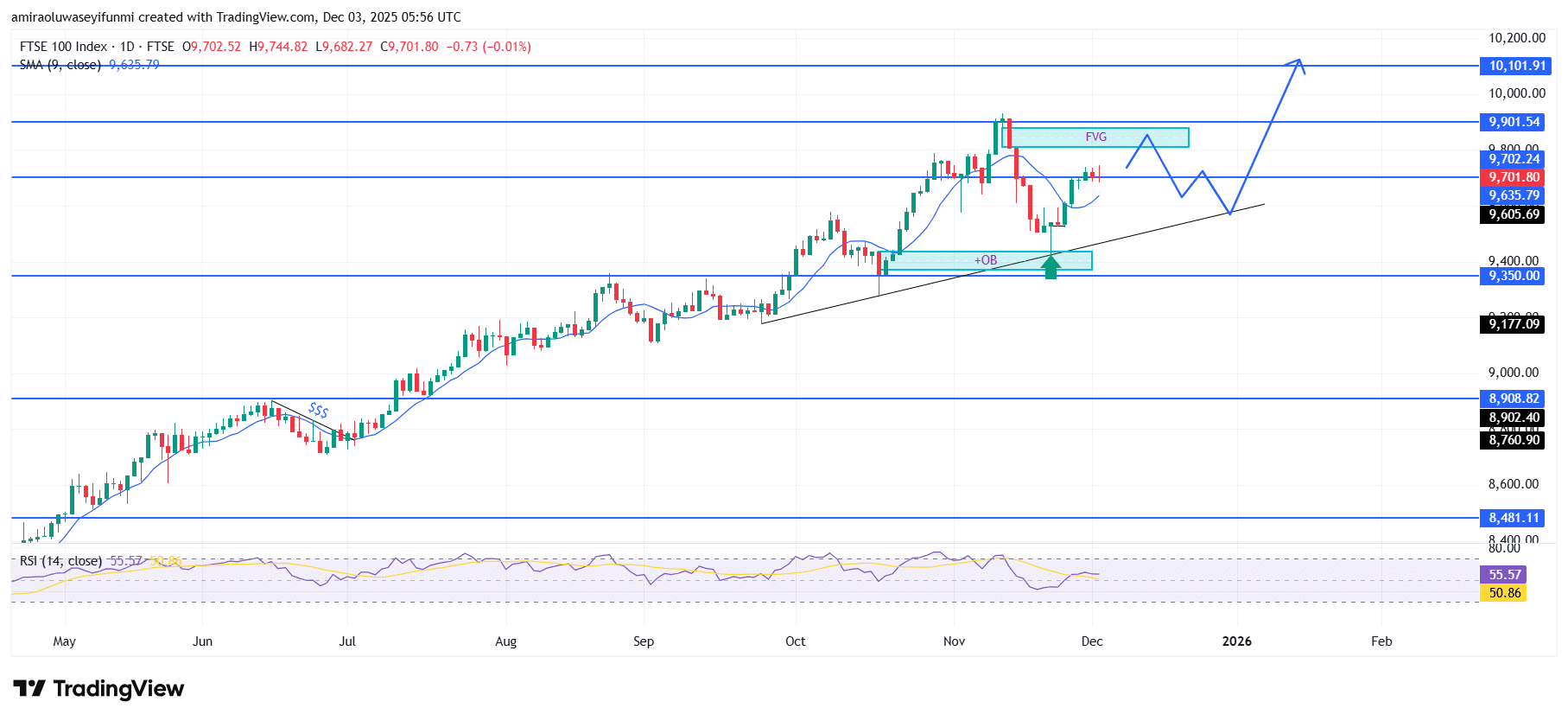

FTSE 100 Analysis – December 3

FTSE 100 positions for an orderly return to upward momentum. The index is progressing through a measured cooling phase after its recent upswing, with price stabilizing above the near-term moving average around $9,660. Broader momentum signals remain balanced, as the RSI holds within a neutral band that typically supports continued buyer engagement rather than indicating exhaustion. This blend of moderated momentum and a consistently aligned trend structure suggests that the underlying upward bias is largely preserved.

FTSE 100 Key Levels

Supply Levels: $9700.0, $9900.0, $10100.0

Demand Levels: $9350.0, $8900.0, $8480.0

FTSE100 Long-Term Trend: Bullish

Structurally, the index is navigating a controlled pullback from the upper-value region near $9,900, where sellers briefly imposed pressure and drove price toward the rising trendline. The market is now approaching the liquidity cluster and prior accumulation zone around $9,350–$9,400, an area that has historically supported significant demand. Alongside the ascending trendline, this region is likely to act as a platform for renewed accumulation before the next upward phase unfolds.

Looking forward, a constructive reaction from the mid-$9,300 zone would likely restore bullish momentum, positioning the index to revisit the $9,800–$9,900 region as its initial target. A decisive break above $9,900 would clear the existing ceiling and set the stage for an advance toward $10,000, with potential expansion toward $10,100 thereafter. As long as structural supports remain intact, the broader outlook continues to favour a renewed bullish phase into early 2026.

FTSE100 Short-Term Trend: Bearish

FTSE 100 is displaying early signs of downside rotation on the four-hour chart as price stalls beneath the premium zone near $9,900 and falls out of alignment with the short-term moving average. The formation of lower highs reflects weakening bullish commitment and signals a probable drift toward the ascending trendline around $9,520–$9,540.

RSI momentum is also softening, reinforcing expectations of continued corrective pressure. If sellers maintain their current advantage, a breakdown toward the $9,350 support zone remains the most likely outcome, aligning with patterns often highlighted in forex signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.