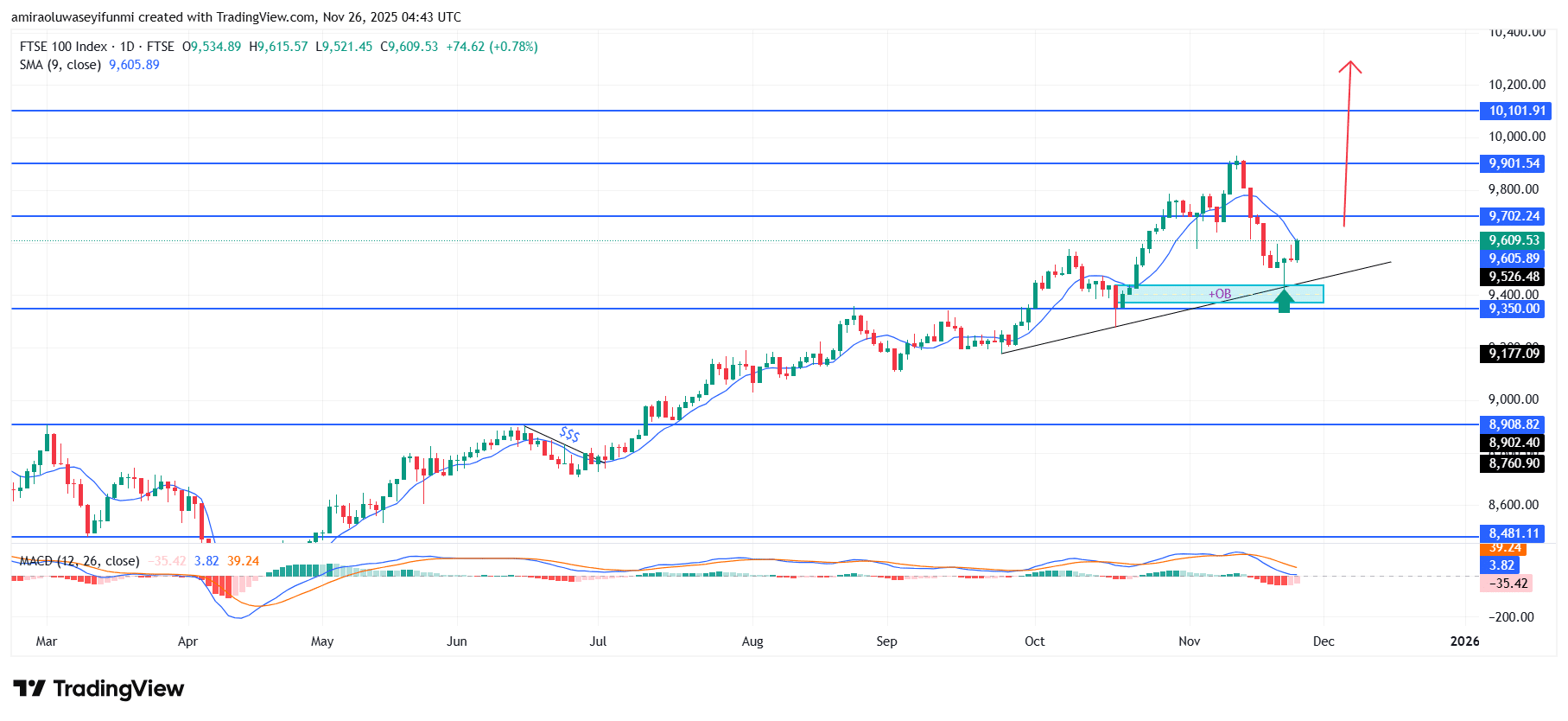

FTSE 100 Analysis – November 26

FTSE 100 shows renewed bullish momentum amid structural recovery. The index is demonstrating a renewed bullish tone as price stabilizes above its short-term moving average and reacts positively to improving momentum indicators. The MACD histogram is beginning to flatten near the zero line, signalling that downside pressure is weakening, while the 9-period SMA around $9,610 is gradually regaining upward slope. This alignment between trend and momentum supports a constructive outlook, suggesting that buyers are re-establishing control after the recent corrective decline.

FTSE 100 Key Levels

Supply Levels: $9700.0, $9900.0, $10100.0

Demand Levels: $9350.0, $8900.0, $8480.0

FTSE100 Long-Term Trend: Bullish

From a technical perspective, price has respected the rising trendline drawn from earlier swing lows and reacted strongly from the demand block around $9,350. The rebound has pushed the index back toward the short-term structure, reinforcing the strength of the ascending channel. Initial resistance remains at $9,700, where previous supply restricted bullish attempts, but the market’s ability to maintain higher lows suggests active accumulation within the range.

Looking forward, holding above $9,700 would reinforce bullish commitment and pave the way for a move toward the $9,900 resistance area. A clean breakout above this zone could accelerate a broader continuation toward the upper target near $10,100, where long-term sellers may reappear. As long as buyers continue to defend the $9,350–$9,400 support area, the medium-term outlook remains upward-leaning, supporting expectations of sustained appreciation into the year’s close.

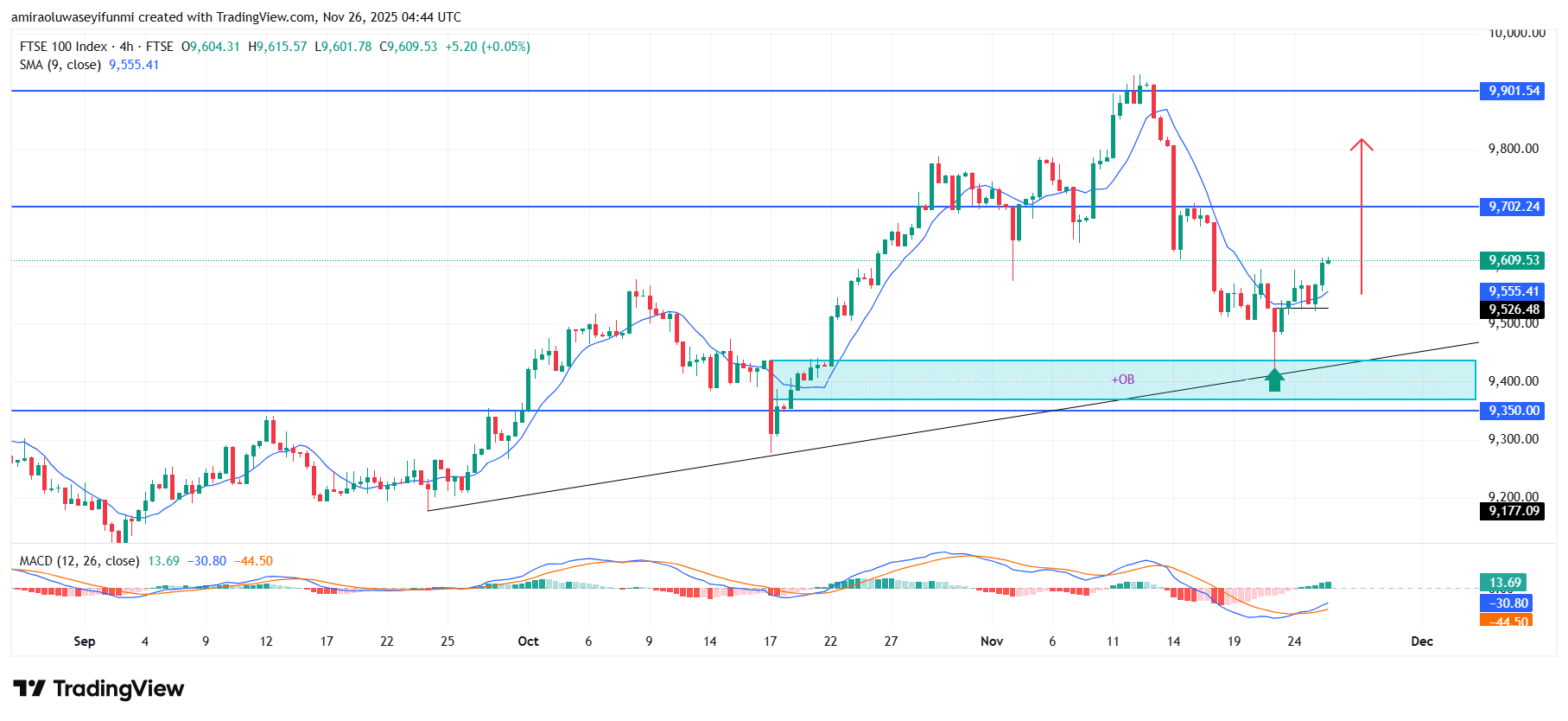

FTSE100 Short-Term Trend: Bullish

The FTSE 100 is regaining bullish momentum on the four-hour chart as price rebounds from the $9,350 demand zone and climbs back above the short-term moving average. Momentum continues to improve, with the MACD lines beginning to converge upward and signalling a strengthening shift in sentiment. Price action is forming a constructive higher-low pattern, reinforcing the underlying ascending structure. A steady advance toward $9,700 may unlock further upside toward $9,900 if buyers maintain pressure, aligning with expectations commonly monitored through forex signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.