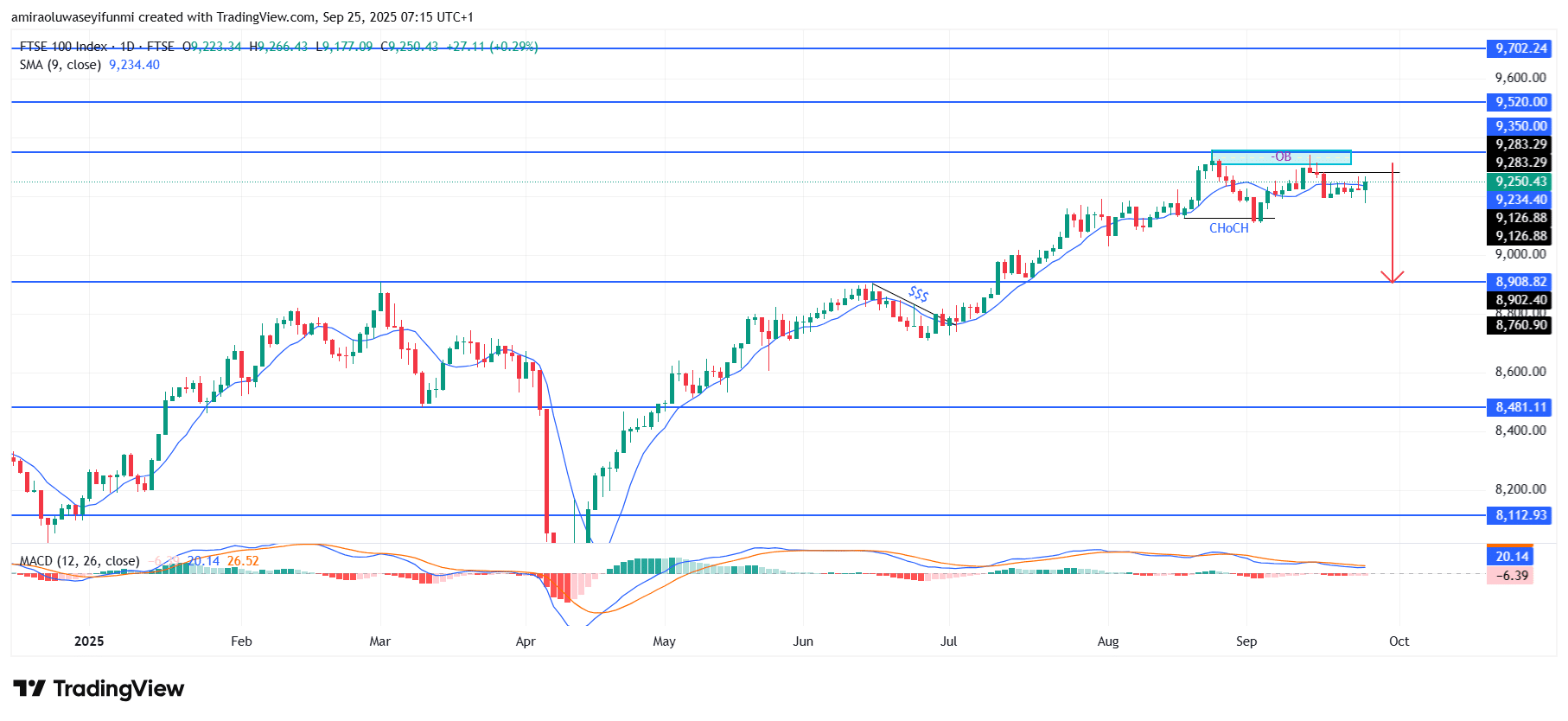

FTSE 100 Analysis – September 24

FTSE 100 exhibits waning strength as downside forces take control. The index is showing clear vulnerability after stalling beneath the $9,350 resistance ceiling. Price action has slipped under the 9-day Simple Moving Average near $9,230, reflecting a shift where selling pressure is outweighing the recent phase of sideways accumulation. The MACD histogram has also crossed into negative territory, signaling weakening momentum and declining buyer participation. Together, these indicators depict a market environment leaning toward deterioration.

FTSE 100 Key Levels

Resistance Levels: $9350, $9520, $9700

Support Levels: $8900, $8480, $8110

FTSE 100 Long-Term Trend: Bearish

Structurally, the index attempted to break the supply corridor between $9,350–$9,520 but was firmly rejected, leaving behind a visible Change of Character (CHoCH) that marks the shift in directional bias. Sellers absorbed buy orders at the upper band, while the subsequent drop beneath $9,230 confirmed that bearish forces have gained control. Current trading around $9,130–$9,120 is testing a fragile support area, and losing this level could accelerate selling momentum.

Forward projections place the FTSE 100 on course for the $8,910–$8,900 demand region, an area aligned with past structural pivots. A decisive break below this zone could deepen the retracement toward $8,480, in line with broader corrective flows. Only a strong recovery above $9,350 would challenge this bearish outlook. Until that unfolds, short-term expectations remain tilted toward continued bearish dominance.

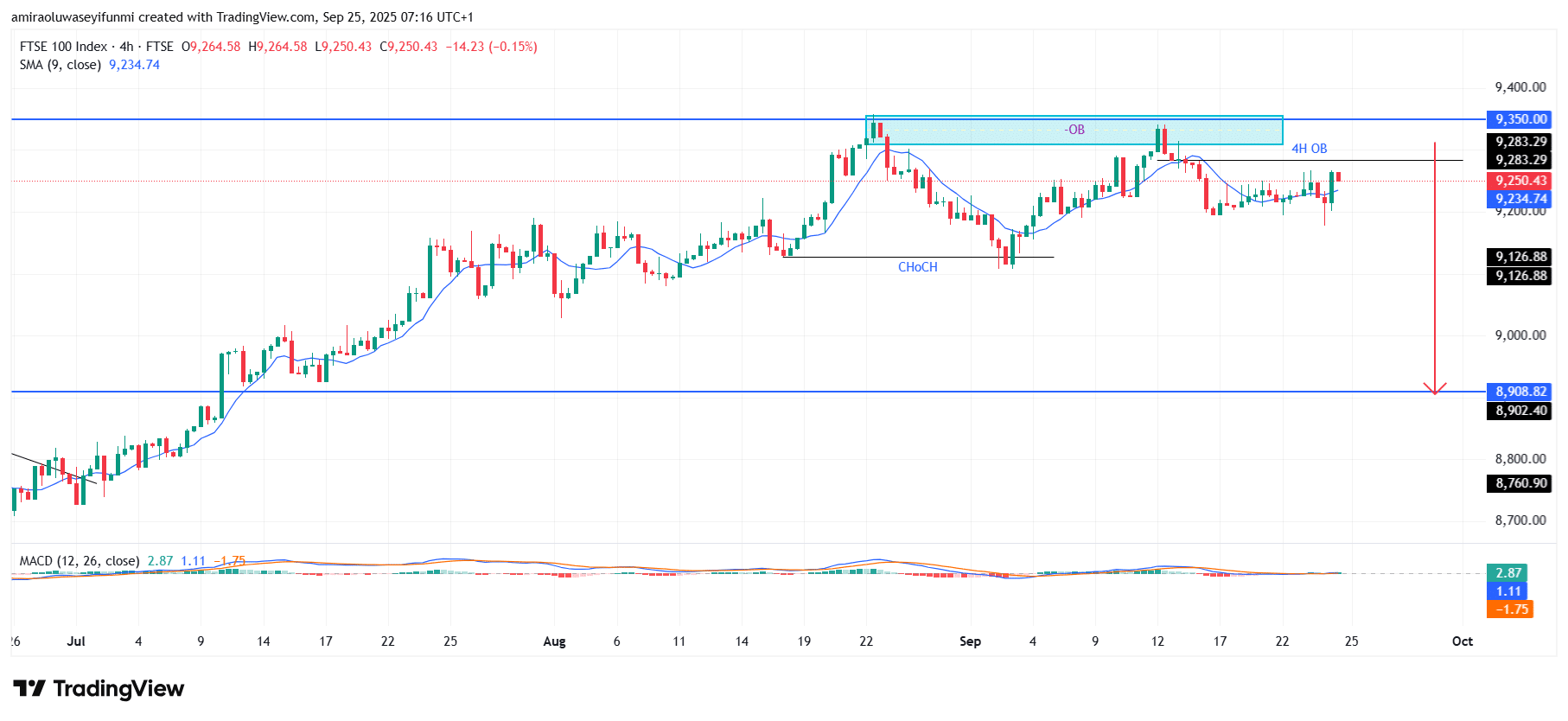

FTSE 100 Short-Term Trend: Bearish

FTSE 100 is showing bearish intent on the four-hour chart after multiple rejections from the $9,350 supply zone. Price is currently trading below the 9-period SMA at $9,230, reflecting weakening upward momentum.

The recent Change of Character (CHoCH) confirms sellers are regaining control after exhausting bullish attempts. A move toward the $8,910 support area remains the most probable short-term scenario, and traders may increasingly turn to forex signals to navigate such volatile conditions.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.