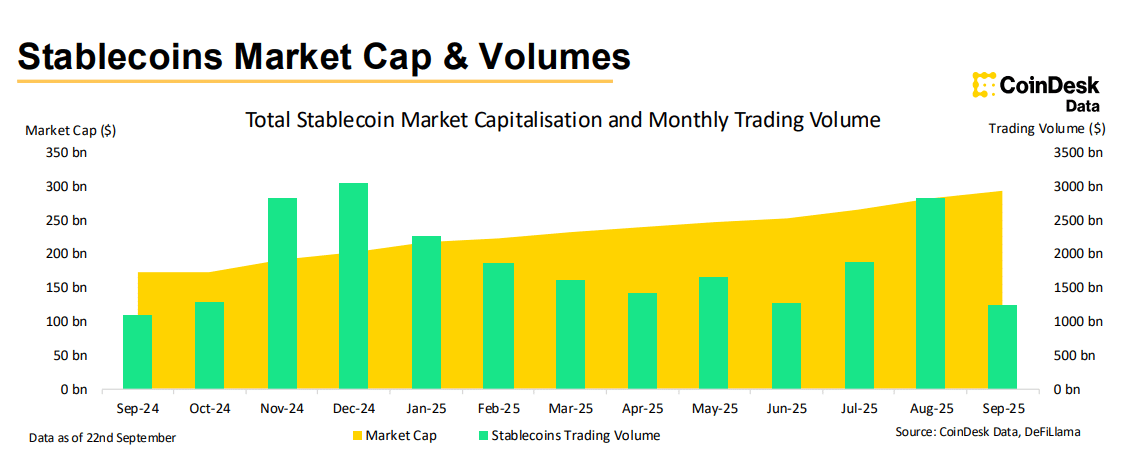

The stablecoin market reached an all-time high of $293 billion in September 2025. This marks the 24th straight month of growth for these digital assets.

Market dominance slightly decreased to 7.34% from August’s 7.36% as broader crypto markets faced seasonal pressure.

Tether (USDT) continues leading with $172 billion in market cap. However, its market share dropped to 58.8% from 59.4% the previous month. USD Coin (USDC) grew 3.27% to $67.1 billion. Ethena’s USDe posted impressive 14% growth, reaching $14.1 billion.

Federal Reserve Rate Cuts Impact Stablecoin Revenue

The Federal Reserve’s 25 basis point rate cut will cost major stablecoin issuers approximately $500 million in annual revenue. USDT faces the largest impact at $325 million lost revenue. USDC follows with $160 million in reduced earnings.

This revenue hit stems from how stablecoin issuers generate profits. They invest user deposits in treasury bills and money market funds. Lower interest rates mean smaller returns on these investments.

Trading volumes reached $1.25 trillion in September but remain on track to finish below August levels. This follows a three-year pattern where September typically sees reduced activity compared to previous months.

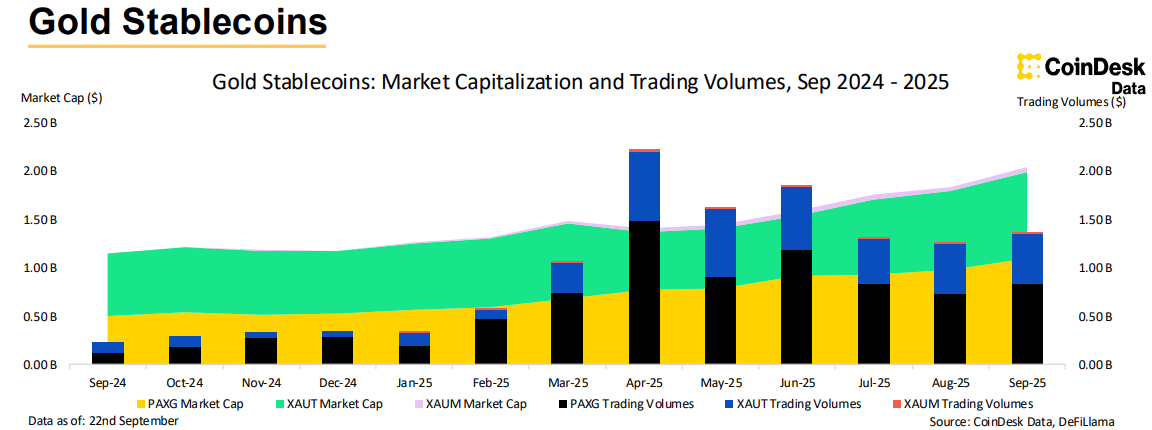

Gold Stablecoins Reach New Heights

Gold-backed tokens surged 11.1% to $2.04 billion as gold prices hit record highs of $3,800. Paxos’ PAXG dominates with 54% market share and a $1.10 billion market cap. Tether’s XAUT holds 43.7% at $890 million.

Trading activity for gold-pegged tokens jumped 8.09% to $1.37 billion. This increased demand reflects gold’s strong performance versus Bitcoin since mid-August. Digital asset investors are showing growing interest in precious metal exposure.

New developments include Native Markets launching USDH on the Hyperliquid platform. This new stablecoin aims to challenge Circle’s USDC dominance on the exchange. USDC currently holds 96% market share with $6.02 billion in supply on Hyperliquid.

The stablecoin sector shows resilience despite seasonal trading slowdowns. Continued growth in market capitalization demonstrates sustained demand for price-stable digital assets among traders and institutions.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.