Looking for forex trading tips? trading forex can be a superb way to make consistent profits and diversify your trading portfolio. But, if you are a newbie trade – it’s likely that you need a few pointers to ensure you get your forex career off on the right foot.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

Crucially, putting forex trading tips into practice can help you hone in on your existing trading skills, as well as potentially learning something new.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

We’ve put together 10 of the most important forex trading tips of 2023 that we think are worth your attention.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Forex Trading Tip 1: Understand the Forex Markets

We must stress how important it is to have a good understanding of the forex market before risking your own funds. By taking the time to educate yourself on things like currency pairs, the spread, and leverage – you could save yourself a lot of stress and money in the long run.

As such, in the initial section of our forex trading tips page, we have listed some of the most important things to understand before you take the plunge.

Currency Pairs

Each currency pair is made up of 2 different currencies. The value of each pair is therefore based on the exchange rate of the two currencies.

As an example, let’s use the EUR/USD. In this currency pair, EUR is the ‘base currency’, and USD is the ‘quote currency’. This will be the case no matter which currency you are using.

In other words, the base currency will always be quoted first, and the second currency will be quoted second. Most importantly, both the first and second currency can weaken or strengthen, and so the exchange rate is constantly changing.

If the base currency grows stronger against the quote currency, the currency pair value would rise. On the other hand, if the base currency gets weaker, the currency pair value will fall.

Forex Market Orders

Orders allow you to enter or exit a trade you are interested in. These orders fall into 2 categories which are ‘buy orders’ and ‘sell orders’. Put simply, a buy order indicates that you think the currency pair will increase in value, and a sell order means the opposite.

For example:

- Let’s say your currency pair is EUR/USD and that the value of the EUR is 1.1334.

- You may suspect that the EUR is going to rise against the USD. So in that case, you might issue a buy order to your broker.

Then, you need to determine whether you want to utilize a ‘market’ order or a ‘limit’ order. By placing a market order you are essentially placing an order to buy or sell at the next price attainable.

Now, remember that the currency pair asking price is unlikely to be 1.1334 on the nail, as the price changes on a second-by-second basis. As such, a market order will likely get you a price just above or below 1.1334.

On the other hand, if you were to place a limit order, you get to specify the exact price that you enter the market. You would, however, need to wait for the price to be matched by another seller before the order goes live.

Spread

In a nutshell, each and every forex trade comprises of two separate prices – a buy price and a sell price. The difference between the two prices is what is known as the spread. It is important to have a basic understanding of spreads, as this is an invaluable part of your forex trading journey.

- For example, let’s suppose that the buy price is 1.1335 and the sell price is 1.1330.

- 1.1334 (buy) – 1.1330 (sell) = 0.0004 (pips).

- In this case, the spread is 0.0004, which is the difference between the buy and sell price.

Throughout the course of a trading day, spreads fluctuate. This spread is swayed by various different factors such as liquidity (how quickly an asset can be bought or sold) and volatility (the variable movement of forex trade movements).

Major currency pairs are traded in much higher volumes than major or exotics currencies. Put simply, the more in demand the currency is, the lower the trading costs will be. This is because the spread will be lower (tighter).

Major or more exotic currency pairs tend to have a wider spread than majors due to the lower trading volume. As such, always try to make yourself aware of the size of the spread, as this can result in you have higher trading costs.

Leverage

Fundamentally, leverage is loaned capital used to multiply your prospective returns and is a big part of trading to make a profit. When you’ve opened up an account with your forex broker you will probably be offered leverage.

If you think of leverage in terms of real estate, you’re essentially controlling an expensive property with a small down payment. In other words, you are controlling a big asset using a small amount of money.

Forex leverage can range from 1:2 all the way up to 1:500 or more.

- If you wager £200 of your trading fund and apply leverage of 1:20 (or 20x), this means instead of trading with £200, you are now trading with £4,000 (£200 x 20).

- With the same wager of £200, if you made gains of 1% you would have ordinarily made £2 (1% of £200 stake). However, with a leverage of 20x, your profit is actually going to be £40 (£2 x 20).

When it comes to leverage, it is important to know your limits. By setting your leverage ratio in line with your experience, you are less likely to find yourself in a position where you are losing more than you can afford to.

With this in mind, it’s a good idea to really have a look at your finances and work out what your realistic budget is, and what you would be comfortable losing. As a side tip, watch out for illiquid currency pairs integrated with leverage, as the higher volatility levels could spell trouble.

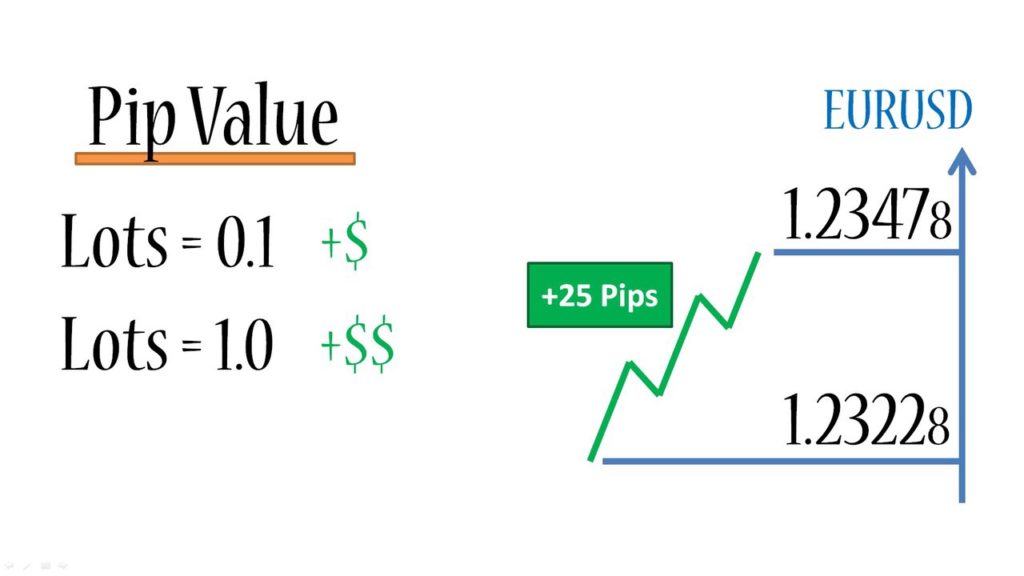

Pips

‘Pip’ is an acronym for ‘point in percentage’ and serves as the minimum amount which a currency pair will shift within the trading market. In simple terms, the pip illustrates any tiny changes marked in the currency pair.

For example, you have a quote for GBP/USD which is 1.2400. To clarify, this means that for every £1 you can purchase 1.2400 US dollars. If there was a change and the pip was to increase by 1, then the pair would now be worth 1.2401.

Generally speaking, when it comes to USD currency pairs the pip would be $0.0001 of the quoted price, often referred to as 1 basis point. As such, a pip is 1/100th of 1%; or four decimal places. The main exception to this rule is trading pairs that contain the Japanese yen, which typically carries two decimal places.

Margin

A margin is comparable to a down payment. It is the amount of money deposited by you so that you can trade and maintain positions within the market.

While your position is active, your margin will be looked after by the forex broker if you have leverage in play. This is because the trader is essentially borrowing from the broker. So, if you had £100 and wished to trade with £1,000 – your leverage would amount to 1:10. In turn, your margin would be £100, as this is 10% of the £1,000 position size!

Forex Trading Tip 2: Make a Plan and Stick to it

A key element of having a successful and profitable trading career is having your own personal plan in place. Your trading plan is going to provide a good framework to guide you through the ever-changing currency prices.

With this in mind, one of the best forex trading tips we can offer you is to think about what your long-term investing goals are. In your plan, you can include daily profit targets, bankroll management, and the number of hours per day you want to spend on research and trading.

Profit Targets

At some point during a trade, there needs to be an exit plan. This is the point at which you close the position and thus – you will either have made a profit or a loss. With that being said, it is crucial that you have a profit target in mind before you place an order.

For example, let’s suppose that you are trading GBP/USD. You think the price of the pair will rise, and so you place a buy order. But, before you do, you also place a take-profit order. This amounts to 1% of the position size. Put simply, your profit target is 1%, and when this gain is triggered your position will be closed automatically.

Ultimately, trading with profit targets makes it easier to assess whether or not the trade is worth the risk by aiding you in filtering out bad decisions.

Daily Research/Time Devotion

It might be a good idea to select a few markets to focus your attention on to start with. And when it comes to time management, it’s also good to set yourself some targets. Once you have thought about how much time you are to commit to forex trading, try to stick with it.

It’s also a really good idea to dedicate some time to just researching and studying financial news and technical analysis, as this is going to help you make the right trading decisions. Crucially, many traders keep a diary. By making note of your trading activity, it can greatly help you reevaluate your trading strategy in the future.

Forex Trading Tip 3: Always Start With a Demo Account

You could be forgiven for assuming that forex demo accounts are just for trading newbies. On the contrary, they are extremely beneficial to both new traders and experienced traders alike. Trading in a market which turns over $5 trillion on a daily basis can be a daunting prospect. So, it makes perfect sense to have a practice run on a demo account which reflects the real-life market environment.

It doesn’t matter whether you need to learn the ropes from the very beginning, or whether you just want to practice some of your new forex trading strategy ideas – opening a demo account is a wise decision for any trader.

Forex Trading Tip 4: Technical and Fundamental Research

Technical and fundamental analysis are complete opposites, but both have their benefits when it comes to researching and predicting forex price trends.

As such, this is one of the most important forex trading tips for you to master. To help clear the mist, below you will find a brief explanation of both research methods.

Fundamental Analysis

Fundamental Analysis studies the overall condition of the financial environment. This is done by analysing anything which might have an effect on currency prices – such as the world’s political unrest, the economy (unemployment, etc.), or a world health crisis such as COVID-19.

Essentially, supply and demand determine the price of a currency, so it makes sense to study anything which is likely to impact the health of an economy. In other words, if an economy is performing badly, its respective currency is likely to suffer.

There are a few different angles that you can utilize to help with fundamental analysis, such as:

- GDP reports.

- Commentary from the IMF.

- Economic calendars.

- Financial news.

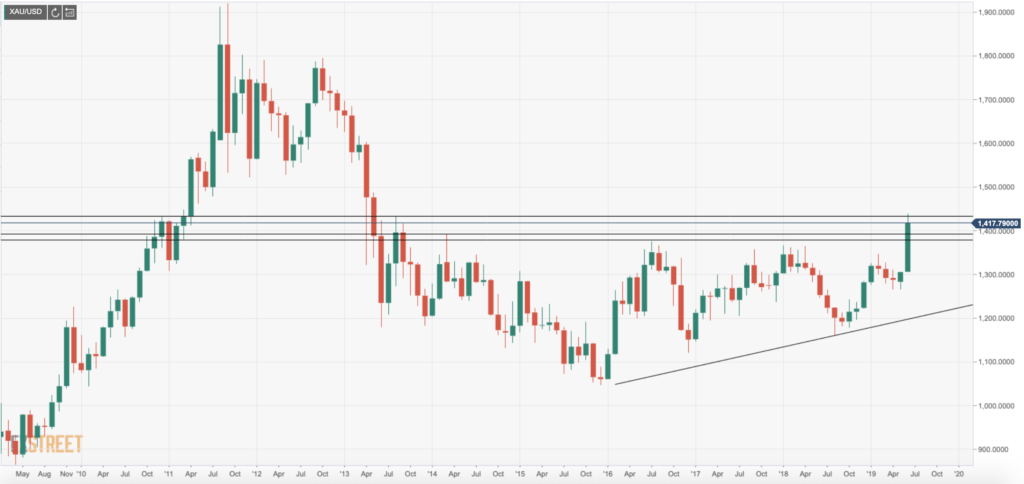

Technical Analysis

The ‘mathematical chaos theory’ is in full effect with technical analysis. That is to say, what comes up must come down, and so patterns tend to repeat themselves over the course of time. With the use of analysis tools, technical data, price charts, and technical analysis indicators – historical price action can help you determine what might happen in the future.

Technical analysis utilizes this historical volume and price data in the hope of spotting patterns, largely due to market and trading psychology price movements and trends (which tend to follow a pattern). This type of analysis doesn’t measure any basic set value. Instead, most traders believe that price patterns will repeat themselves later down the line, so it makes sense to also study the history of forex price movements.

Here are the three main types of technical analysis charts you can study:

- Line charts.

- Bar charts.

- Candlestick charts.

Below we have listed some of the most commonly used chart analysis tools:

- Volatility tools.

- COT data and position summaries.

- Correlation tool.

- Session highlighter.

- Technical indicators.

If you want to, you can combine your technical tools together. In fact, this extra information might even make you a better trader. It is worth noting that each forex broker platform will differ, and not all of them will have the same tools available to you. So, do some research first and see what suits your trading style best.

Forex Trading Tip 5: Know Your Financial Limits

It is of utmost importance to know when to stop when it comes to trading. Crucially, allowing a trading emotion like greed get the better of you could be disastrous.

Knowing your limits is vital if you want to be a successful trader, and so we have a couple of forex trading tips listed below that will help point you in the right direction.

Stop and Limit Orders

High leverage can provide investors with huge gains. But there’s always the possibility that they could be faced with huge losses, too. Two of the main orders that traders tend to put in place are ‘stop’ and ‘limit’ orders, as this helps them to better manage their positions in the market.

A limit order is going to allow you to set a min or max price to buy or sell at. On the contrary, a stop order allows you to set a specific price you would like to buy or sell at, meaning you can’t go beyond that price. If you are an investor with a short position you will set a price limit below the current market price as the first target. In order to manage it, you can place a stop order above the current price.

If you are an investor with a long position you will set a price limit above the current market price so that you can make a profit from it. You will then set a stop order below the current price so that you can try and cap the loss on your position.

Stop and Limit orders are a great way for you as a trader to be able to take profits and limit margin calls, and everything is automated once the position goes live. These orders are very flexible, so you can amend them at any given time – as per current market conditions.

Trailing Stops

The main purpose of a trailing stop is to eliminate the need for you to adjust and intervene as the market moves, meaning you can ensure that you walk away from the trade at a profit. Traders like to say ‘cut your losses short, and let your profits run’. Put simply, this is where a trailing stop order can come in.

As we’ve said, unlike a regular stop order, a trailing stop can be pre-set to move with the market allowing you to follow market trends without having to constantly check what is happening.

A trailing stop will change the stop-loss to their break-even price (or initial price). This means that if the GBP/USD currency pair goes into reverse and is going against you, you are able to shield the gains you have already made from the initial position.

Forex Trading Tip 6: Familiarise Yourself With Forex Trading Costs

No matter how successful your trading career is, you will always incur some expenses along the way. Some of the costs you might encounter will be entirely optional, such as charges linked to personalised technical analysis services, enhanced order executions, and specific financial news services.

One of the best forex trading tips that we can give you is to ensure you have a firm grasp of direct fees, commissions, or other unavoidable costs. These costs will vary depending on each individual broker, so always check these rates before committing.

Below we have listed some of the most common fees and charges you are likely to encounter as a forex trader.

Trading Commissions

Forex trading commissions are sometimes charged by brokers when you place a trade. They can come in 2 forms; fixed fees (regardless of trade volume) or relative fees (the higher the volume, the higher the commission will be).

An example of a relative fee is a broker charges you £1 per £100,000 of each currency pair you sell or buy. If you enter a contract worth £1 million of GBP/EUR, the broker will take £10 in commission. If you buy £10 million, the broker will take a £100 commission.

In the broker charges a relative fee of 1%, then a £1,000 position would cost you £10. A £2,000 position would cost £20, and so on.

The good news is that the best forex brokers allow you to enter buy and sell positions without paying any trading commissions. You will find a selection of such brokers further down in this guide.

Spread

As we covered further up this page, the spread is essentially a fee which your forex broker will charge you to trade.

The broker will give you a quote of two prices on each currency pair they have to offer. The two prices will be a bid price (price to buy) and an ask price (price to sell).

Although the spread is often discussed in pips (as we did earlier on), it is sometimes easier to convert this to a percentage. This will give you a much clearer idea of how much you are paying, and how much you need to make in gains just to break even.

As a side tip, keep an eye on financial news, volatility, and liquidity. This is because the broker might decide to widen their spreads in preparation for volatile market conditions.

Overnight Financing Fees

When you are holding a position in the market, another cost which you need to be aware of is the ‘overnight roller’.

This is an overnight interest rate attached to each currency you buy or sell. This is because forex pairs are leveraged financial instruments, meaning that you are effectively borrowing funds from the broker. Naturally, this attracts interest.

The amount is based on the variance between the two interest rates (for each currency). These rates are decided by large financial institutions and not your broker.

The overnight rollover fees are based on percentages which increase as more leverage is used. To put it another way, the more leverage you use, the higher the costs could be.

Data Feeds

Another cost to bear in mind is data feed fees, and it is usually charged on a monthly basis. As the data helps you gain an insight into when to enter and exit the market, how to manage your positions and where you should set stop loses – it’s an essential cost that you might need to bear.

Each provider will have a different charge for data feeds, so it does tend to depend on the nature and quality of the service on offer. We recommend trying a few out before committing to a monthly subscription fee.

Deposit and Withdrawal Fees

There are some big differences when it comes to deposit and withdrawal fees. This is because it will ultimately depend on the broker in question, as each platform will carry out slightly different procedures.

A lot of forex brokers don’t charge any withdrawal fees at all, but of course, always check the terms and conditions before signing up. The same goes for deposit fees.

Remember that the payment method you choose might affect the length of time it takes for your deposit to reach your trading account. However, also some costs may be incurred depending on the third party or bank you deposit with.

Forex Trading Tip 7: Managing Your Trading Emotions

According to trading psychology, there are 3 main emotions people experience when buying and selling assets – greed, fear, and hope.

When you are actively trading, losing control of any of these three emotions could land you in hot water. Emotional discipline is often considered the key to success, and so the best way to achieve this is with a few simple rules.

- Try not to trade out of greed. Greed is often considered the worst of the three emotions for a trader. This is because it can lead traders to make rash decisions when looking for that pot of gold at the end of the rainbow.

- Try to be aware of any uncertainty in the forex market. As we’ve said before, you can do this by putting a trading plan into action and researching various sources of information before making any decisions.

- You can manage your expectations by alleviating the assumption that you will make huge profits straight away. Instead, patience could be key and this is a great way to practice risk management as well.

If you want to avoid the temptation of going over your budget, place your trade, and then just leave it be. Watching the trade constantly could lead you to temptation.

Forex Trading Tip 8: Don’t Be Afraid to Change Your Strategy

Some of the most seasoned forex traders out there swear by changing their strategy from time to time and reevaluating their trading plans entirely. If you’ve been using the same strategy for a while and don’t feel like you’re getting the gains you should be, there’s nothing to stop you from trying a different approach.

Forex Trading Tip 9: Understand how to set up a Forex Trading Account

Without intending to state the obvious, this section of our top 10 forex trading tips is suited for the absolute beginner. In other words, if you’ve never placed a single forex trade in your life, you likely don’t know how to set up a trading account!

The good news is that this part is fairly simple and straight forward, but we’ve compiled a simple step-by-step guide to get you started nonetheless.

Step 1 – Find a Broker

You need to find the right broker for your trading style. We have dedicated a section below on how to find one and what to look out for, should you need any help. We have also listed our top five recommended forex brokers of 2023 further down, should you not have the time to research a platform yourself.

Step 2 – Choose a Trading Account

Make a decision on what type of trading account you want to open. Some will be small scale with low minimum trade account balance requirements, whilst some are for more experienced traders.

Step 3 – Application Form

Now you will need to complete the application form on the broker’s website. The information needed varies, but usually includes your full name and address, as well as contact details and date of birth.

You might also need to tell them a little bit about your financial situation such as monthly income, employment status, and trading experience. Again, each forex broker will vary slightly

Step 4 – Identity

Before you can complete your forex account registration, you are going to need to prove who you are. The vast majority of forex brokers will just require a scanned copy of your passport or national ID.

Some might need a scanned copy of a utility bill or a letter which has your name and residential address on it. This usually has to be from within a certain period of time, say within 6 months.

Step 5 – Login

Assuming you have received confirmation almost immediately (which is usually the case); you can now use your login details to access your new forex trading account.

Step 6: Fund Your Trading Account

Now you can deposit funds into your trading account. Payment methods offered are usually pretty standard and include; debit/credit cards, bank transfers, and e-wallets such as Neteller, PayPal, and Skrill.

Forex Trading Tip 10 – Choosing a Forex Broker

It is extremely important to choose the right broker for you. This is going to be your trading partner helping you to navigate your way through the forex market.

Some of the things that you need to assess when choosing a forex broker that meets your needs are:

- Is the broker regulated by a tier-one licensing body like the FCA, ASIC, or CySEC?

- How many currency pairs does the broker list?

- How competitive is the broker in the fees and commissions department?

- Does the broker offer tight spreads?

- What payment methods does the broker support?

- Is the trading platform packed with technical indicators and chart reading tools?

- What is the minimum deposit amount required?

Taking into account just how time-consuming it can be to choose a forex broker, in the next section we briefly discuss the best platforms of 2023.

Best Forex Trading Platforms of 2023

Don’t have time to choose a forex broker yourself? If so, below you will find a selection of regulated platforms that offer competitive fees, heaps of forex pairs, and an all-around seamless trading experience.

1. AVATrade – 2 x $200 Forex Welcome Bonuses

AVATrade is an established online broker that offers everything from forex, indices, commodities, and stock CFDs. You can trade without paying any commissions, and spreads on major currency pairs are super-tight. You can choose from MT4 or the AVATrade platform, both of which come back with advanced trading tools. AVATrade is heavily regulated, accepts heaps of payment methods, and requires a minimum deposit of just $100..

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

2. VantageFX – Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

To Conclude

We hope that you have found our forex trading tips page helpful in gaining a good understanding of how to be a successful trader. Crucially, it is really important that you have a firm understanding of how the forex markets work before starting, and that you have a long-term plan in place.

You also need to pay attention to all of the costs involved with forex trading, such as spreads, commissions, and overnight financing. When it comes to leverage increasing your gains, it can also amplify your losses. This can be a major set back, especially if you are on a tight budget.

We also cannot stress enough the importance of technical and fundamental research when it comes to forex trading. There is a vast amount of forex trading tools available at your fingertips. So make sure you take full advantage of that.

Al in all, one of the best forex trading tips that we can give you is to start off with a demo account facility. After all, practice makes perfect.

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card

Read more related Articles:

Forex Trading for Beginners: How to Trade Forex and Find the Best Platform 2024