Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Introduction

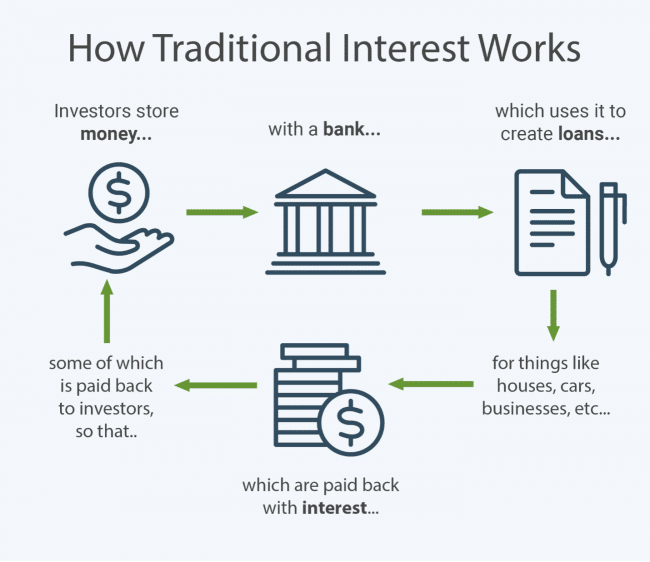

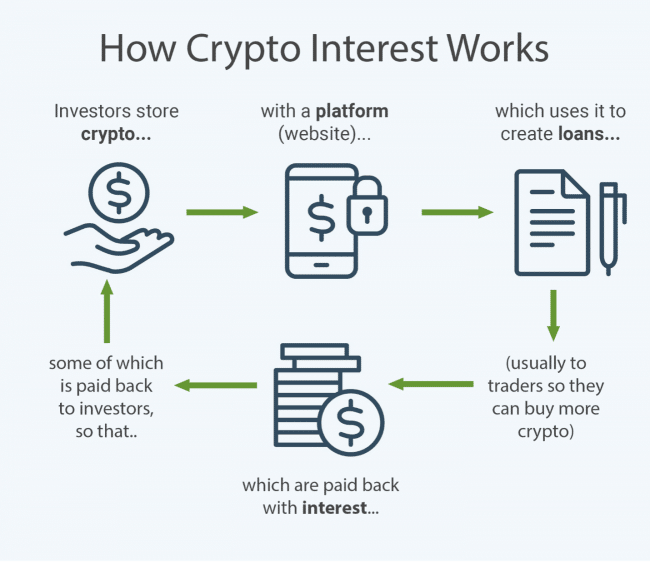

Crypto lending allows investors to lend money to borrowers and earn interest on their crypto assets. While traditional banks offer minimal interest rates, crypto lending platforms can provide higher returns. However, choosing a reliable platform in the rapidly changing crypto landscape can be challenging. In this article, we have compiled a list of the best rates to help you make an informed decision.

How Crypto Lending Works

Crypto lending involves three parties: lenders, borrowers, and platforms that act as intermediaries. The lenders deposit their digital assets on the lending platforms to earn passive income, whereas borrowers use their crypto assets as collateral to obtain loans. The platforms facilitate transactions between lenders and borrowers and manage the entire lending process.

Types of Cryptocurrency Lending Platforms

There are two main types of crypto lending platforms: centralized finance (CeFi) platforms and decentralized finance (DeFi) platforms. CeFi platforms operate similarly to traditional banks, with a central entity responsible for managing funds. On the other hand, DeFi platforms leverage blockchain-based smart contracts to connect lenders and borrowers in a distributed network.

CeFi Platforms

CeFi platforms, such as Coinbase and Binance, offer convenience and higher interest rates compared to traditional banks. These platforms implement Know Your Customer (KYC) and Anti Money Laundering (AML) practices to ensure regulatory compliance. Additionally, some CeFi platforms allow users to borrow fiat against their cryptocurrency, making them more versatile.

DeFi Platforms

DeFi platforms, like Aave and Compound, operate on a decentralized network, enabling users to lend and borrow without KYC verification. While they offer more privacy, users entrust their funds to smart contract algorithms. It’s important to note that DeFi platforms do not have a centralized entity to address complaints or issues.

Best CeFi Lending Rates

Best DeFi Lending – Guide, Tips & Insights | Learn 2 Trade Rates

Selecting the Best Crypto Lending Platforms

To choose the right crypto lending platform, consider factors such as longevity, costs and fees, collateral amount, and minimum deposit. Opt for platforms that have been operating for at least two years, have a growing user base, and transparent fee structures. Evaluate collateral requirements and calculate your real interest rate after taxes and fees using a crypto interest calculator.

Conclusion: Is Crypto Lending Safe?

While the cryptocurrency market has experienced volatility and risks, reputable CeFi and DeFi lending platforms prioritize the security of funds. Platforms like Binance and Nexo maintain good reputations and offer insured custody, ensuring the safety of users’ assets.

DeFi lending platforms provide full control over funds, but users should be aware of the extreme volatility of cryptocurrencies. CeFi and DeFi lending platforms each have their advantages and drawbacks, and thorough research is crucial to make informed investment decisions.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.