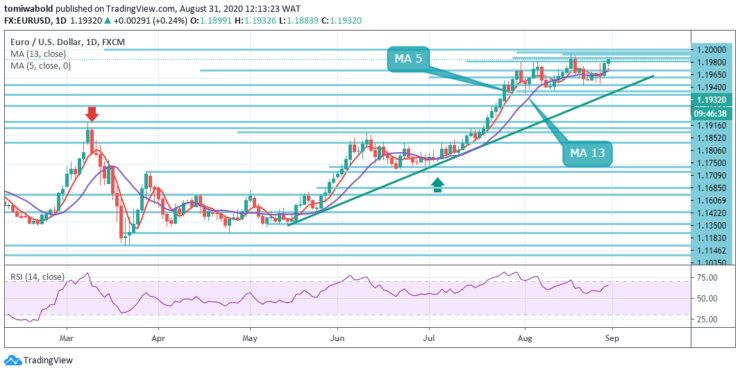

EURUSD Price Analysis – August 31

EURUSD continues to keep traction past the 1.19 mark, recapturing the upside bias to the 1.1883/80 band or daily lows after an early lower move. The pair holds gains of more than 1.19 marks to last weeks, notching fresh multi-day highs at the same time and relaunching the positive side weekly.

Key Levels

Resistance Levels: 1.1980, 1.1965, 1.1940

Support Levels: 1.1750, 1.1685, 1.1606

Last week, EURUSD emerged beyond the multi-day trending structure and proceeded to reclaim the 1.19 mark and beyond, where it is now seeking to consolidate. The pair is currently up 0.24 percent at level 1.1932 and a step beyond level 1.1965 (2020 high Aug.18) may aim 1.1996 (strong) on the way to level 1.2032.

On the other side, the next support is situated close to level 1.1750 seconded by level 1.1709 (weekly low Aug.12) and finally level 1,1695 (low Jul 27). As long as the 1.1422 resistance level turned support holds, this might stay the desired scenario.

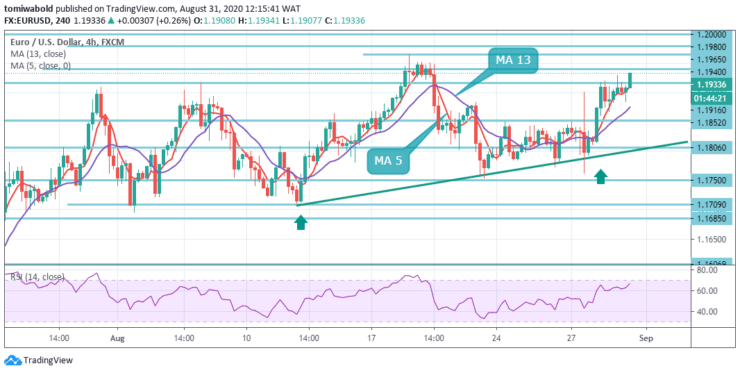

In EURUSD, range trading persists and intraday bias stays initially neutral. A further increase is in support and breach of level 1.1965 may restore entire growth from level 1.0635. Regarding the upside condition in 4 hour RSI, nevertheless, a breach of 1.1709 level may indicate short-term topping.

The short-term oscillators further show that positive traction is rising. For intraday bias can be switched back to the downside (now at 1.1606 horizontal support level). If sellers re-emerge, initial obstacles may emerge from the near-term low horizontal support lines at 1.1852 and 1.1806 levels respectively, ahead of the 1.1750 level.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.