XAGUSD Price Analysis – August 31

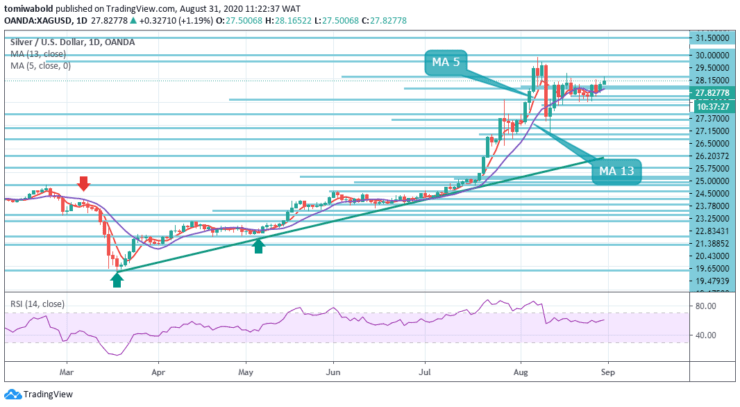

Having initially surged to the highest since August 18, Silver prices recede to $27.87 level during Monday’s early European session. Even so, the white metal flashes 1.30% gains while rising for the second day in a row. However, Silver’s downside appears more compelling in the absence of long term buyers, as the XAGUSD path of least resistance stays to the downside.

Key Levels

Resistance Levels: $30.00, $29.50, $28.15

Support Levels: $27.15, $26.50, $25.00

At press time, the spot is trading well above the bullish MA 5 and MA 13 at $27.84 level, looking to retest the horizontal trendline resistance placed at the $28.15 level. As a result, the bulls may wait for a clear break of the mid-August peak around $28.50 level for fresh entries. In doing so, the current monthly high near $29.85 and $30.00 levels will be on their radars.

Meanwhile, a downside break of the MA 5 and MA 13 levels of $27.00 region can trigger the quote’s fresh declines targeting the previous week’s low around $26.00 level. Sellers will then target a low level of $25.00 level should the downside pressure intensify.

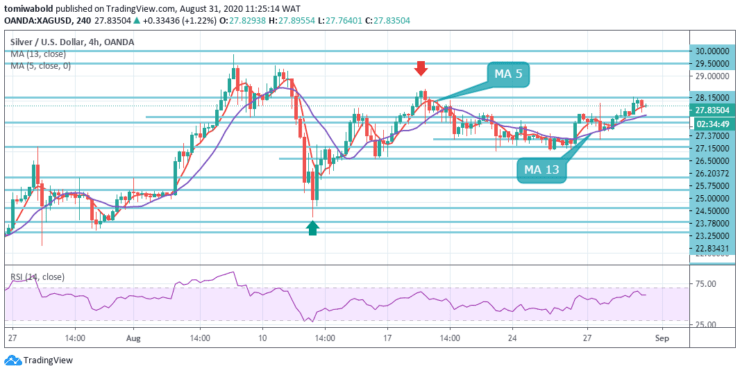

From a short-term technical perspective, the white metal fell as low as $27.57 level during the European trades, piercing through the Moving Average 5, then at $27.80 level as it approaches the Moving Average 13 at $27.50 zone.

The pair is supposed to find support at the level of $27.15, and a plunge over could take it to the next level of $26.50. The pair is supposed to meet its initial resistance at the level of $28.15, and a spike out could push it to the next level of resistance of $29.50.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.