The yellow metal couldn’t hold on to its bullish momentum from Friday, which shot it to its previous high around the $1977 supply region. However, the upbeat risk appetite in the equities market was the major factor weakening demand for gold’s safe-haven appeal.

The global risk sentiment was bolstered by positive Chinese Manufacturing and Services PMI data released on Monday. The data renewed hopes among investors for a strong economic recovery from the Coronavirus pandemic.

Also, a goodish bounce in the US dollar (DXY) today has applied more bearish pressure on the dollar-denominated commodity. However, last week’s dovish stance by the Fed might keep the USD bulls from becoming aggressive in the near-term, which could help the non-yielding metal consolidate or recuperate. Fed Chair Jerome Powell, at last week’s highly-anticipated Jackson Hole Symposium, announced that the central bank was considering a major policy shift to create more room for inflation to wiggle while unemployment stabilizes.

That said, traders will be looking for a strong breakout at this level before placing any aggressive bets.

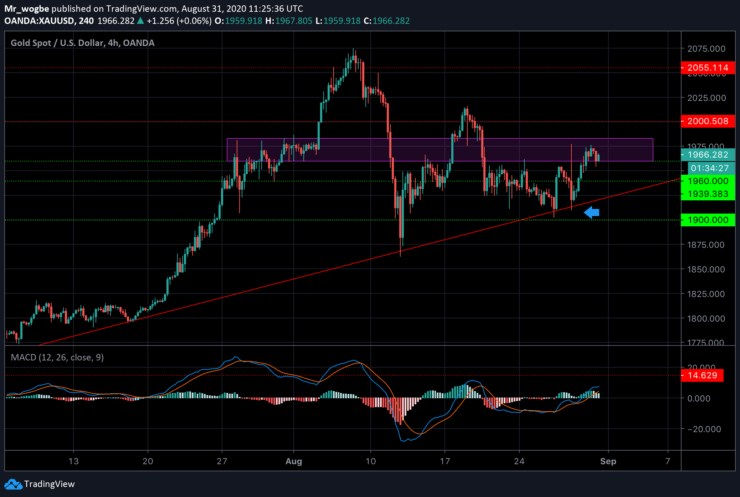

Gold (XAU) Value Forecast — August 31

XAU/USD Major Bias: Sideways

Supply Levels: $1977, $1983, and $2000

Demand Levels: $1940, $1923, and $1909

Gold has reentered the $1983 – $1960 pivot/consolidation range and a break of either end of this region could precipitate a rally. Meanwhile, last week’s drop was strongly supported by the ascending trendline once again, signifying that this level is key if bears desire to take prices lower.

That said, we could see a retest of this level in the near-term, which could strongly push the price upwards.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.