EURUSD Price Analysis – August 3

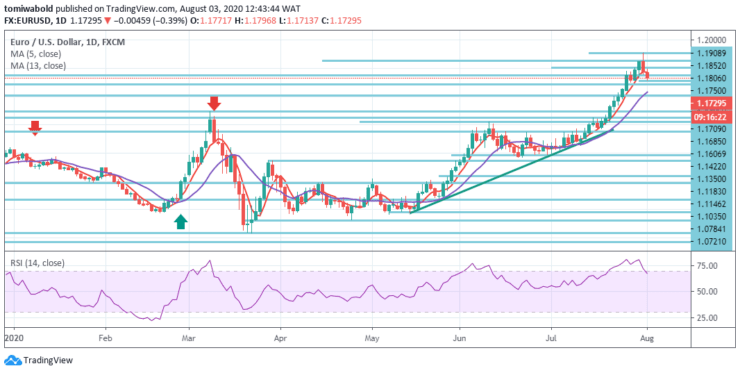

EURUSD has begun the week on a negative basis and is adding losses underneath the 1.18 benchmark to the prior session low, all amid a widespread profit-taking trend and a strong dollar correction. EURUSD ended the session on Friday in the negative territory as the push to fresh 2-year highs beyond 1.19 levels was lacking.

Key Levels

Resistance Levels: 1.1908, 1.1852, 1.1806

Support Levels: 1.1685, 1.1606, 1.1495

The EURUSD pair appears sold as it comes from overbought levels and the path is now open to initially broader retracement towards level 1.1709. Even farther south, the next appropriate support coincides close to level 1.1495. Taking a look at the wider context, as long as the moving average of 13 retains a support level of 1.1606 and holds downside, more EURUSD gains stay much on the cards.

Following a pullback, we ‘d look for the uptrend to restart with initially seen resistance at 1.1750 level and with 1.1852 level to be permitted for a direct reversal back to 1.1908 level. Over here in due time, the intensity may continue to the first major signaled resistance at level 1.2145.

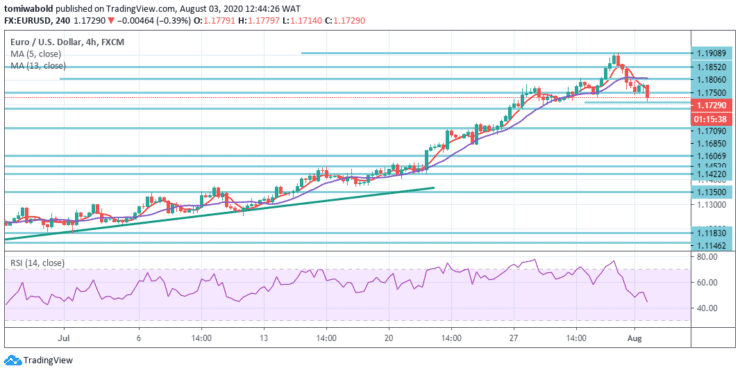

Intraday bias in EURUSD stays initially neutral. Taking into account the marginal bearish divergence condition in 4 hour RSI, a breach of 1.1685 minor support level may indicate short-term topping. For a stronger pullback, intraday bias is shifted to the downside.

Yet downside to carrying rebound may be confined beyond 1.1422 resistance turned to support level. On the upside, the entire increase from 1.0635 level should then continue beyond 1.1908 level. As long as 1.1422 resistance turned support holds, this will remain the preferred scenario.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.