The exacerbating Coronavirus crisis across the globe coupled with worries over the US fiscal deadlock bolstered demand for gold throughout last week, while the US dollar got displaced.

Gold spot reached a high of $1,988 yesterday before shedding $18 to where it now lingers. The US is set to release its critical Manufacturing PMI reports (from both market and ISM), which has put gold traders in a reserved mode.

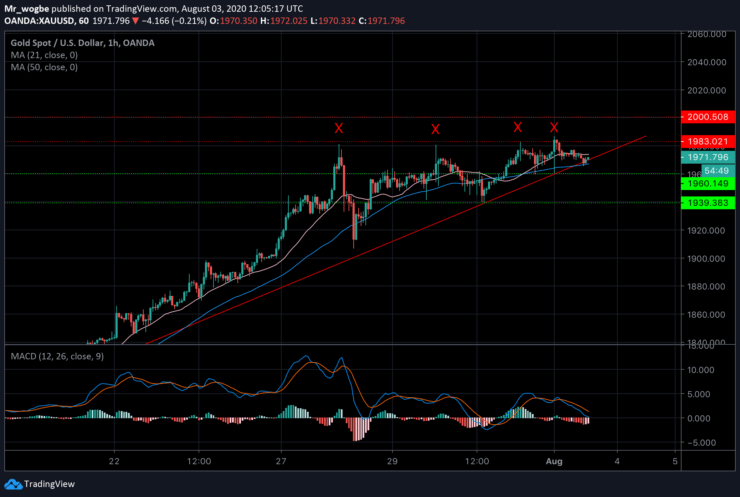

Gold (XAU) Value Forecast — August 3

XAU/USD Major Bias: Bullish

Supply Levels: $1,975, $1,983, and $2,000

Demand Levels: $1,970, $1,967, and $1,960

From a technical standpoint, the price is trading in a rising wedge pattern on the hourly chart and bears seem to lack the power for a follow-through sell pressure. Our MACD indicator is now nearing a neutral level, which is an indication that a fresh bullish wave is very likely.

Gold is currently trading below the 21-Hourly Moving Average at $1,975. Immediate support can be found at the 50-HMA of $1967.

Sellers will be looking for entries below the $1,960 support line. However, this will be a very difficult stunt to pull off.

On the flip side, bulls are likely to regain momentum if we break the 21-HMA again. The next important resistance is the $1,983 which gold has been finding difficult to clear for a while now.

A break above that level could clear the way for the critical $2,000/oz gold price.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.