In a day of seeming fortune for the euro, the common currency managed to gain ground on Thursday, navigating through a nuanced portrayal of the eurozone economy revealed by the latest surveys by Reuters. Germany, the bloc’s largest economy, exhibited signs of potential recovery from recession, while France, the second-largest, continued to grapple with contraction. Despite this mixed panorama, the euro showed resilience.

Euro Pulls Back from the Abyss

As of the latest update, the euro displayed a modest 0.17% rise against the dollar, reaching $1.0906, and a 0.19% dip against the pound, settling at 86.97 pence.

Surprisingly, the anti-EU populist Geert Wilders’ unexpected triumph in the Dutch elections didn’t significantly impact the currency. Eyes are now on the European Central Bank (ECB) as it gears up to release the minutes of its October meeting, potentially providing insights into its policy outlook.

Meanwhile, the pound rebounded from a recent dip triggered by the UK finance minister’s grim budget update, featuring lower growth forecasts and increased spending. A silver lining emerged with a marginal improvement in UK business activity for November after three consecutive months of decline, propelling the pound to a 0.4% gain against the dollar, reaching $1.2543.

Dollar Weakens as BLS Reports Fewer Benefits Claims

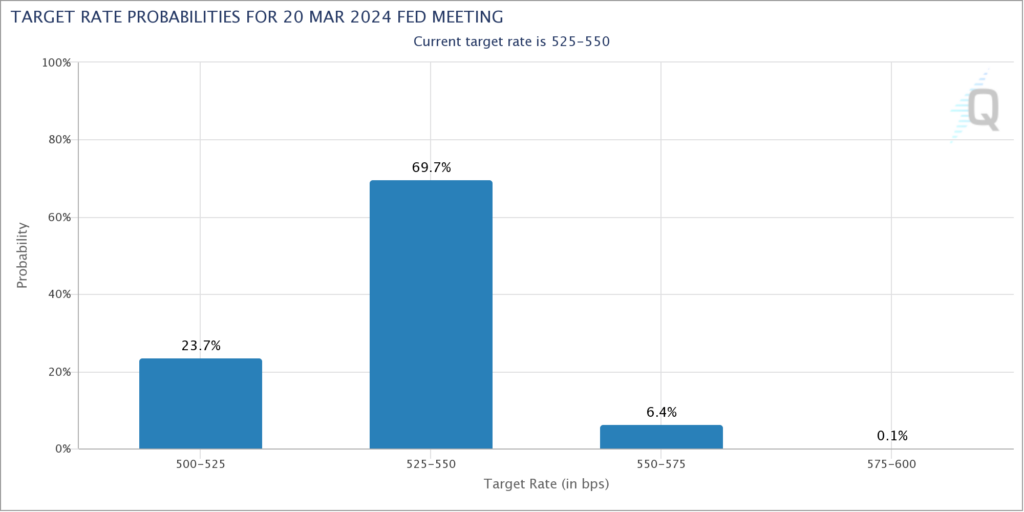

In the realm of the dollar, a decline ensued following a report indicating a more significant than anticipated drop in Americans filing for unemployment benefits last week. However, concerns loom as another report reveals consumer expectations of higher inflation, a factor that might trouble the Federal Reserve. Notably, market expectations for Fed rate cuts in 2024 have dropped by 1% since the last time we reported it on November 22, according to the CME Group’s FedWatch tool.

Meanwhile, the yen exhibited strength against the dollar, riding on expectations that the Bank of Japan might tighten its monetary policy in the coming year. Having reached a two-month high of 147.15 per dollar earlier in the week, the yen currently hovers at a neutral position, trading at 149.53.

As global financial landscapes continue to evolve, the euro remains a focal point, navigating through the complexities of regional economic dynamics.

Interested In Becoming A Learn2Trade Affiliate? Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.