In a swift rebound, the dollar index surged 0.5% to 104.13 on Wednesday, staging a comeback from its recent three-month low of 103.17, fueled by insights gleaned from the Federal Reserve’s October meeting minutes.

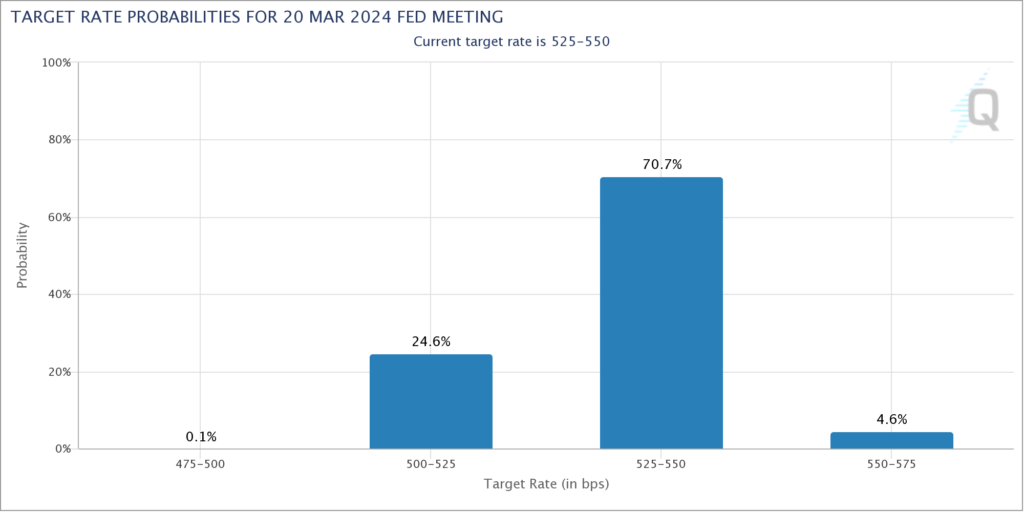

The Fed, signaling a measured approach, affirmed its commitment to the current rate-setting process, emphasizing a cautious trajectory unless inflation veers significantly from its target. Surprisingly, it kept the door ajar for future rate hikes, contrary to market expectations of impending cuts in early 2024.

Analysts, however, speculate the Fed might resort to a 50 basis point rate cut when easing begins, a strategy employed in the past.

Dollar Recovers Ground Across the Field

The greenback’s resilience is further buoyed by enticing U.S. Treasury yields, although slightly diminished from October’s multi-year highs.

As of Wednesday, the 10-year note’s yield lingered at 4.3751%, enticing investors despite the dip from October peaks.

Contrastingly, the euro slipped to $1.0866 after reaching $1.0965 on Tuesday, marking its best monthly performance in a year with a 2.5% gain against the dollar in November.

The British pound, taking a hit at 0.61%, landed at $1.2461, not far from its two-month high of $1.2559. Market attention is now riveted on Britain’s finance minister, Jeremy Hunt, as he unveils the Autumn Statement, anticipated to reveal tax cuts for businesses and voters.

Across the Pacific, the Japanese yen weakened by 0.9% to 149.70 per dollar, relinquishing gains from its recent two-month high of 147.15 on Tuesday. Despite a November rise of nearly 1.5% against the dollar, the yen still languishes around 13% lower for the year.

As the dollar charts its course amidst Fed nuances and global economic dynamics, markets are bracing for potential shifts, keeping a close eye on both domestic and international indicators.

Interested In Becoming A Learn2Trade Affiliate? Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.