The European Central Bank (ECB) announced recently that it was set to ‘tweak’ its major policy objectives, as it continues to battle the Coronavirus pandemic-induced economic fallout. For close to two decades, the ECB has sought to keep inflation just below 2% to tackle consumer price increases. However, given the recent sluggish price increases triggered by the economic crisis, a new inflation target could be implemented to prop-up the economy soon.

Speaking at a meeting with European lawmakers on Monday, ECB Chair Christine Lagarde warned that incoming data could portend further deflation (when inflation rates become negative), indicating that prices are falling rather than increasing.

Also, the EUR has come under further pressure following the second wave of the COVID-19 pandemic sweeping across Europe.

In other news, the Australian dollar (AUD) is not faring any better as it risks extending its decline from its yearly high against the US dollar set on September 1, ahead of the Reserve Bank of Australia’s (RBA) interest rate decision on the 6th of October. It seems that the central bank is considering cutting the Official Cash Rate (OCR) from 0.25% to 0.1% and probably introduce a government bond purchase program soon.

Regardless, the AUD appears to be performing strongly against the EUR and other G8 currencies on Thursday.

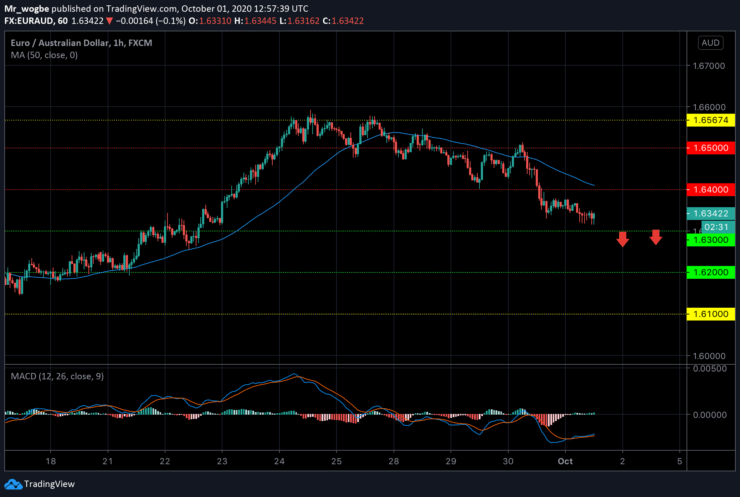

EUR/AUD Value Forecast — October 1

EUR/AUD Major Bias: Bearish

Supply Levels: 1.6400, 1.6500, and 1.6567

Demand Levels: 1.6300, 1.6200, and 1.6100

The EUR/AUD continues on its retreat from the 1.6567 strong resistance and is now faced with the 1.6300 psychological level. Given the current momentum, we expect this pair to break below that support line in a bearish continuation towards the 1.6250-200 area.

However, in an unlikely event where it finds strong support at the 1.6300 level, the EUR/AUD could stage a recovery to the 50 SMA at 1.3410.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.