EURUSD Price Analysis – October 1

EURUSD buying interest picks up traction near the 1.1770 region-or multi-day highs as the pair progresses on high expectations for a US fiscal agreement. The pair may be haunted by a possible deadlock in negotiations, fears of a disputed election, and growing US coronavirus infections.

Key Levels

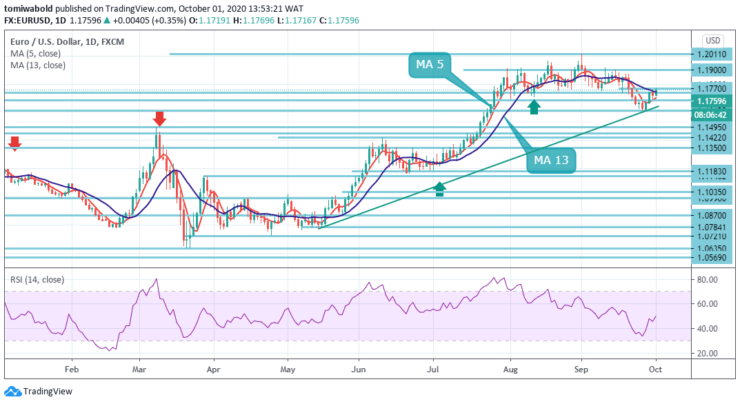

Resistance Levels: 1.2011, 1.1900, 1.1770

Support Levels: 1.1612, 1.1495, 1.1350

On Thursday, the Euro gathered traction after bulls halted at 1.1757 level on the prior day. A firm breach beyond 1.1800 will lay the groundwork for a stronger recovery and neutralize the current downside risk on poor daily momentum. To enable a more sustainable recovery, additional gains now need to exceed this area coupled with the immediate resistance line at level 1.1770.

In the larger sense, rising from the level of 1.0635 is seen as the third phase of the trend from the level of 1.0339 (low). A more rally increase can be seen at the next threshold of 1.2011 to cluster resistance (38.2 percent retracement from 1.6039 to 1.0339 at 1.2516 levels). It might stay the ideal case as long as the level of support transformed to 1.1422 resistance stays.

Intraday bias in EURUSD holds firm with an emphasis on 1.1770 support turned resistance level. The decisive split there will contend that corrective pullback has finished. For the 1.2011 level re-test, intraday bias will be shifted around to the upside. On the downside, the 1.1612 level breach might instead extend the fall from the 1.2011 short-term top-level to 38.2 percent retracement from 1.0635 to 1.2011 at 1.1495 level.

The euro/dollar gains from upside momentum and has preserved its movement above the 5 and 13 moving average. The Relative Strength Index, however, is approaching 70, nearer to conditions of overbought. Support is at the level of 1.1737, a support line from last week, followed by a level of 1.1685, a swing low reported on Wednesday. The next lines to watch are the levels of 1.1625 and 1.1612.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.