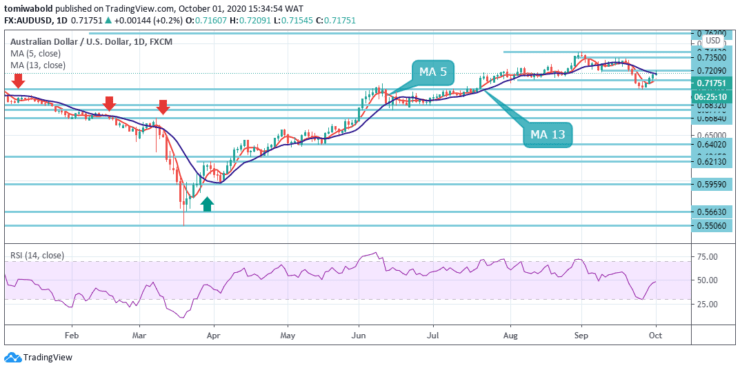

AUDUSD Price Analysis – October 1

The AUDUSD has recovered optimistic bias during the initial half of the trading activity on Thursday, with investors now seeking a steady advance toward the 0.7200 marks. The trend was assisted by several factors – the upbeat market sentiment and a weaker mood around the US dollar.

Key Levels

Resistance Levels: 0.7413, 0.7350, 0.7209

Support Levels: 0.7100, 0.7000, 0.6832,

AUDUSD Long term trend: Bullish

The Australian dollar is increasing the upside rally to the 4th successive day, advancing 0.23 percent from the daily time frame basis. Near-term activity may be more skewed than the breached moving average of 5. To generate a trigger for continuation, the bulls need to clear the daily top near the moving average 5 at (0.7209 level), but daily analysis informs of pause as direction turns sideways.

Although the rebound from the 0.5506 level was significant in the wider context, there is not enough proof to substantiate the bullish trend reversal now. That is, in the long-term upward trend, it may only be a corrective. The emphasis will be reset to a low of 0.5506 level. On the upside, the increase from 0.5506 to 38.2 percent retracement from 1.1079 (high) to 0.5506 (2020 low) at 0.7635 levels will be extended by the breach of 0.7413 level.

AUDUSD Short term Trend: Ranging

AUDUSD’s intraday bias holds firm with an emphasis on the level of support shifted to 0.7209 resistance. Thus, the continuous breach may imply the success of the pull back from the level of 0.7413. To retest this height, intraday bias will be switched back to the upside.

On the downside, the decline from 0.7413 level, which is a reversal to increase from 0.5506 level to 38.2 percent retracement of 0.5506 to 0.7413 at 0.6684 levels, may continue the breach of 0.7003 level. AUDUSD, tentatively, maintains a short-to-medium-term neutral-to-bullish bias beyond the level of 0.7003.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.