Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

In the past, whenever the crypto market started heating up, Ethereum would face a familiar problem: skyrocketing gas fees.

It got so bad that even simple ETH transfers could cost you $30 — sometimes way more.

For small-time users, this was a dealbreaker. They’d jump ship to cheaper chains, ditching Ethereum. And who can blame them? Spending $55 to buy $100 worth of a dog meme coin is not my idea of the “future of finance,” either.

BUT, here’s my bold prediction:

Post-Dencun upgrade, Ethereum’s going to slay the Ethereum killers.

To be sure, Ethereum’s competitors will still exist and might even do pretty well. But the idea that they will “kill Ethereum” will lose its potency.

Skeptical? You’re not alone.

In fact, because so many people think the Ethereum ecosystem can’t pull it off…

(Because they think they’ve found the next 1,000x King Killer.)

It presents one of the BIGGEST opportunities in crypto.

And it’s all thanks to what’s called “rollups.”

Allow me to explain.

NOTE: Because my aim here is to be thorough, this is a long one. But if you’re interested in where we believe the smart contract landscape is headed, it’s got everything you need. (That said, if you want to cut to the chase, skip ahead to the subhead: “An Asymmetric Bet.”)

What the Feck is a Rollup?

For starters, Ethereum is a smart contract network. It is competing with other smart contract networks. It is NOT competing with Bitcoin, which is serving an entirely different purpose.

But that’s a conversation for another day.

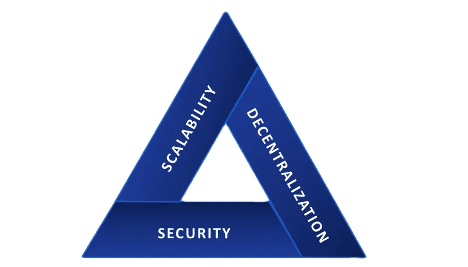

Since the beginning, Ethereum has operated under a mental model: the blockchain trilemma.

Ethereum has prioritized decentralization and security over scalability, maintaining a high degree of decentralization and security, even if it means slower transaction throughput and higher gas fees on the base layer.

(Before I get ambushed by the “ETHEREUM IS CENTRALIZED” crowd: While no system is perfectly decentralized (not even Bitcoin!) Ethereum’s large, diverse network of nodes, its open development process, and its resistance to censorship make it far more decentralized than, say, the rails that run traditional finance. Which is the point.)

To solve the trilemma, the ETH ecosystem has put a big emphasis on external rollups as a way to scale Ethereum.

A rollup is a “Layer 2 scaling solution” — or a blockchain network built on top of Ethereum with the aim of increasing Ethereum’s transaction throughput and reducing gas fees.

Rollups do this by bundling (or “rolling up”) multiple transactions and then submitting them to the main Ethereum chain as a single transaction. This way, the rollup can process many more transactions than the Ethereum base layer, while still inheriting the security of the main chain.

So…

Instead of abandoning Ethereum altogether, users can now move to a rollup and enjoy cheap transactions while still staying within the Ethereum ecosystem.

Some critics argue that this modular approach to scaling will hurt Ethereum in the long run. They say it will cannibalize the Ethereum chain and tank the value of ETH.

We think not.

For one, they fail to mention that rollups use ETH as their gas token, and sequencers (those who bundle up the transactions and submit them to Ethereum) still have to pay in ETH to write data to the base chain.

This is important because it means that rollups are still contributing to the demand for ETH.

It’s like the traditional financial system: you’ve got FedWire for the big dogs doing billion-dollar payments, and Venmo for the pups splitting the bill at lunch. Ethereum is now building a similar stack, where users can choose the layer that works best for them.

And it looks like it’s working: Popular rollups are giving cheap Layer 1s like BNB Smart Chain a run for their money. They’re scooping up users Ethereum would have lost otherwise.

This is great for ETH.

It’s going to send most other smart contract platforms to the graveyard. For the past few years, we’ve seen a bunch of smart contract platforms popping up, all claiming to be faster and cheaper than Ethereum.

Their main selling point was that they could handle more transactions at lower costs than Ethereum. They made a bunch of compromises — security, uptime, and decentralization, namely — to be “cheaper Ethereum,” but now there’s a rollup for that.

THERE’S A ROLLUP FOR THAT.

In fact, there are many rollups competing to become Ethereum’s go-to scaling solution, most of which have their own token that’s designed to reward those who hold and use it.

There’s one problem with this… and an obvious opportunity.

First, the problem.

The Problem

Warning: another buzzword incoming: composability.

Composability, or the ability for different DeFi applications to interact seamlessly, is a key feature of Ethereum.

The problem with rollups is — at the moment — they don’t communicate well with one another without the use of bridges, or applications to bridge from one chain to another. But bridges are expensive. They also layer on more risk. (Many of the biggest hacks in crypto involved bridges.)

I say “at the moment” because this problem can be solved. Developers are working on what’s called “shared sequencing,” where rollups can communicate with one another seamlessly.

It’s an elegant solution, but isn’t ready for prime-time.

In the short-term, this lag presents an opportunity.

You see…

Lack of composability also fragments liquidity, and makes the user experience more complex. Users may need to manage multiple accounts across different rollups and navigate through bridges to move their assets or interact with various decentralized applications (DApps).

Hence, the opportunity.

The Opportunity

With so much development happening on Ethereum, I think its smart contract competitors will have a hard time keeping up.

And yet…

The short-term lack of direct communication between rollups will probably lead to this scenario:

One — yes, ONE — rollup provider will capture a significant portion of the liquidity in the Ethereum Layer 2 ecosystem.

That one rollup provider will — in a short amount of time — gain millions of new users.

As users and developers gravitate towards a particular rollup with the most liquidity and activity, it can create a positive feedback loop. More users and DApps on a rollup attract even more users and DApps, further concentrating liquidity on that rollup.

DeFi protocols often rely on liquidity to function effectively. If one rollup has significantly more liquidity than others, it can attract more DeFi projects, which in turn attracts more users and liquidity.

If most of the liquidity and popular DApps are on one rollup, users may prefer to stay within that ecosystem to avoid the costs and friction associated with moving assets across different rollups via bridges.

The first rollup to gain significant traction and liquidity may have a strong advantage over competitors, as it becomes the default choice for users and developers.

These new users will translate to higher prices for the rollup provider’s token.

Bigly.

However…

It’s important to note that this outcome is not guaranteed. Factors such as innovation, user experience, transaction costs, and community support can all influence which rollup(s) ultimately succeed in capturing the most liquidity.

The competition is fierce…

Author: James Altucher

Source: AltucherConfidential

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.