The world of cryptocurrency investments has been buzzing with excitement and uncertainty since the introduction of Ethereum ETFs in July 2024. These new investment products have sparked both interest and concern among investors and market watchers alike.

VanEck, a major player in the crypto ETF space, recently announced the closure of its Ethereum Futures ETF. The fund will stop trading on September 16, 2024, with final liquidation expected around September 23. This move comes just weeks after the launch of spot Ethereum ETFs in the United States, highlighting the rapidly changing landscape of crypto investments.

Now that our spot ethereum ETP has been approved, we are closing our ETF that invested in ethereum futures. https://t.co/xYfK6StoWS

— VanEck (@vaneck_us) September 6, 2024

The closure of VanEck’s Ethereum Futures ETF raises questions about the future of similar products. The company cited an internal review of the fund’s performance, liquidity, and investor interest as reasons for the shutdown. This development suggests that not all Ethereum-based investment products are finding their footing in the market.

Ethereum ETFs Fail to Bring Anticipated Liquidity

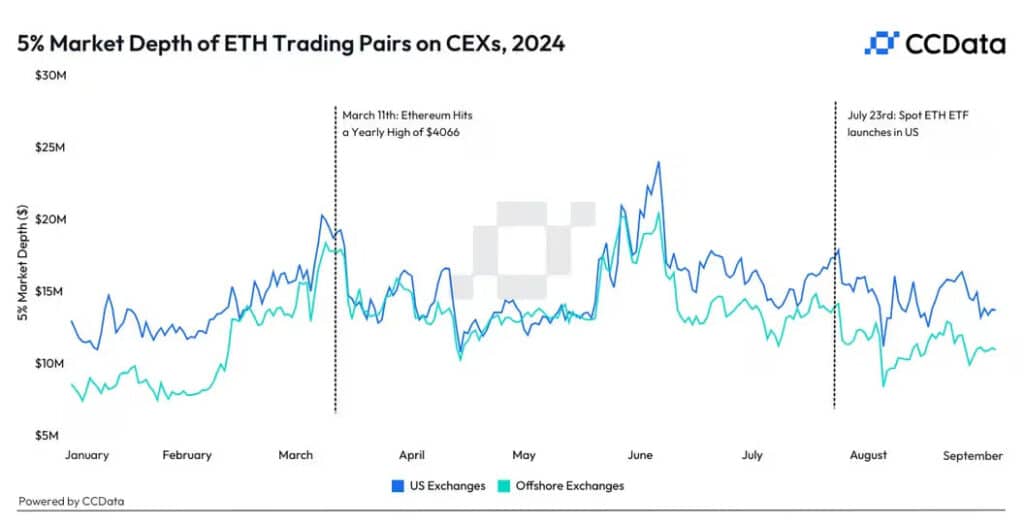

Interestingly, the introduction of Ethereum ETFs hasn’t brought the expected boost to market liquidity. Data from CCData shows that the average 5% market depth for ETH pairs on U.S.-based centralized exchanges has dropped by 20% since the ETFs’ debut. This means it’s now easier to move Ethereum’s price with large trades, which could lead to more price swings.

The decline in liquidity isn’t limited to U.S. exchanges. Offshore centralized venues have seen a similar 19% drop in market depth. This trend goes against earlier predictions that ETFs would improve market liquidity for Ethereum.

Several factors might be contributing to this unexpected outcome. Poor overall market conditions and the typical summer slowdown in trading activity could be playing a role.

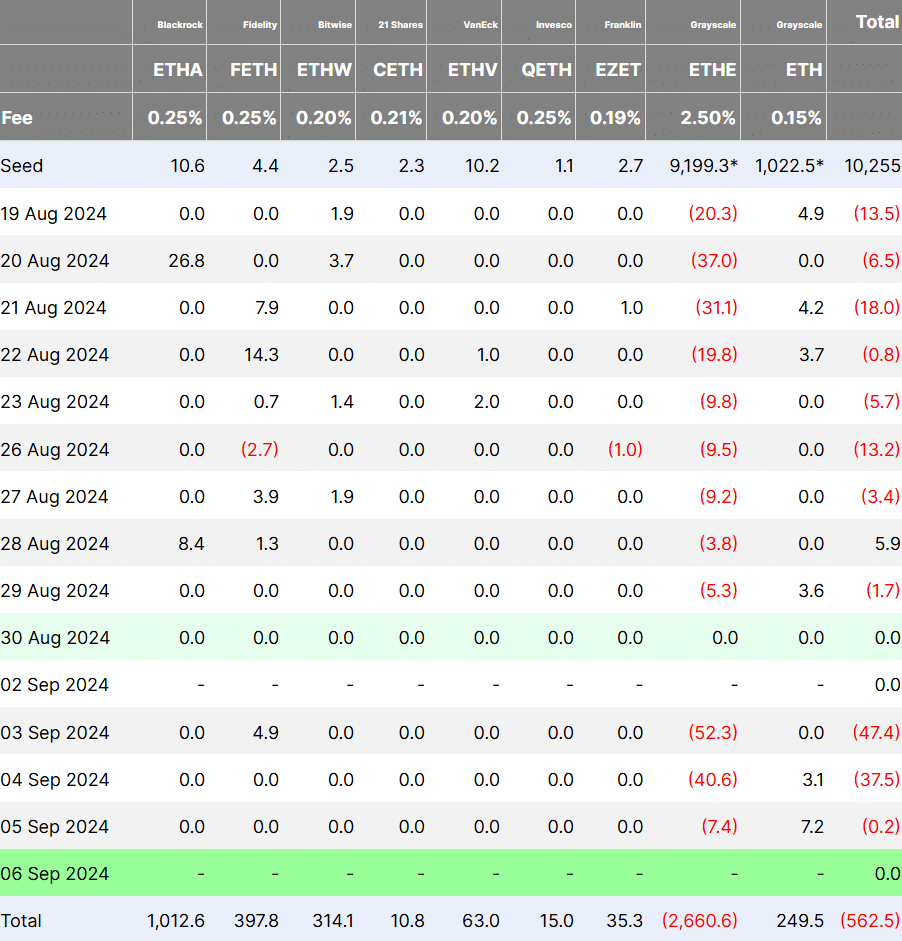

Additionally, Ethereum ETFs have seen outflows of over $560 million since their launch, according to Farside Investors. This suggests that investor enthusiasm for these products might be lower than initially anticipated.

The price of Ethereum itself has taken a hit, falling by more than 25% since the ETFs were introduced. This price drop, combined with the liquidity issues, paints a complex picture of the current Ethereum investment landscape.

Despite these challenges, it’s important to note that the Ethereum ETF market is still in its early stages. As with any new financial product, there may be a period of adjustment as investors and market makers figure out how to best utilize these tools.

Make money without lifting your fingers: Start using a world-class auto trading solution

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.