The Indian rupee concluded the week on a positive note, bolstered by the retreat in U.S. Treasury yields and a slight easing in the dollar’s strength. This respite follows a period of concern earlier in the week when fears of prolonged elevated U.S. interest rates had driven the rupee perilously close to an all-time low.

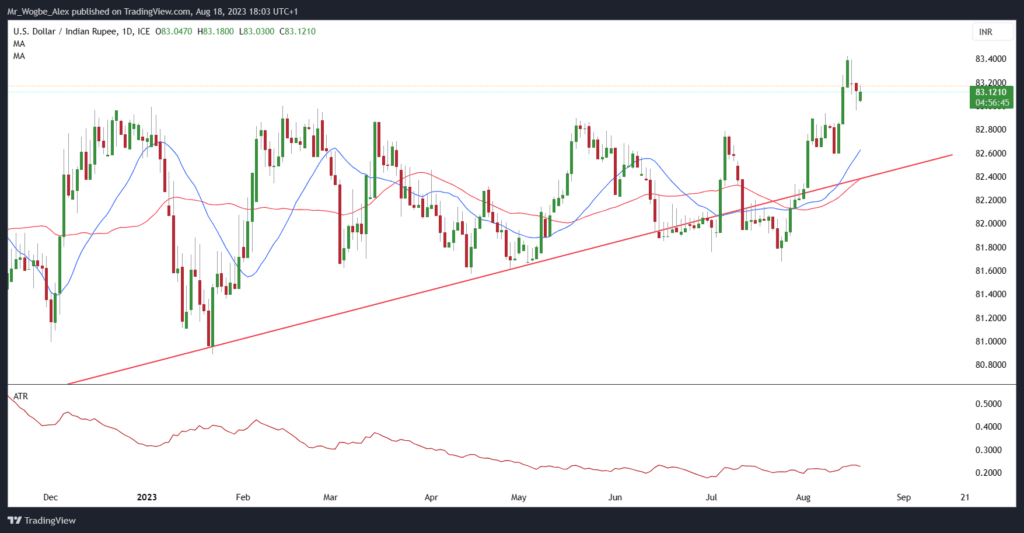

Closing around 83.12 against the U.S. dollar, the rupee recorded a modest 0.02% gain for the day. However, over the course of the week, the currency saw a marginal decline of 0.34%.

According to Reuters analysts, factors such as equity outflows and persistently high crude oil prices have acted as brakes on the rupee’s potential for further appreciation, citing a foreign exchange trader at a state-run bank. This expert views the rupee’s recent movement as primarily reflective of dollar strength rather than inherent INR weakness.

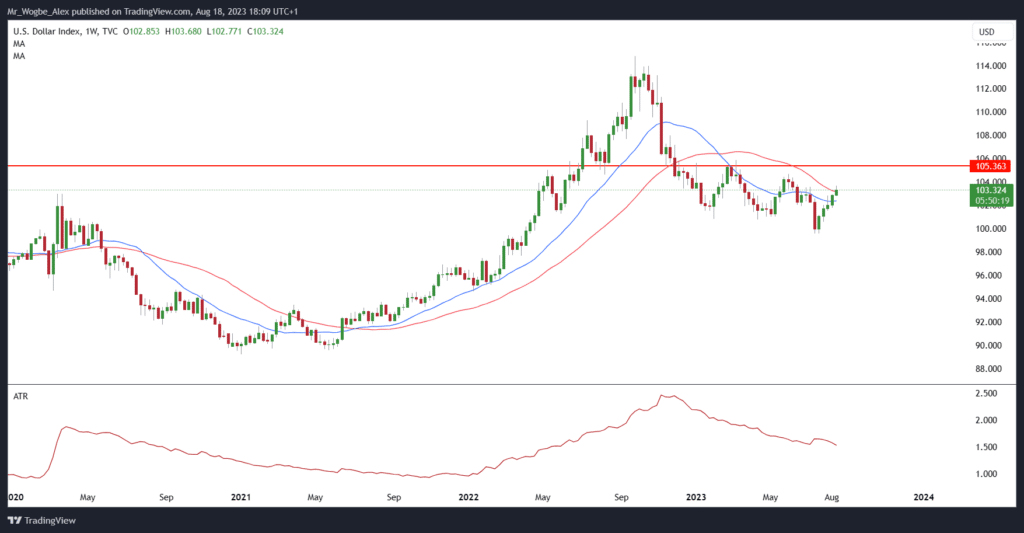

The dollar index displayed strength on Friday, indicating a possible fifth consecutive week of gains for the greenback. The surge can be attributed to the demand for safe-haven assets, a reaction to the anticipation of sustained U.S. treasury yields amidst ongoing concerns about China’s economic stability.

Dollar to Keep the Upper Hand Against the Rupee: IDFC Bank

IDFC Bank, in a recent note, pointed out the likelihood of continued upward pressure on the USD/INR exchange rate in the short term. The bank underscored the impact of rising U.S. Treasury yields on the dollar’s standing and highlighted that the potential announcement of heightened stimulus measures by China might further elevate crude oil prices, contributing to the dollar’s strength.

As the week drew to a close, Mandar Pitale, the head of treasury at SBM Bank India, projected a confined trading range for the rupee in the upcoming week, fluctuating between 82.75 and 83.25. Nevertheless, Pitale cautioned that extensive regulatory interventions could propel the rupee beyond these boundaries, leading to unforeseen strengthening.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.