In an astonishing turn of events within the cryptocurrency landscape, traders have been dealt a heavy blow, contending with staggering losses totaling a jaw-dropping $1 billion in liquidations. The digital asset markets have been thrust into a maelstrom of uncertainty, experiencing one of the most pronounced sell-offs witnessed throughout the entirety of this year.

JUST IN: $1,000,000,000 liquidated from the #crypto market in the past 24 hours.

— Watcher.Guru (@WatcherGuru) August 18, 2023

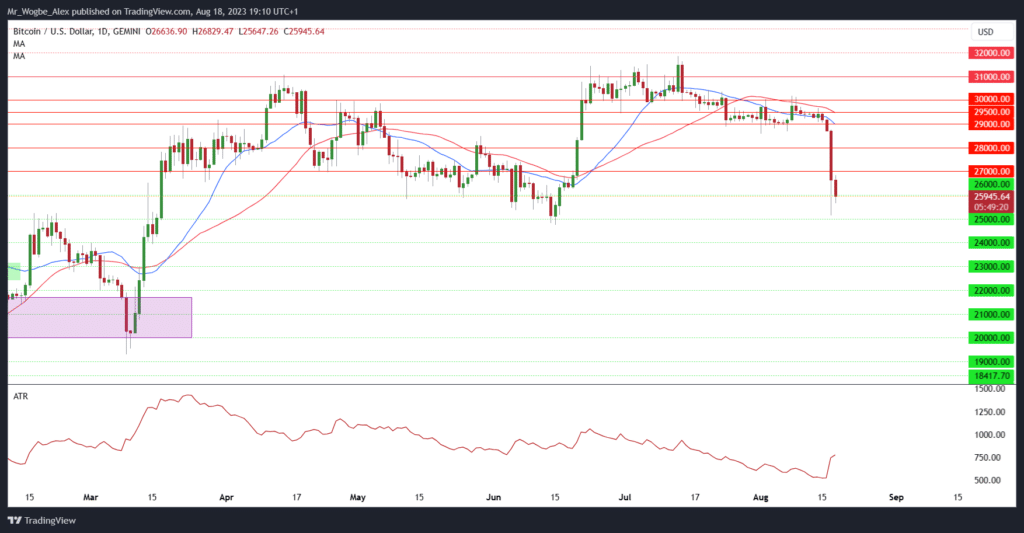

This unsettling slide in prices has had its most significant impact on Bitcoin, the pioneer and still the largest cryptocurrency, as its value dipped to a two-month nadir.

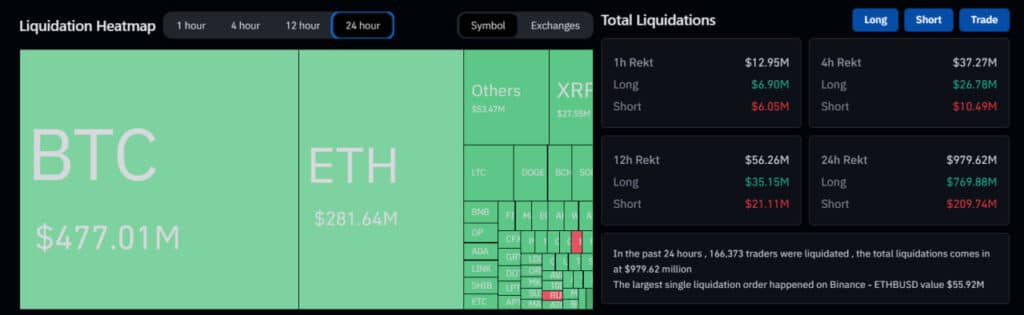

The figures themselves are enough to invoke a sense of awe, but the emotional reverberations within the trading community have been palpable. According to data from Coinglass, a colossal sum of $769 million, out of the total $979.6 million, had been liquidated from long positions in the past 24 hours.

Bitcoin Suffers Highest Liquidation, Followed by Ethereum

The epicenter of this financial shockwave has predominantly been within the realm of Bitcoin traders, who collectively absorbed losses amounting to a staggering $477 million as a result of long liquidations. Following closely in these tumultuous footsteps, Ethereum (ETH) suffered less pronounced, yet no less impactful, losses totaling $281 million, as of the time of this report.

The intricate mechanics underpinning this wave of liquidations find their roots in the precipitous descent of crypto prices. What might have begun as a gradual downtrend for the month quickly snowballed into an outright bloodbath. This disconcerting trajectory was accentuated by a concatenation of unsettling factors: the fragility of foreign currencies, escalating concerns enveloping the Chinese economy, and bond yields skyrocketing to heights unseen in years.

As the cryptocurrency market grapples with the aftershocks of this seismic event, all eyes remain intently focused on Bitcoin’s journey to recovery. The trading community and fervent crypto enthusiasts alike tread carefully, navigating these uncertain waters in the hopes of witnessing a resurgence in the fortunes of the crypto realm.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.