The Indian rupee is gearing up for a notable surge as market optimism grows with expectations of a potential pause in interest rate hikes by the US Federal Reserve. Traders and investors are closely monitoring the trajectory of inflation in the United States, as it could influence the Fed’s monetary policy decisions in the near future.

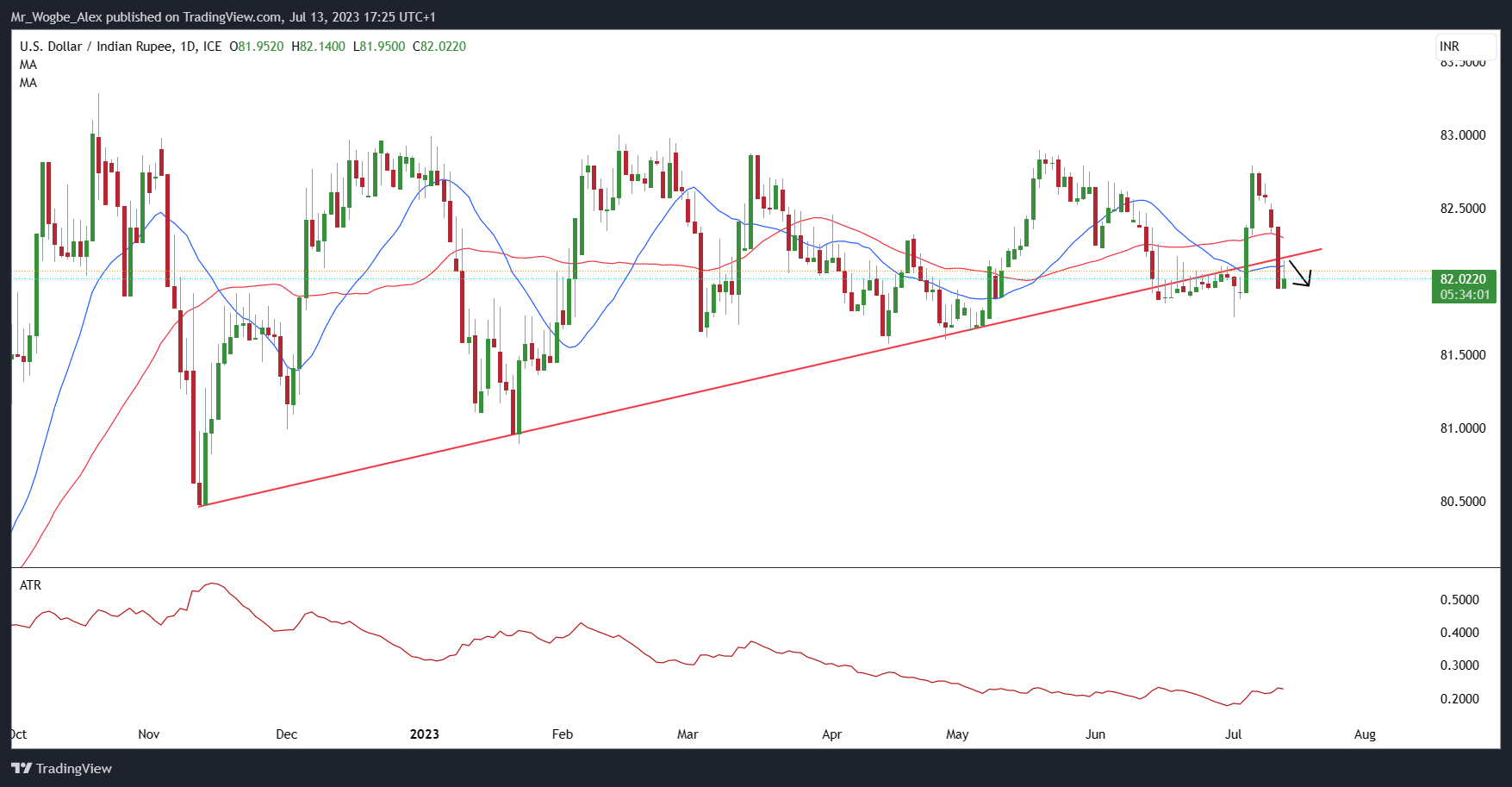

The rupee reached a high of 81.95 earlier today against the US dollar, displaying signs of continued strength compared to the previous session’s closing rate of about the same price point. This promising rebound brings the local currency tantalizingly close to recouping all the losses it suffered just last week when the USD/INR pair surged from 81.75 to 82.79.

Reserve Bank of India Supports Rupee at 81.70–81.80 Level

To ensure stability in the Indian currency, the Reserve Bank of India has been actively purchasing dollars in the range of 81.70–81.80 through public sector banks, Reuters reported on Thursday. This proactive approach has effectively communicated the central bank’s commitment to preventing any sharp depreciation of the rupee against the US dollar.

Interbank traders have taken note of this strategic intervention, which has bolstered their confidence in the rupee’s resilience and limited the downside potential of the USD/INR exchange rate.

US Dollar Weakens on Diminished Inflationary Pressure

In an interesting turn of events, the US dollar has encountered significant weakening, reaching its lowest level since April of the previous year. This depreciation is primarily driven by market speculation that the US Federal Reserve may decide to pause its ongoing interest rate hikes sooner than anticipated. The catalyst for this shift in sentiment was the release of unexpectedly subdued US inflation data, which triggered the largest one-day sell-off of the dollar in the past five months.

Consequently, the greenback finds itself at its weakest point in over a year against major currencies such as the euro and sterling. Furthermore, it has reached an eight-year low against the Swiss franc, underscoring the depth of its decline.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.