The U.S. dollar maintained its position close to a three-month peak on Tuesday, showing resilience against other major currencies despite a slight dip. The currency found support in robust U.S. economic indicators and a steadfast stance on interest rates by the Federal Reserve.

Earlier expectations of imminent and substantial rate cuts by the Fed were quashed by a string of positive reports, including an impressive unemployment update last Friday. Federal Reserve Chair Jerome Powell reinforced the message of patience regarding monetary policy adjustments.

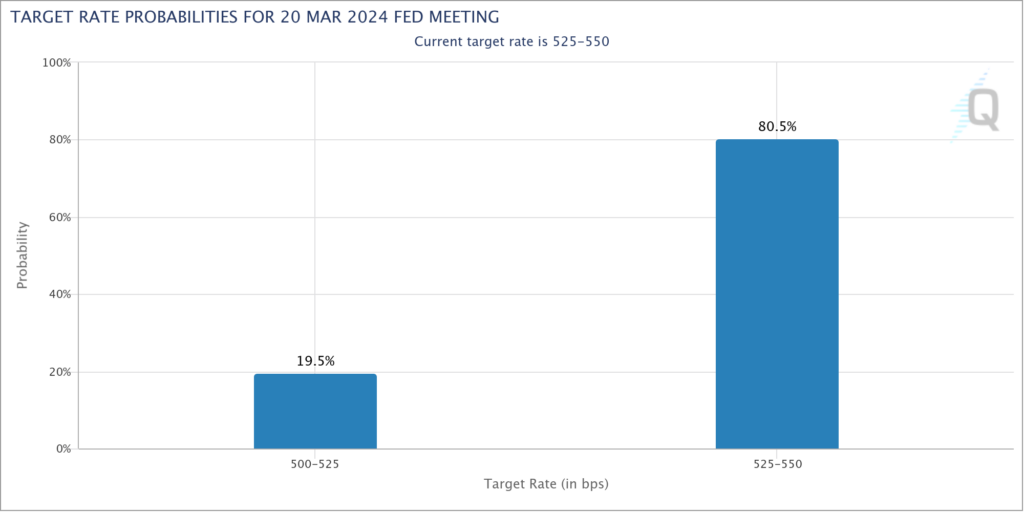

Traders, relying on the CME Group’s FedWatch Tool, now perceive a mere 19.5% likelihood of a rate decrease in March, marking a significant drop from the 68.1% estimate at the year’s onset.

Dollar Slips By 0.22% on Tuesday

At the time of this report, the dollar index, gauging the currency against six peers, saw a marginal decline of 0.22%, resting at 104.24. Nonetheless, it remained close to its recent high of 104.604 observed on Monday, the loftiest level since mid-November.

According to Reuters, Matthew Weller, leading research head at FOREX.com, highlighted a resurgence in the “U.S. economic exceptionalism trade,” a trend prominent in the third quarter of the previous year. He emphasized a shift in focus towards speculation on whether the U.S. economy could sidestep a slowdown or even undergo a revival, rather than succumbing to recessionary pressures.

The dollar’s vigor hinges significantly on interest rate projections, with higher yields rendering it more appealing to investors.

Elsewhere, the euro held steady at $1.0748, reflecting mixed economic signals from the eurozone. While German industrial orders climbed unexpectedly in December, consumer inflation expectations for the ensuing year receded.

The Australian dollar recorded a 0.50% uptick to $0.6515, rebounding from Monday’s 2-1/2-month trough at $0.6468. The Reserve Bank of Australia, maintaining the status quo on rates, cautioned of potential tightening measures in response to inflation and growth dynamics.

The RBA’s stance provided modest backing for the Australian dollar in the short term.

For those keen on delving deeper into the forex market and mastering currency trading, access to our premium forex signals service is available for enrollment.

Interested In Becoming A Learn2Trade Affiliate? Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.