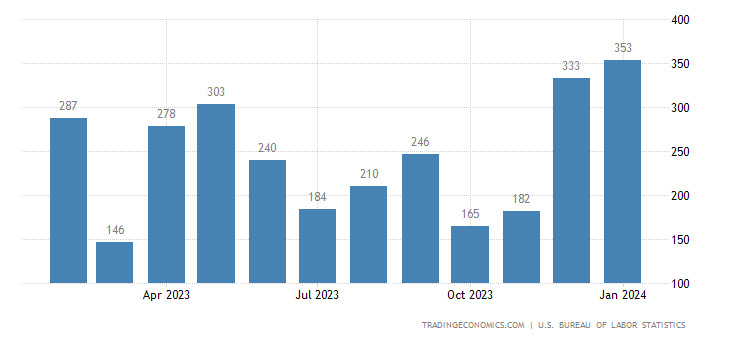

The US dollar marked its highest point this year on Friday following an impressive January jobs report. The Bureau of Labor Statistics revealed that the US economy generated a staggering 353,000 new jobs, surpassing market expectations of 180,000 and marking the most significant increase in a year.

The data also showcased a steady unemployment rate of 3.7%, maintaining its stability for the third consecutive month. Moreover, the average hourly earnings witnessed a substantial rise of 0.6%, outperforming the projected 0.3%.

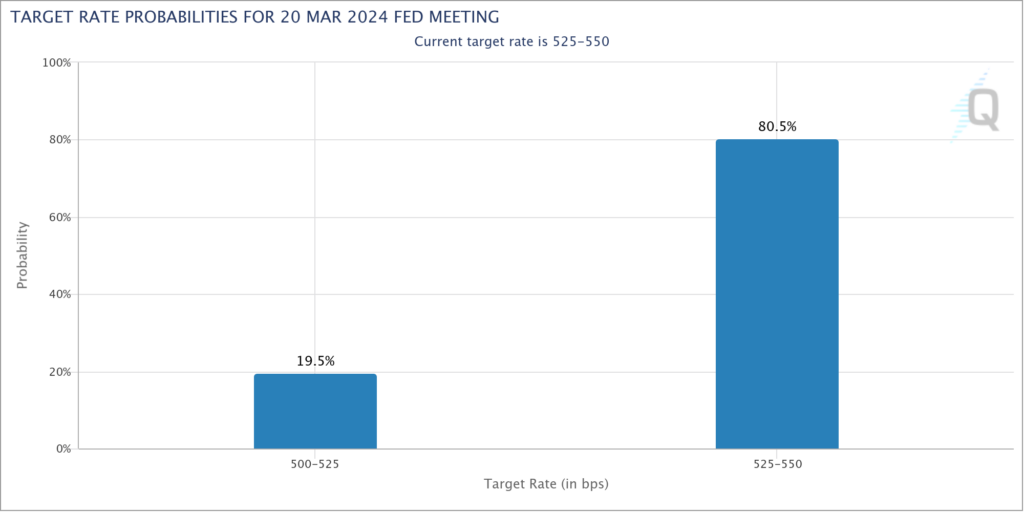

This upbeat employment report dealt a blow to expectations of a Federal Reserve rate cut, propelling the dollar index to 103.86—an increase of 0.83% on the day and 0.25% on the week.

The dollar’s robust performance extended beyond that, as it gained over 1% against the Japanese yen, reaching 148.05.

The CME FedWatch tool now assigns a mere 19.5% probability of a rate cut in March, a dramatic decrease from the over-80% estimation just a month ago. Meanwhile, Reuters indicates that a rate cut in May is nearly fully priced in by the market.

Dollar Jumps to New Highs as Other Currencies Slip

The dollar’s ascension wasn’t solely attributed to its domestic strength; other major currencies, including the euro, pound, and Australian dollar, grappled with disappointing economic data and political uncertainties.

The euro fell to 1.0797 against the dollar, the pound dropped to 1.2657, and the Australian dollar slid to 0.6532. Similarly, the Swiss franc experienced a 0.64% decline, settling at 0.8632.

As the US economy continues to outshine its global counterparts and the Federal Reserve maintains a relatively hawkish stance, the outlook for the dollar remains positive. Investors interested in currency trading can explore our premium forex signals service, which offers real-time market analysis and expert trading tips.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.