The dollar index, a gauge of the dollar’s strength against six major currencies, experienced a slight decline following the release of the Federal Reserve’s January meeting minutes.

The minutes revealed that most Fed officials expressed concerns about the risks of lowering interest rates prematurely, indicating a preference for more evidence of inflation growth. Despite the Fed’s 2% inflation target, actual inflation has consistently fallen short of this goal for several years.

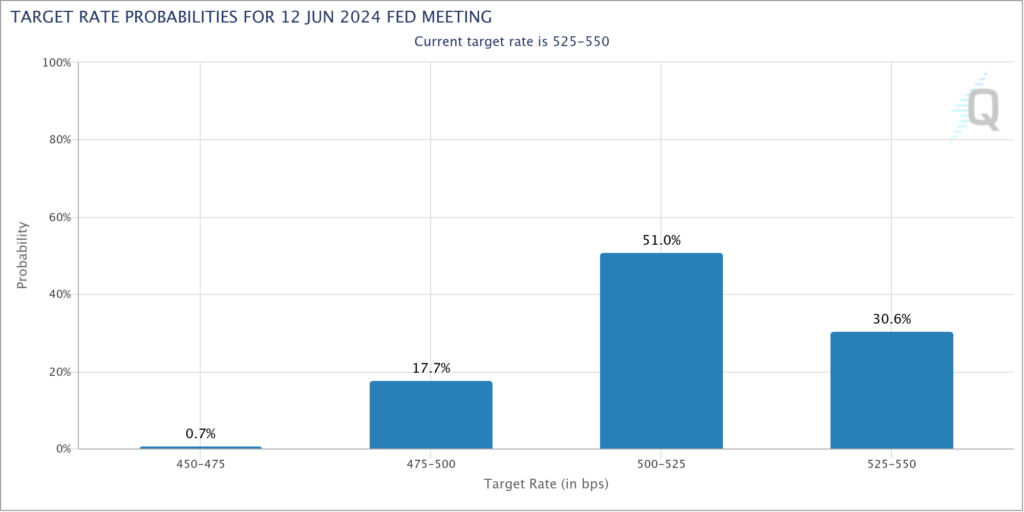

Interestingly, the minutes also highlighted that some officials were open to the possibility of raising rates should inflation data exceed expectations. This contrasts with market expectations, which have been leaning towards a rate cut by June, fueled by weak retail sales and other economic indicators.

Dollar Slips 0.04% on Wednesday

In response to these developments, the dollar index slipped by 0.04% to 103.99, touching a two-week low of 103.89 in the early Asian session on Thursday.

Meanwhile, the euro saw a modest increase of 0.11% to $1.0818 as the European Central Bank (ECB) signaled its readiness to implement additional stimulus measures if necessary. The ECB has been maintaining record-low interest rates and purchasing bonds to support the eurozone economy.

Also, the pound sterling strengthened by 0.15% to $1.2637, following the UK’s report of a record-high budget surplus in January. This development has raised expectations for increased fiscal spending by the government.

Conversely, the yen, a currency known for its low yields, depreciated by 0.21% to 150.28 per dollar on Wednesday as traders favored higher-yielding currencies in carry trades. This strategy involves borrowing low-interest currencies to invest in higher-yielding ones, profiting from the interest rate differential.

Overall, the dollar’s future remains uncertain as the Federal Reserve seeks to navigate a delicate balance between managing inflation and promoting economic growth. To stay informed about the latest market trends and receive top forex signals, sign up for our Telegram today.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.