The pound exhibited resilience on Wednesday, bolstered by the revelation of a significant uptick in UK house prices.

According to data released by Halifax, a prominent mortgage lender, house prices surged by 2.5% in the year leading up to January, marking the fastest pace of growth in a year. This surge hints at a robust recovery within the housing market, following a notable slump experienced in 2023.

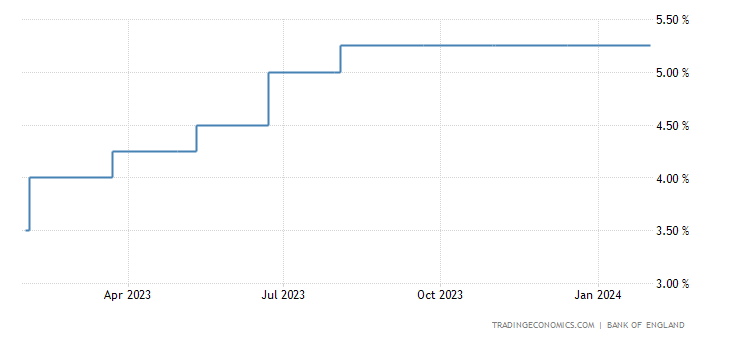

The buoyancy in the pound was further reinforced by statements from the Bank of England’s Deputy Governor, Sarah Breeden, who indicated a reluctance towards lowering interest rates hastily. Breeden emphasized a focus on the duration for which interest rates would remain anchored at their current level of 5.25%.

Such sentiments echoed the analysis put forth by Jane Foley, the head of FX strategy at Rabobank, who told Reuters that the resilience depicted by the Halifax survey in the UK housing sector suggests a tempered approach towards rate cuts by the BoE.

Pound Pulls Back from the Deep End Against the Dollar

The positive momentum translated into a commendable 0.24% ascent for the pound against the dollar, reaching $1.2628, thereby recuperating from a recent dip.

Additionally, the pound saw gains against the euro, climbing to 85.40 pence, marking a one-week high.

Despite these encouraging developments, the future trajectory of the pound remains somewhat uncertain, with money markets still indicating a 61% probability of a BoE rate cut by June. While the BoE maintained interest rates unchanged in February, indications of a potential cut emerged should inflation dwindle further and economic conditions falter.

Interestingly, a member of the BoE’s policymaking committee voted in favor of a rate cut, signaling a potential shift in monetary policy.

Looking ahead, while the pound enjoys a momentary uplift, analysts caution that challenges persist, particularly regarding British living standards.

A recent warning from a prominent think tank suggests that it may take until 2027 for less affluent households to regain their pre-pandemic spending power, underscoring the lingering economic disparities.

For those keen on exploring further insights into the pound and its trading dynamics, an opportunity presents itself through our premium forex signals service, offering valuable expertise and analysis.

Interested In Becoming A Learn2Trade Affiliate? Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.