The U.S. dollar soared to its highest level in three months on Monday, as the latest inflation data showed a stronger-than-expected rise in consumer prices in January.

The report boosted the outlook for the Federal Reserve to keep interest rates unchanged in March, while other major central banks are expected to ease their monetary policies.

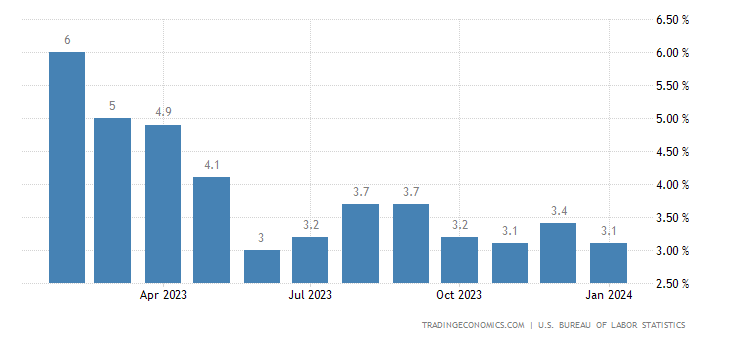

The Consumer Price Index (CPI) rose by 0.3% in January compared to the previous month, outperforming the anticipated 0.2% increase. Year-on-year, the CPI climbed by 3.1%, exceeding economists’ forecast of 2.9%.

Moreover, the core CPI, which excludes volatile food and energy prices, recorded a 0.4% month-on-month rise and a 3.9% year-on-year increase, aligning with December’s figures.

Dollar Etches Notable Gains Across the Board

These inflationary indicators propelled the dollar against its major counterparts, notably the Japanese yen. The dollar strengthened to 150.58 yen, marking its highest level since November, before settling at 150.88 yen, reflecting a 1.04% gain for the day.

Similarly, the dollar index, a measure of the greenback’s performance against a basket of six currencies, surged to a three-month peak of 104.96 before slightly retreating to 104.86 as of writing, marking a 0.7% increase.

Conversely, the euro experienced a decline, sliding to its lowest level since mid-November and dropping by 0.62% to $1.0700. This downward trend came amidst expectations of further interest rate cuts by the European Central Bank in March.

Where Market Sentiment Lies Right Now

Market sentiment shifted regarding the Federal Reserve’s monetary policy, with reduced expectations for imminent rate cuts.

Futures tied to the federal funds rate now imply no adjustments in March and less than a 50% likelihood of easing in May. The most probable scenario for the first rate cut by the Fed is now projected to occur in June, with a 74.4% probability.

The dollar’s surge underscores investors’ confidence in the U.S. economy’s resilience amid inflationary pressures, setting the stage for continued vigilance by central banks worldwide.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.