The U.S. dollar showcased resilience on Thursday, bolstered by encouraging figures on unemployment benefits, signaling a robust labor market and diminishing prospects of a Federal Reserve rate cut.

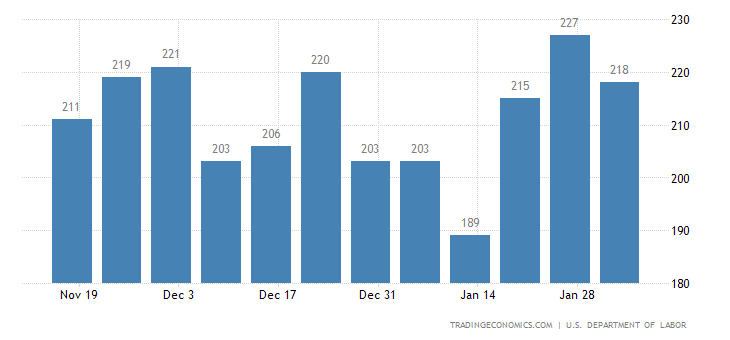

According to the latest report from the Labor Department, initial jobless claims decreased by 9,000 to 218,000 during the week ending February 3, surpassing expectations set at 220,000.

The positive data on jobless claims echoed the Federal Reserve’s assertion of maintaining steady interest rates in the foreseeable future, citing a buoyant economic landscape. This sentiment was reinforced by last week’s employment report, which revealed an addition of 353,000 jobs in January, marking the most substantial monthly gain in a year.

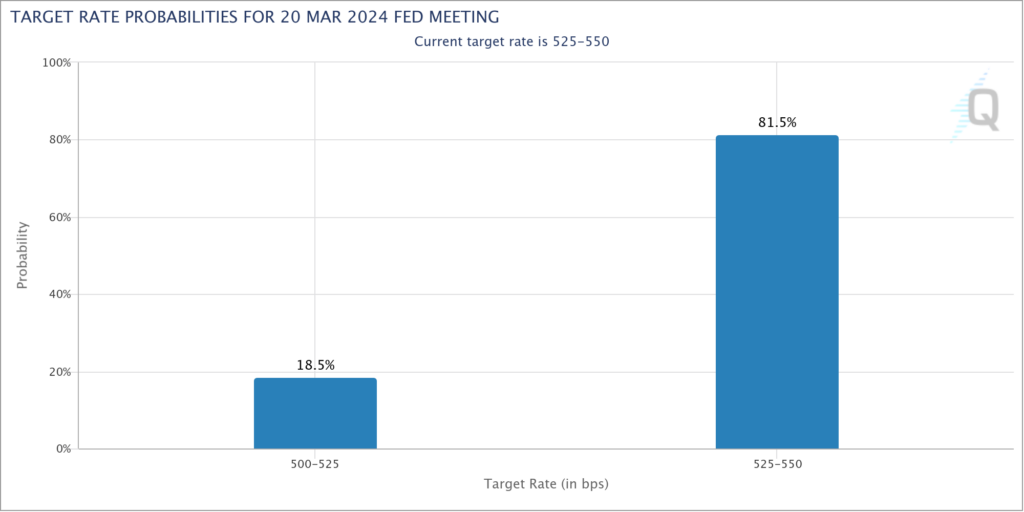

As a consequence, market projections for a rate cut by year-end dwindled to 117 basis points from 140 basis points prior to the release of the employment report, as indicated by the overnight Fed funds rate. Moreover, the likelihood of a rate cut in March plummeted to 18.5% from 38% a week earlier, according to data from CME Group’s FedWatch Tool.

U.S. Dollar Index Rebounds

The dollar index, gauging the currency against a basket of six major counterparts, ascended by 0.15% to 104.20, following a peak of 104.43 after the publication of the jobless claims data, interrupting a recent two-day dip.

Meanwhile, the dollar strengthened against the yen, typically considered a haven currency during market turbulence, with the yen declining by 0.82% to 149.37 per dollar, marking its lowest level since late November.

Shinichi Uchida, the deputy governor of the Bank of Japan, remarked on Thursday that the central bank was unlikely to adopt an aggressive stance on interest rate hikes, even upon exiting negative interest rates.

The trajectory of the dollar’s ascendancy appears poised to persist as long as the U.S. economy continues to outshine its counterparts, coupled with the Federal Reserve’s measured monetary policy approach.

For those interested in delving deeper into the dynamics influencing the dollar and exploring trading opportunities, our complimentary forex signals service offers invaluable insights.

Interested In Becoming A Learn2Trade Affiliate? Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.