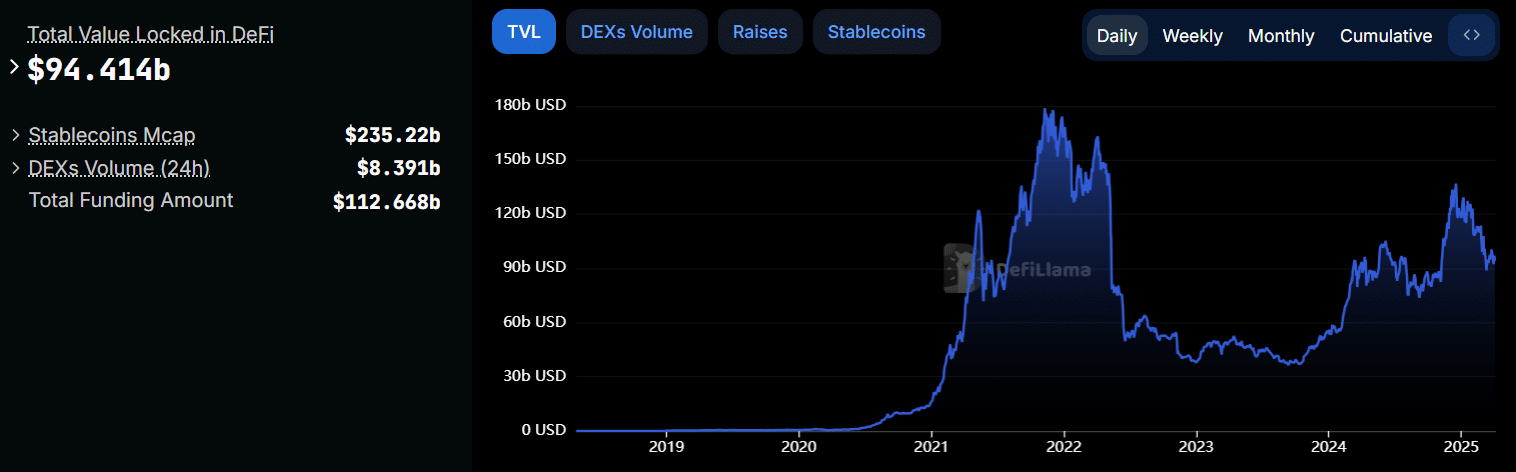

The DeFi sector has experienced a significant downturn, with total value locked (TVL) falling more than 30% from its December high.

According to DefiLlama data, DeFi’s TVL now stands at approximately $94.4 billion, down from $137 billion in mid-December, even hitting a recent low of $88 billion in March.

This decline mirrors broader cryptocurrency market trends, which initially surged following Donald Trump’s election in November but have since cooled considerably during 2025’s first quarter.

What’s Causing the DeFi Retreat?

Several key factors appear to be driving this pullback:

1. Macroeconomic pressure: President Trump’s implementation of reciprocal tariffs on trading partners has dampened the initial optimism from his pro-crypto policies.

2. Persistent inflation concerns: Fears that U.S. inflation will remain high have led to expectations that Federal Reserve rate cuts will be delayed further.

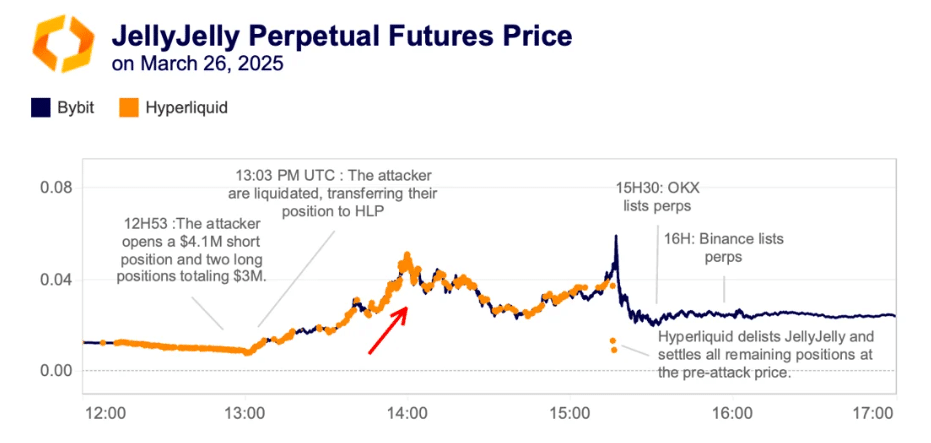

3. Market manipulation incidents: Recent exploits like the March 26 attack on Hyperliquid, a major decentralized perpetual futures platform, have highlighted vulnerabilities in DeFi systems.

The Hyperliquid attack followed a familiar pattern seen in previous DeFi exploits. A trader manipulated the price of Jelly-My-Jelly, a Solana-native token with extremely thin liquidity (averaging just $72,000 daily).

By opening large positions in its perpetual futures market while simultaneously withdrawing margin and pumping the spot price, the attacker caused the token’s price to surge over 500% within an hour.

This manipulation exposed weaknesses in Hyperliquid’s liquidation system, preventing liquidators from effectively closing positions and amplifying losses.

Experts Weigh In on DeFi’s Future

Industry analysts point to both short-term challenges and long-term potential for the sector: “The drop shows how market uncertainty can significantly impact decentralized finance,” explained Kronos Research CIO Vincent Liu to The Block, noting decreases in Ethereum and Bitcoin active addresses signaling reduced user confidence.

HashKey Research Director Kevin Guo attributed the decline to DeFi’s lack of maturity:

“While the broader DeFi ecosystem has matured over the past few years, it still needs to mature further to build integrations with institutions and financial products at competitive rates.”

Despite current challenges, LVRG Research Director Nick Ruck remains optimistic about DeFi’s long-term prospects, describing it as,

“Positioned for potential long-term gains as a relatively stable source of return for investors, especially as regulators around the world warm to institutions integrating blockchain technology.”

Short-term recovery may depend on potential reversals in Trump’s tariff policies and positive U.S. consumer price index data expected next week, which could contribute to a broader market recovery.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.