Digital asset investment products recorded $1.17 billion in crypto outflows during the latest reporting week, marking the second consecutive week of negative flows.

The sell-off stems from market volatility following the October 10 liquidity cascade and growing uncertainty about whether the Federal Reserve will cut interest rates in December.

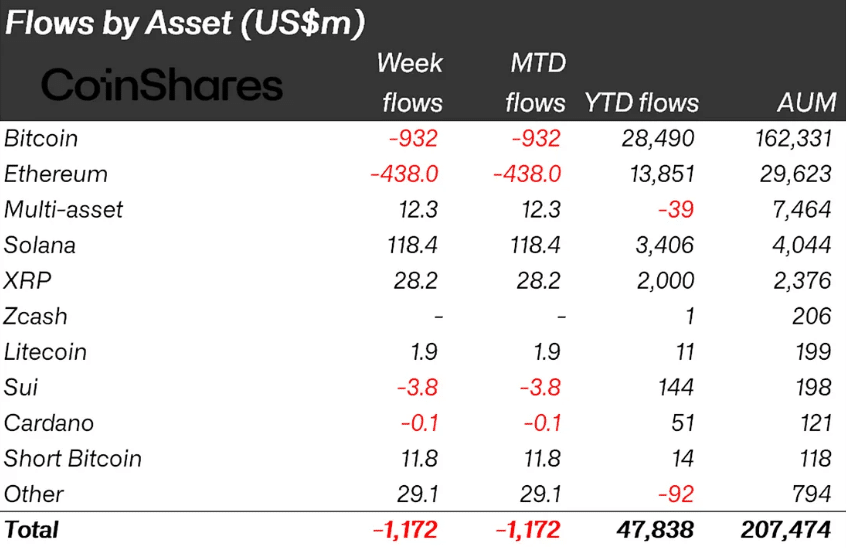

According to the latest CoinShares report, Bitcoin bore the brunt of the crypto outflows, with investors withdrawing $932 million from Bitcoin-focused products. Ethereum wasn’t spared either, seeing $438 million leave the market.

What’s interesting is that short Bitcoin ETPs—investment products that profit when Bitcoin prices fall—pulled in $11.8 million.

This marks one of the highest weekly inflows for these bearish bets since May 2025, suggesting some investors are actively betting against Bitcoin’s near-term price action.

Trading volumes stayed elevated at $43 billion for the week, with a brief recovery on Thursday as hopes emerged around resolving the U.S. government shutdown. But those hopes quickly faded by Friday, triggering fresh outflows.

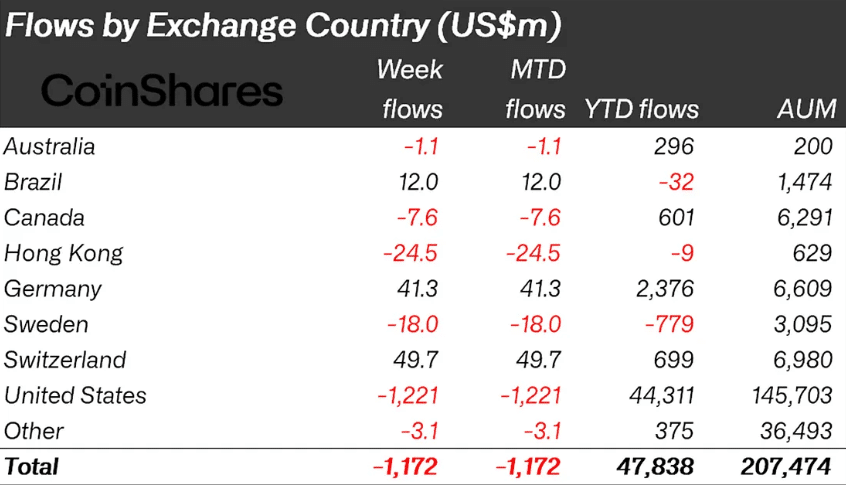

Regional Crypto Outflows Breakdown: U.S. Weakness vs. European Strength

The geographic breakdown reveals a stark contrast. U.S.-based products took a $1.22 billion hit, shouldering nearly all the week’s losses.

Meanwhile, European investors moved in the opposite direction. Germany and Switzerland recorded inflows of $41.3 million and $49.7 million, respectively, showing sustained confidence despite American pessimism.

This regional split matters for traders watching institutional sentiment. When U.S. funds see heavy withdrawals while European counterparts buy the dip, it often signals different macroeconomic concerns or regulatory expectations between markets.

Altcoins Buck the Trend with Solana Leading

While major assets struggled, alternative cryptocurrencies showed resilience. Solana led with $118 million in inflows last week alone, bringing its nine-week total to an impressive $2.1 billion.

Other altcoins also attracted fresh capital, including HBAR with $26.8 million and Hyperliquid with $4.2 million.

For crypto enthusiasts, this pattern suggests investors are diversifying beyond Bitcoin and Ethereum, possibly seeking higher growth potential or hedging against major asset volatility.

The continued strength in altcoins during broader market weakness could signal shifting investor preferences worth monitoring closely.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.