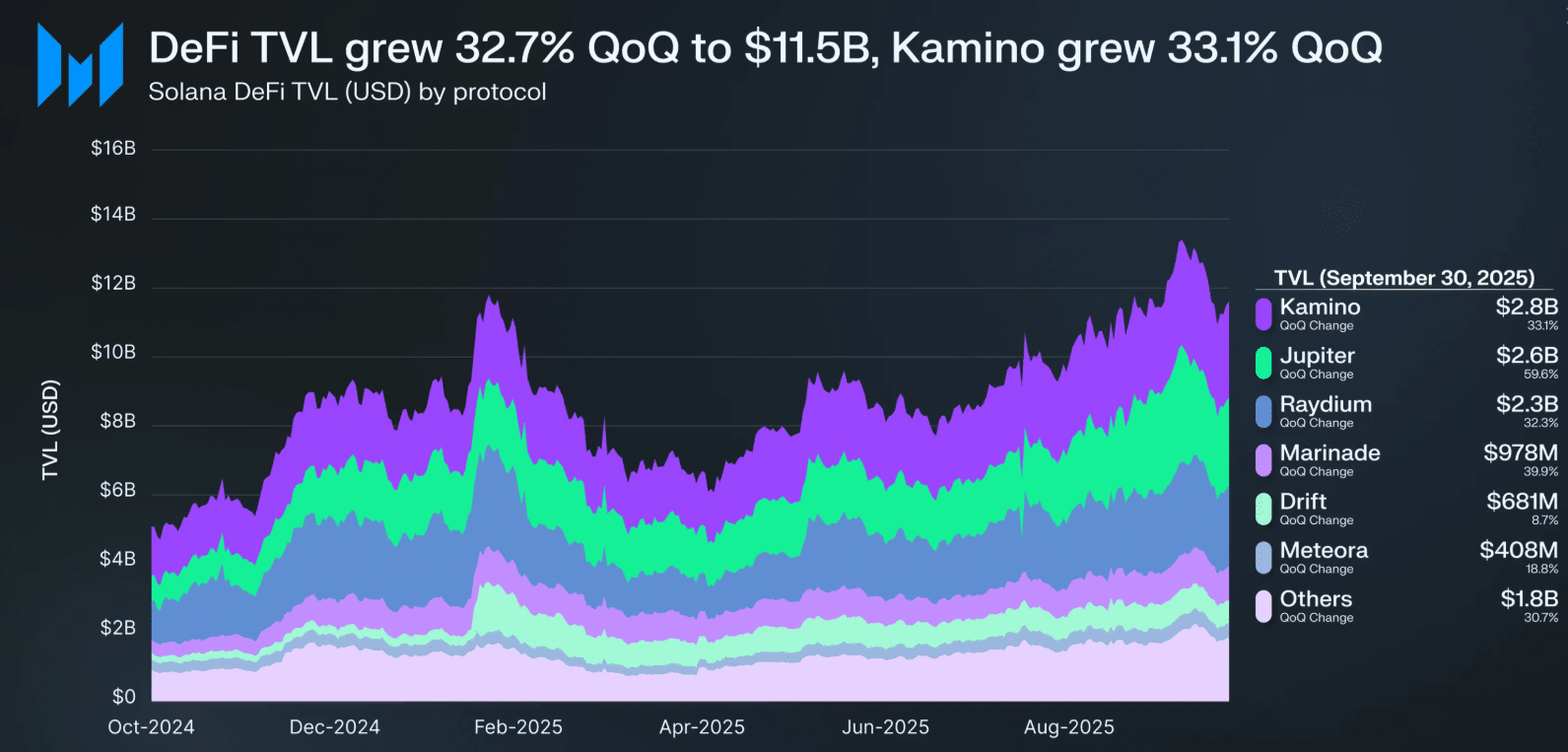

Solana finished Q3 2025 with impressive numbers across its ecosystem. The network’s total value locked in decentralized finance reached $11.5 billion, marking a 32.7% jump from the previous quarter, according to the latest Messari report.

SOL’s market cap climbed to $113.5 billion by quarter’s end, placing it sixth among all cryptocurrencies.

The network generated $222.3 million in real economic value during Q3, which includes all transaction fees and validator tips. What’s particularly interesting is that applications on Solana earned $2.63 for every dollar spent on transaction fees.

This metric, called the Application Revenue Capture Ratio, increased from 222.8% to 262.8%, showing that developers are finding better ways to monetize their platforms.

Stablecoins and DeFi Lead the Expansion on Solana

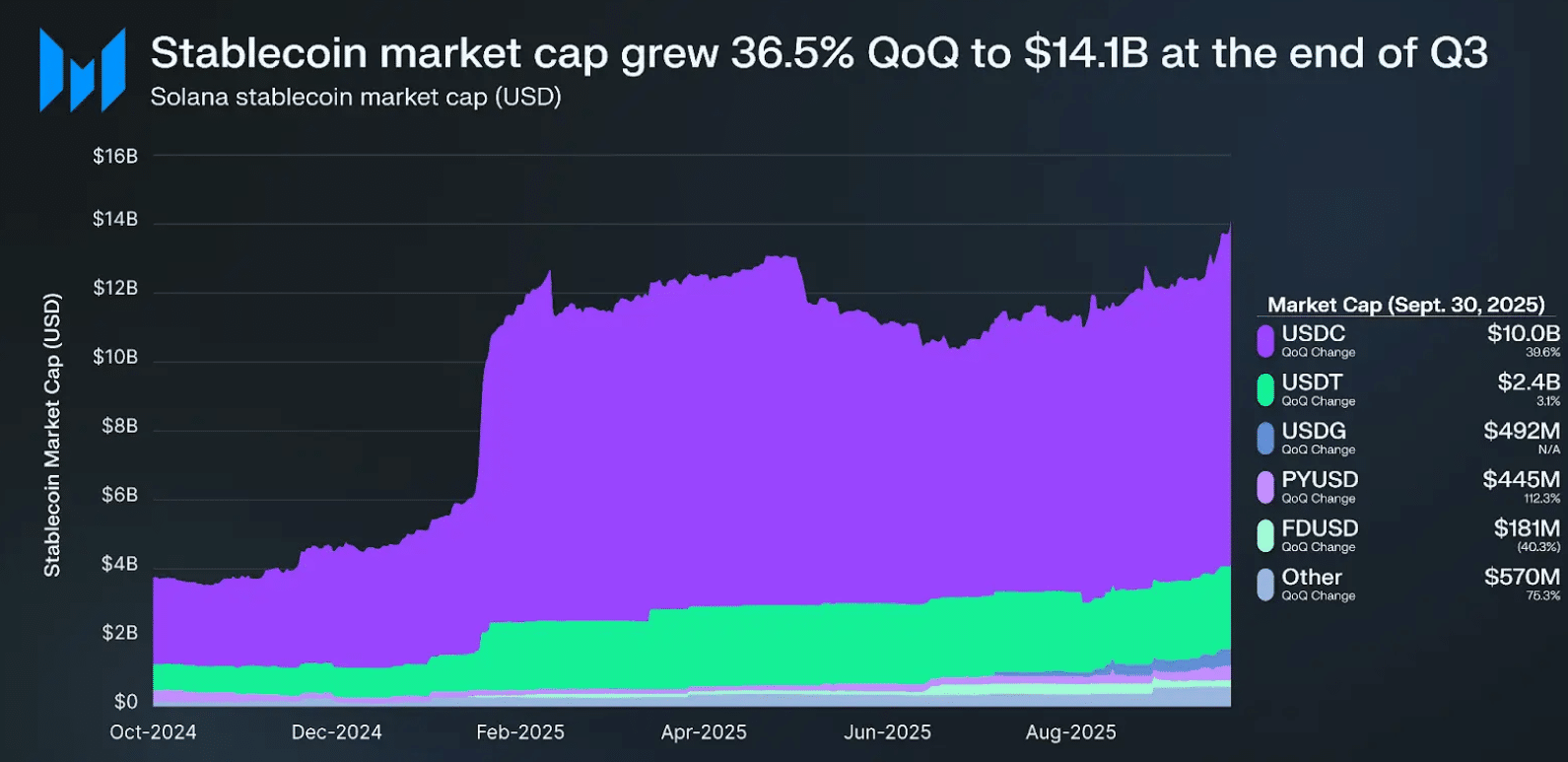

Stablecoin adoption on Solana hit a new peak at $14.1 billion, up 36.5% from Q2. USDC grew to $10 billion, while PYUSD more than doubled to reach $445.3 million.

This surge in stablecoins points to sustained capital flow into the network, especially after high-profile token launches earlier in the year created new trading pairs.

Kamino maintained its position as the top DeFi protocol with $2.8 billion in TVL. Jupiter climbed to second place with $2.6 billion after launching Jupiter Lend in August. Raydium came third with $2.3 billion.

Daily spot DEX volume averaged $4 billion, up 17% from the previous quarter.

Real-World Assets and Infrastructure Updates

The real-world asset sector grew 41.9% to $682.2 million. Ondo Finance’s USDY led with $176.8 million, followed by BlackRock’s BUIDL at $175.2 million. Backed’s xStocks product, which tokenizes U.S. equities and ETFs, reached 70,420 holders with a market cap of $115.7 million.

Infrastructure developments included the announcement of Alpenglow, a new consensus protocol expected to reduce transaction finality from 12.8 seconds to just 100-150 milliseconds. The Firedancer client continued testing on mainnet, with 17% of the network stake running Frankendancer versions by October.

Digital asset treasury companies collectively held 18.9 million SOL worth $3.9 billion, led by Forward Industries’ $1.65 billion raise backed by Galaxy, Jump, and Multicoin Capital.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.