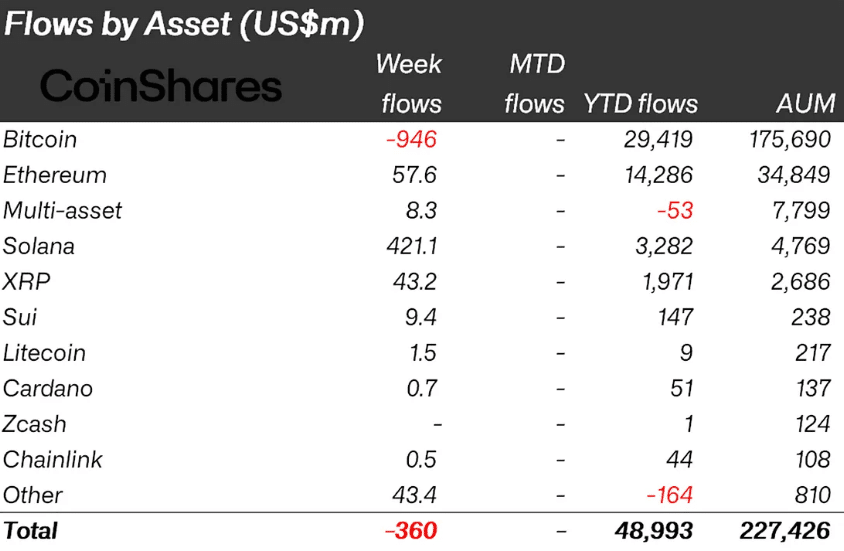

Digital asset investment products saw $360 million in crypto outflows last week, marking a sharp reversal in market sentiment.

The selling wave came after Federal Reserve Chair Jerome Powell signaled that another interest rate cut in December wasn’t guaranteed, creating uncertainty among investors who had grown comfortable with easier monetary policy.

Bitcoin ETFs absorbed the brunt of the damage, recording $946 million in redemptions. This represents one of the largest single-week outflows since these products launched, suggesting that institutional investors are pulling back from their positions.

The timing is particularly notable because it follows a recent rate cut that many expected would boost crypto prices.

Meanwhile, US-based funds led the exodus with $439 million in withdrawals. Germany and Switzerland provided some relief with modest inflows of $32 million and $30.8 million, respectively, but these couldn’t offset the American selling pressure.

Solana Bucked the Crypto Outflows Trend

Not all coins suffered equally. Solana attracted $421 million in new money, marking its second-largest inflow week ever.

The surge came from newly launched US-based Solana ETFs, which have now pulled in five consecutive days of positive flows. For traders, this presents an interesting opportunity to watch whether Solana can maintain momentum while Bitcoin struggles.

The divergence also hints at a potential rotation strategy. When major assets like Bitcoin face headwinds, some investors shift capital into higher-risk alternatives rather than exiting crypto entirely.

What This Means for Traders

The current situation puts the market in a fragile state. Bitcoin remains highly sensitive to Federal Reserve decisions, and with key economic data releases sparse, traders lack clear directional signals.

Long-term holders continue selling their positions, which adds consistent downward pressure on prices.

Liquidation data tells a concerning story too. Roughly $1.99 billion in leveraged positions got wiped out as Bitcoin dropped below $104,000, with long positions accounting for over $1.6 billion of those losses.

This suggests many traders were caught betting on price increases that didn’t materialize.

For those watching the market, the key question becomes whether ETF inflows can resume or if selling will push Bitcoin toward the $100,000 level. Until that clarity emerges, caution appears warranted.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.