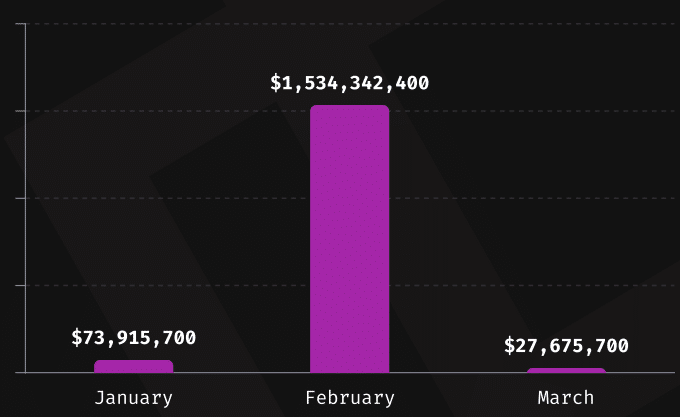

The cryptocurrency sector faced unprecedented security challenges in the first quarter of 2025, with total crypto losses reaching a staggering $1.63 billion according to Immunefi’s latest report.

This figure represents a 4.7x increase compared to Q1 2024, making it the worst quarter for crypto hacks in the industry’s history.

Breakdown of Major Crypto Losses

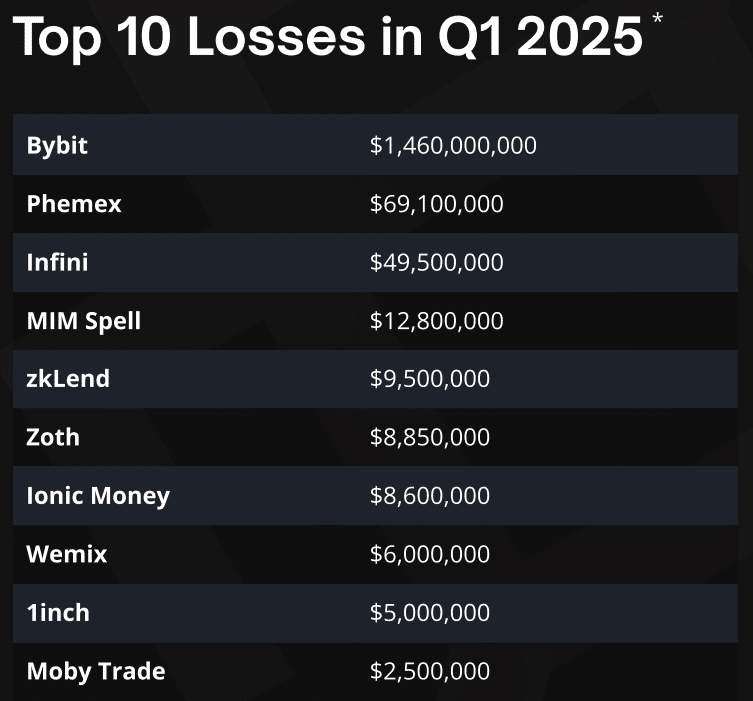

The financial damage was primarily concentrated in two devastating attacks on centralized exchanges (CeFi). Bybit suffered the largest hack in crypto history, losing $1.46 billion when attackers gained control of an Ethereum cold wallet in February.

Singapore-based Phemex lost $69.1 million in a January breach. Together, these two incidents accounted for 94% of all Q1 losses.

Security researchers have linked both major attacks to the North Korean Lazarus Group, highlighting the growing threat of state-sponsored hackers targeting crypto platforms. These sophisticated attackers exploited infrastructure vulnerabilities rather than smart contract weaknesses, giving them complete access to stored funds.

“The Q1 2025 breaches mark a historic moment in crypto security,” said Mitchell Amador, Founder and CEO at Immunefi. “The sheer scale of the Bybit and Phemex attacks shows how state-backed actors are arguably the most pressing threat to our industry.”

Shifting Attack Patterns and Recovery Challenges

While the total financial damage increased dramatically, the number of attacks actually decreased by 36% compared to Q1 2024, dropping from 63 to 40 incidents. This suggests attackers are focusing on fewer but more profitable targets.

The report reveals several significant trends:

- CeFi platforms became the primary target, accounting for 94% of losses despite facing only two attacks, while DeFi protocols experienced 38 separate incidents but represented just 6% of total losses.

- Hacks remained the exclusive cause of losses, with no significant fraud incidents reported in Q1 2025.

- BNB Chain suffered the most individual attacks (19), followed by Ethereum (15) and Base (3).

- Fund recovery efforts were largely unsuccessful, with only $6.5 million (0.4% of total losses) recovered – a sharp decline from the 21.2% recovery rate in Q1 2024.

The attacks occurred against a backdrop of growing capital in the crypto ecosystem, with nearly $100 billion locked across Web3 protocols as of March 2025. This concentration of value continues to attract sophisticated threat actors.

Industry experts now emphasize the need for comprehensive security measures that protect not just smart contracts but entire infrastructure stacks to prevent catastrophic breaches before they happen.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.