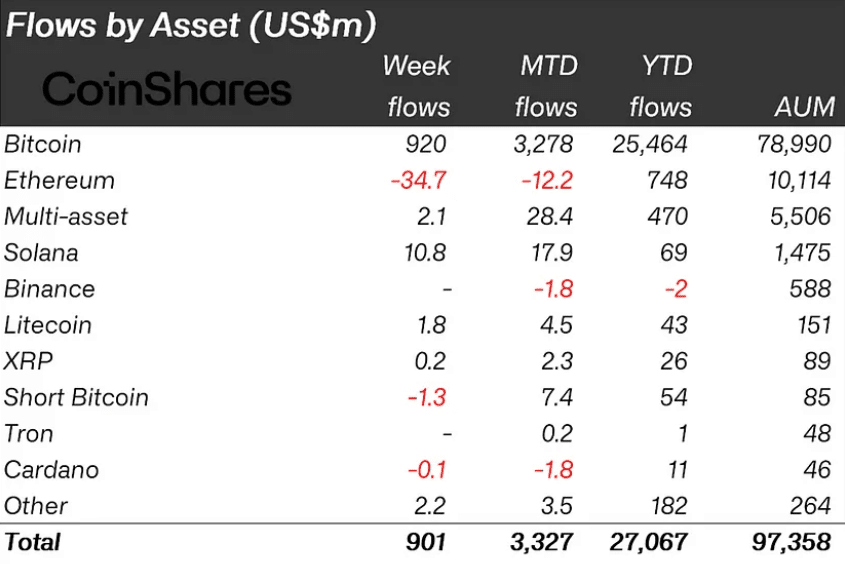

Fresh data from CoinShares shows crypto investments are reaching new heights, with weekly crypto inflows hitting $901 million. This surge has pushed the total inflows for 2024 to an impressive $27 billion, nearly tripling the previous record set in 2021.

The United States led this investment wave with $906 million in inflows, while smaller markets showed mixed results. Germany and Switzerland recorded modest gains of $14.7 million and $9.2 million, respectively. Meanwhile, Canada, Brazil, and Hong Kong saw small outflows.

Understanding the Bitcoin ETF Rush

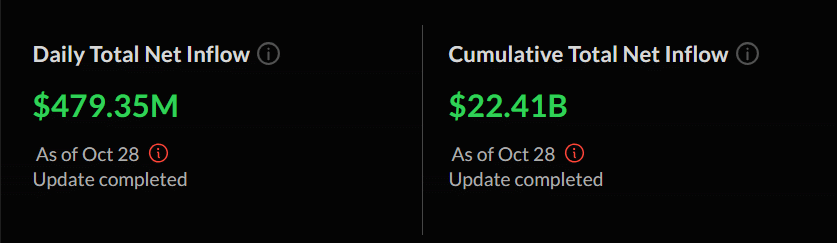

Bitcoin continues to attract the lion’s share of investments, pulling in $920 million in the latest week. The momentum carried into Monday, with U.S. spot Bitcoin ETFs recording their highest daily inflows in two weeks at $479 million, according to SoSoValue data.

BlackRock’s IBIT fund stood out by attracting $315 million on Monday alone, marking its eleventh straight day of positive flows.

While Bitcoin dominates the headlines, other crypto investments show interesting patterns.

Ethereum faced some resistance, with $35 million in outflows last week. However, Solana emerged as a bright spot, securing the second-highest inflows at $10.8 million.

The blockchain stock sector also showed signs of recovery, marking its third straight week of gains with $12.2 million in new investments.

Surge in Crypto Inflows Linked to U.S. Political Row

Market observers link the current investment surge to U.S. political developments, particularly Republican polling gains. This political factor appears to be driving both Bitcoin prices and investment flows.

The flagship cryptocurrency reached $73,600 on Wednesday, marking its highest point since June and returning to its all-time high level.

The remarkable inflows into crypto investments this month represent 12% of total assets under management, making it the fourth-largest month of inflows ever recorded. These numbers suggest growing institutional confidence in digital assets, despite ongoing market volatility.

This trend extends beyond pure crypto investments. Traditional finance companies are increasingly entering the space, with major asset managers launching new crypto investment products. The success of spot Bitcoin ETFs, in particular, shows how mainstream financial tools are making crypto more accessible to traditional investors.

These developments paint a picture of a maturing crypto market, where institutional money flows more freely and investment options continue to expand. However, the concentration of flows in Bitcoin suggests investors still prefer the most established digital asset when making significant investments.

Interested In Trading The Market With A Trustworthy Partner? Try LonghornFX Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.