As crypto ETFs continue to make waves in the investment world, new data from Binance Research reveals a bright future ahead.

The market has already seen amazing growth, with Bitcoin ETFs alone gathering over $63.3 billion in assets under management. This success story shows just how much investors want easier ways to invest in digital currencies.

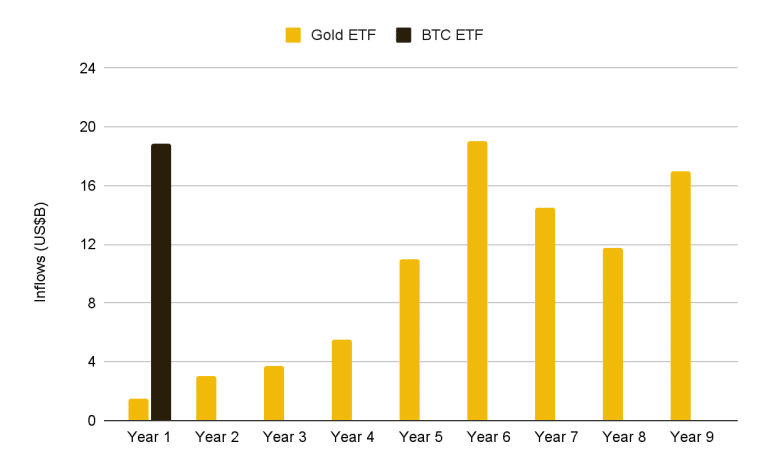

The numbers tell an impressive story. Bitcoin ETFs have pulled in more money in less than a year than gold ETFs did in their first year.

While gold ETFs attracted about $1.5 billion in their first year, Bitcoin ETFs have already brought in $18.9 billion. Even more striking is that over 1,200 institutions now invest in these ETFs, compared to just 95 institutions that invested in gold ETFs when they first launched.

What’s Coming Next for Crypto ETFs

Several big changes are on the horizon. First, we’re likely to see more countries letting people trade crypto ETFs. Hong Kong has already approved Bitcoin and Ethereum ETFs, and other countries might follow suit.

Another exciting development is that some ETFs might start offering extra earnings through staking, especially for Ethereum ETFs. This means investors could earn more money just by holding their ETF shares.

The market might also see new types of ETFs for different cryptocurrencies. Companies have already asked permission to create ETFs for cryptocurrencies like Solana and XRP. While getting approval might take time, it shows that the market is ready to grow beyond just Bitcoin and Ethereum.

One of the most important changes coming is the ability to trade options on crypto ETFs. This will give investors more ways to manage risk and could bring even more money into the crypto market. It’s especially important for big investors who want more sophisticated trading tools.

The impact of these developments could be huge. More investment options could lead to steadier prices and make cryptocurrencies more appealing to traditional investors.

As more people get comfortable with crypto ETFs, we might see them become as common as stock ETFs in investment portfolios.

Looking ahead, success will depend a lot on whether central banks keep interest rates low and if regulations stay friendly to crypto. But with major financial companies backing these products and growing investor interest, crypto ETFs seem set for strong growth in the coming years.

Interested In Trading The Market With A Trustworthy Partner? Try LonghornFX Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.