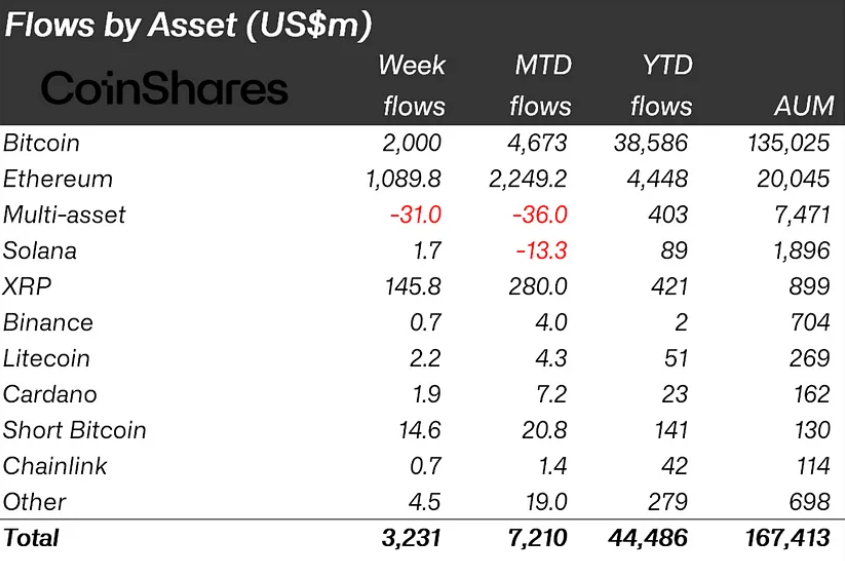

Digital asset investment products have shattered previous records, with 2024 crypto inflows reaching an unprecedented $44.5 billion. The latest data from CoinShares shows a remarkable ten-week streak of positive investments, with the most recent week adding another $3.2 billion to the total, highlighting growing institutional confidence in cryptocurrency markets.

Main Catalysts of Recent Crypto Inflows

Bitcoin continues to dominate institutional interest, drawing $2 billion in the latest weekly report and accumulating $11.5 billion since November’s election results. Ethereum has emerged as a strong second contender, maintaining seven consecutive weeks of inflows totaling $3.7 billion.

Trading volumes tell an equally impressive story, with cryptocurrency Exchange-Traded Products (ETPs) averaging $21 billion in weekly activity. This represents 30% of all Bitcoin trading on trusted exchanges, showcasing the growing prominence of institutional investment vehicles in the crypto market.

The Next Wave: 2025 ETF Outlook

As the cryptocurrency market matures, analysts predict a significant expansion in ETF offerings throughout 2025. Bloomberg experts have outlined several key developments expected to shape the ETF landscape:

First-wave approvals are likely to include dual Bitcoin-Ethereum ETFs from established financial institutions like Hashdex, Franklin Templeton, and Bitwise. These combination products could offer investors exposure to both leading cryptocurrencies through a single investment vehicle.

The second wave might bring Litecoin and HBAR ETFs to market. These cryptocurrencies could see faster approval processes since regulators haven’t classified them as securities, potentially smoothing their path to market.

Later in 2025, pending new SEC leadership, the market could see the introduction of Solana and XRP ETFs. Industry experts suggest high probability for Solana ETF approval by year-end, while XRP’s prospects depend heavily on regulatory clarity.

We expect a wave of cryptocurrency ETFs next year, albeit not all at once. First out is likely the btc + eth combo ETFs, then prob Litecoin (bc its fork of btc = commodity), then HBAR (bc not labeled security) and then XRP/Solana (which have been labeled securities in pending… pic.twitter.com/29vMdciZxE

— Eric Balchunas (@EricBalchunas) December 17, 2024

The ETF expansion reflects broader market trends, with regional data showing strong global adoption. The United States leads with $3.1 billion in recent inflows, followed by Switzerland ($36 million), Germany ($33 million), and Brazil ($25 million).

This surge in cryptocurrency investment products, coupled with the anticipated expansion of ETF offerings, suggests a fundamental shift in how traditional financial institutions approach digital assets.

As regulatory frameworks evolve and new leadership takes shape at the SEC, 2025 could mark a pivotal year for cryptocurrency investment vehicles, offering investors unprecedented access to a diverse range of digital assets through conventional financial channels.

Make money without lifting your fingers: Start using a world-class auto trading solution

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.