Securities and Exchange Commission (SEC) Chairman Gary Gensler announced his upcoming departure from the regulatory body, set for January 20, 2025. The news sent ripples through the cryptocurrency markets, with major digital assets seeing significant price increases.

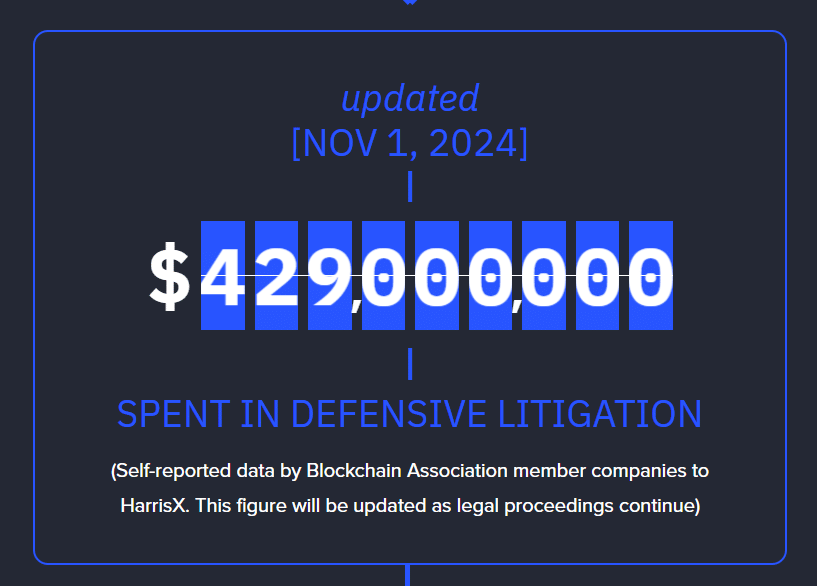

During his tenure, Gensler took an aggressive stance toward the cryptocurrency industry. His leadership saw the SEC file over 100 enforcement actions against crypto companies through 2023, resulting in defensive litigation costs exceeding $429 million for these firms.

This strategy, often criticized as “regulation by enforcement,” created significant challenges for American crypto companies trying to operate in an uncertain regulatory environment.

Gary Gensler Exits SEC: Market Response and Industry Outlook

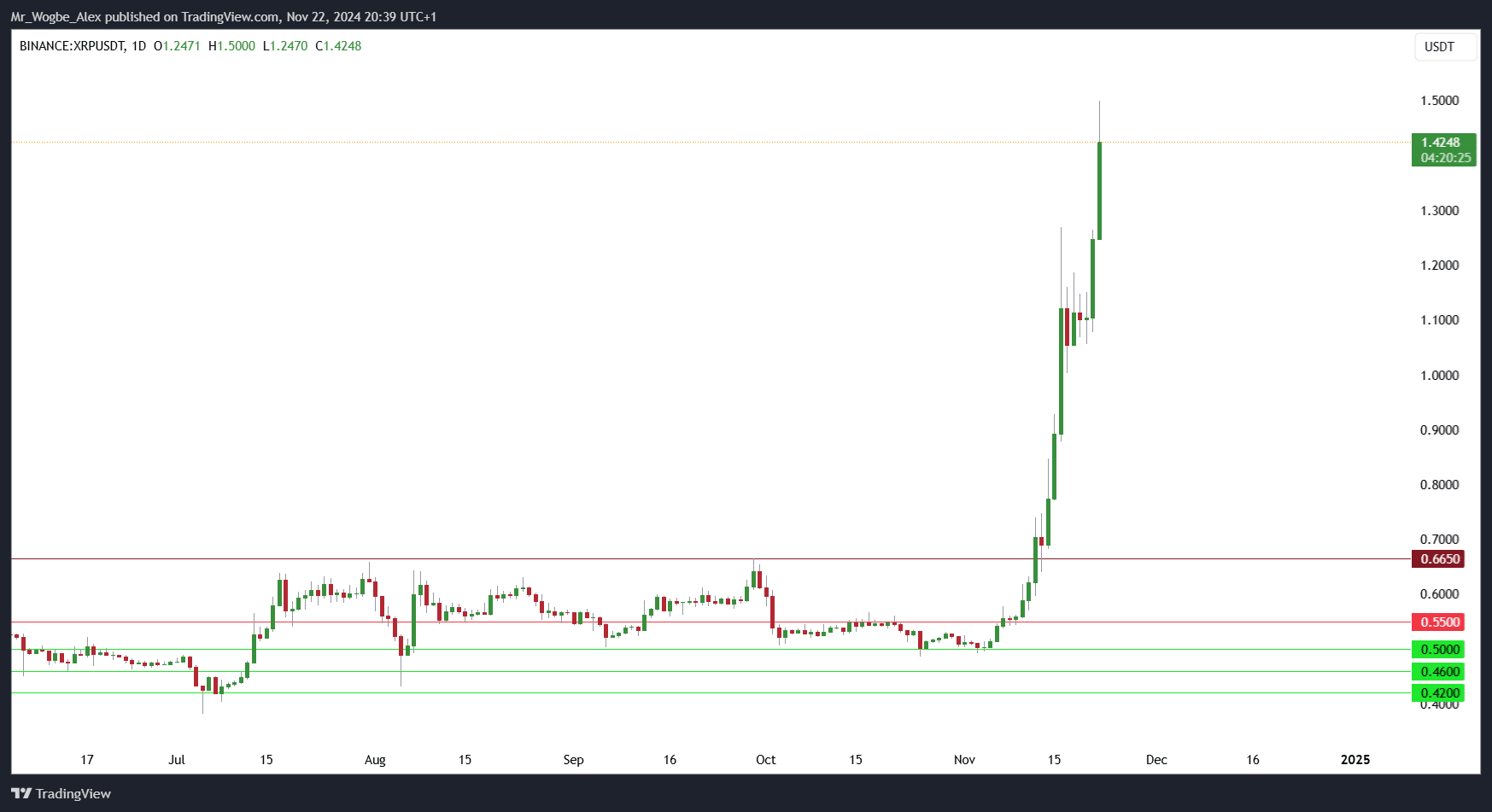

The cryptocurrency market’s reaction to Gensler’s departure announcement was immediate and positive. XRP, which had been at the center of a lengthy legal battle with the SEC, saw its price surge by more than 35% within 24 hours of the news, reaching $1.5—its highest level since May 2021.

The announcement coincides with broader changes in the U.S. political landscape. President-elect Donald Trump, who will take office in January 2025, has expressed plans to strengthen America’s cryptocurrency industry. These plans include establishing a bitcoin reserve and creating the first dedicated crypto-focused position in the White House.

Industry leaders have largely welcomed the change in leadership. Chris Perkins of CoinFund suggests that Gensler’s departure signals the end of an era marked by costly litigation and regulatory uncertainty. The shift could encourage institutional investors to re-enter the crypto space and allow developers to innovate without fear of regulatory reprisal.

The transition at the SEC comes as the cryptocurrency industry faces new opportunities. Several firms have filed for XRP exchange-traded funds (ETFs), including 21Shares, Canary Capital, and Bitwise. These developments, combined with the changing regulatory landscape, could reshape the relationship between traditional finance and cryptocurrency markets.

Looking ahead, the crypto industry appears poised for potential growth under new SEC leadership. The end of Gensler’s tenure might lead to clearer regulatory frameworks and more constructive dialogue between regulators and industry participants, potentially fostering innovation while maintaining necessary investor protections.

Make money without lifting your fingers: Start using a world-class auto trading solution

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.