Crypto ETFs are expanding rapidly in 2025, with Tuttle Capital leading a wave of new applications that include leveraged funds for memecoins and alternative cryptocurrencies. This surge in filings comes as Bitcoin trades near $104,000 and the U.S. regulatory environment shows signs of warming to digital asset investment products.

Current State of Crypto ETFs

According to VettaFi’s latest data, 32 Bitcoin ETFs currently trade in the U.S. markets, with 11 being spot Bitcoin ETFs.

The market’s evolution has accelerated since December 2024, when the SEC approved Hashdex and Franklin Templeton’s Bitcoin and Ethereum index ETFs, marking a significant shift in regulatory stance.

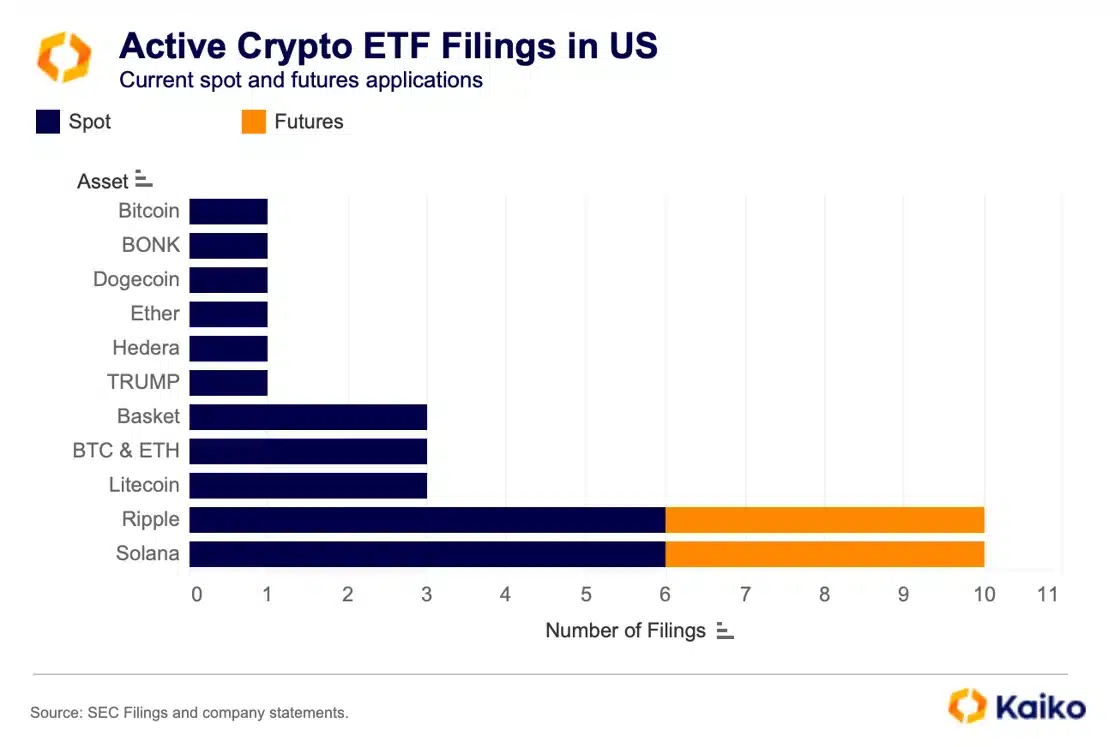

Tuttle Capital has submitted applications for 10 different leveraged crypto ETFs, including novel products tied to Donald Trump and Melania Trump-themed tokens.

NEW: @TuttleCapital just filed for 10 different leveraged crypto asset ETFs. Including a bunch of memecoin products and assets that don’t have ETPs yet. pic.twitter.com/i8X0rSdbK7

— James Seyffart (@JSeyff) January 27, 2025

The proposed funds would offer 2x leverage on various assets, including established cryptocurrencies like XRP, Solana, and Litecoin, as well as emerging tokens like Bonk.

Market experts note this aggressive expansion in ETF applications directly tests the boundaries of what regulators might permit. Bloomberg ETF analyst James Seyffart points out that these filings represent a strategic push to explore the limits of the new regulatory environment under the crypto-friendly SEC leadership.

Trading and Market Impact

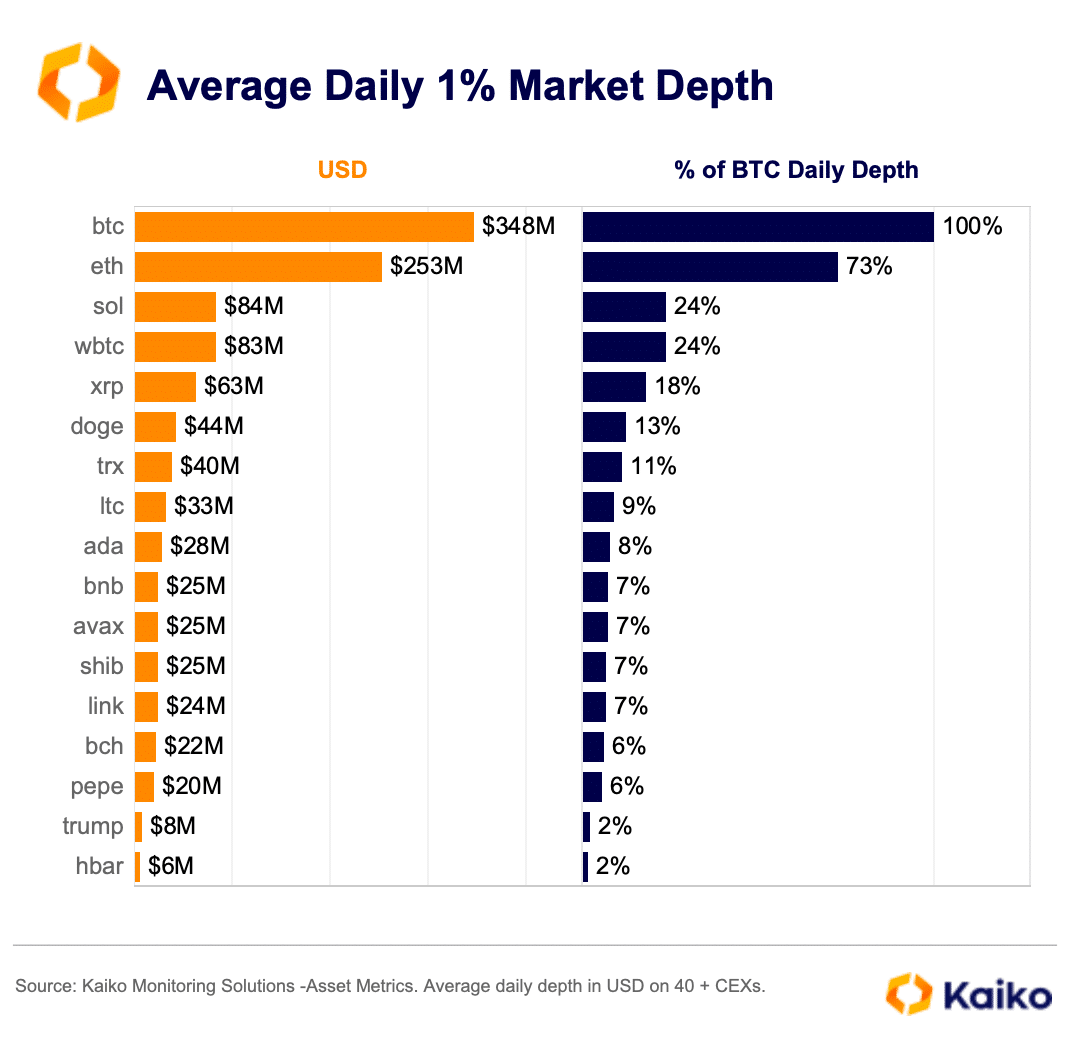

The data reveals significant variations in market depth among different cryptocurrencies, which could affect ETF approval chances. Bitcoin and Ethereum lead with the highest liquidity, while Solana’s market depth represents only 24% of Bitcoin’s.

This disparity in market depth could influence regulators’ decisions on approving new ETF products.

Other asset managers, including Osprey Funds and REX Shares, have also joined the race, filing plans for memecoin ETFs. This expanding range of crypto investment products signals growing institutional interest in providing regulated exposure to digital assets beyond just Bitcoin and Ethereum.

The market anticipates these new ETF applications could receive responses by April 2025, assuming the SEC doesn’t disapprove them. The timeline aligns with the standard 40-act filing process, though analysts caution that approval isn’t guaranteed, especially for more exotic products like leveraged memecoin ETFs.

These developments mark a significant shift from previous years when crypto ETF approvals were rare and limited to specific products. The current wave of applications suggests a maturing market infrastructure and growing confidence in cryptocurrency as an institutional investment vehicle.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.