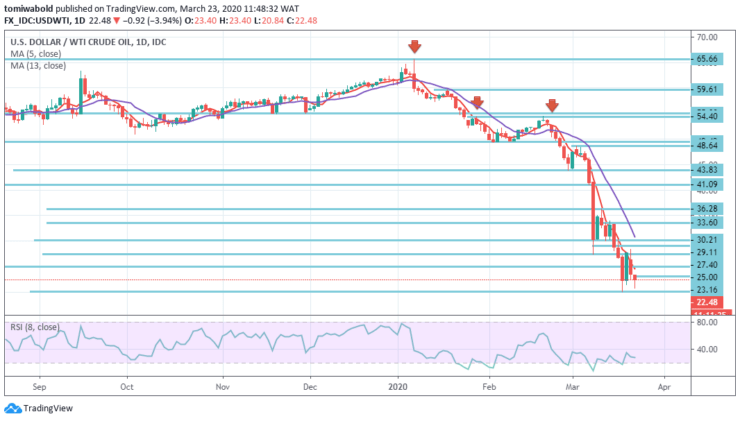

USDWTI Price Analysis – March 23

West Texas Intermediate oil prices extend the downside which started in today’s trading session since Friday. Increasing open interest combined with volatile market activity favors extra losses, well on the cards in the short-term horizon with another visit to the $20.00 level neighborhood.

Key Levels

Resistance Levels: $33.60, $30.21, $27.40

Support Levels: $20.08, $15.00, $10.00

USDWTI Long term Trend: Bearish

The pair finished higher around $23.00 level from the Asian session, with oil trading down 4.02 percent from the closing of Friday against the USD. During the European session, it’s trading even lower to $20.84 level, which saw the pair attempting to expand towards the $20.08 lower level to break the support.

USDWTI is expected to find support at level $20.08, and a drop through may usher it to the next support level of $17.34. The pair is expected to reach their first level of resistance at $27.40, and a rise through may usher it to the next level of resistance of $30.21.

USDWTI Short term Trend: Bearish

After the declines down to the $20.00 region on the 4-hour time frame, market action is similar to that level. A break down beneath could be seen dragging WTI crude oil into fresh depths.

The RSI is beneath its neutrality, indicating around 40, however, WTIUSD level of intraday resistance is estimated at $23.16, while the possibility that OPEC and Texas might reach an agreement to cut supply seems highly unlikely, suggesting that this week’s WTI crude may break the $20 mark.

Instrument: USDWTI

Order: Sell

Entry price: $23.00

Stop: $25.00

Target: $17.34

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.