EURUSD Price Analysis – March 23

Despite the opening bell in Europe at the moment, EURUSD has now come under some selling pressure after climbing to the 1.0770 regions earlier in the session and is dropping to the area beneath the 1.0700 level. The attitude of US politicians and Europe’s desperate condition with the prospect of more economic pressure may weigh heavily on the Fx pair.

Key Levels

Resistance Levels: 1.1172, 1.1000, 1.0779

Support Levels: 1.0635, 1.0569, 1.0397

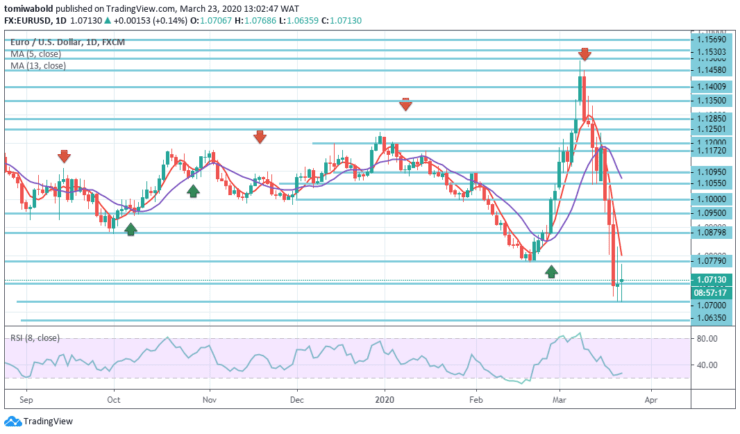

EURUSD Long term Trend: Bearish

At this point, the pair is losing about 0.05 percent at 1.0675 level and faces the next support at level 1.0635 (2020 low Mar.23) seconded by level 1.0569 (monthly low Apr.10 2017) and next is level 1.0397 (low).

The entire downtrend pattern from 1.1495 (high) level in the larger structure should have continued. The next goal is a forecast of 61.8 percent from 1.1495 to 1.0779 from 1.1495 to 1.0397 levels. That level is near 1.0339 (low in 2017). On the upside, for authenticating long-term reversal, a break of 1.1495 resistance level is required. Otherwise, even in the event of a strong recovery, the pattern can stay bearish.

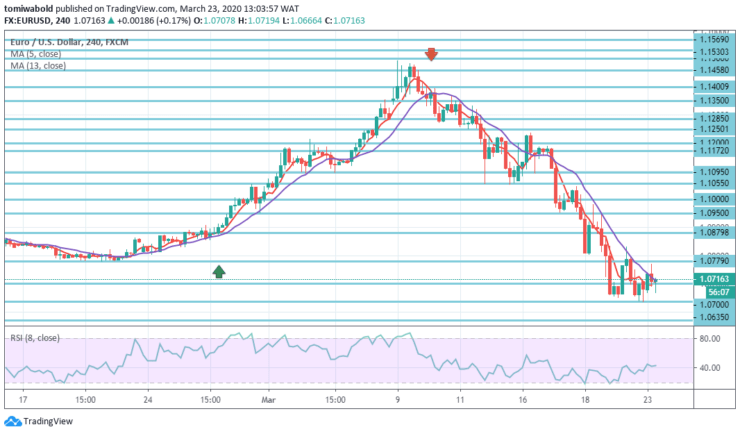

EURUSD Short term Trend: Bearish

A transient low is established at 1.0635 level with 4 hour RSI crossed at reading 40 beneath its neutrality axis, while the EURUSD Intraday bias is first turned neutral for consolidations.

The upside of recovery may be contained by 1.1000 level of resistance to usher in fall resumption while downside break of 1.0635 level may extend a broader downward trend to 1.0397 level next goal estimate.

Instrument: EURUSD

Order: Sell

Entry price: 1.0750

Stop: 1.0779

Target: 1.0635

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.