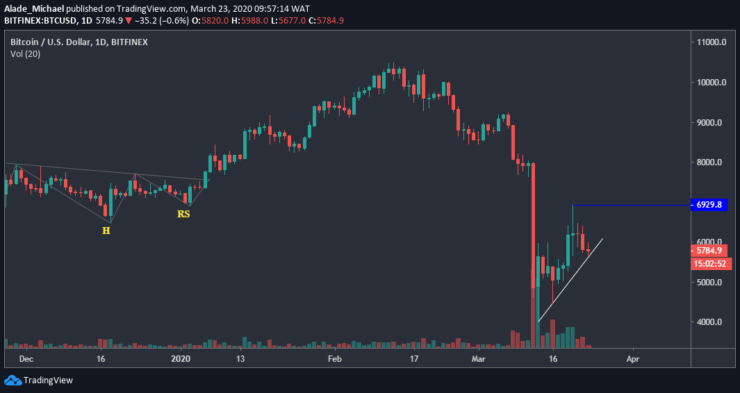

• Bitcoin is likely to resume bearish if the price drops below the daily low – $5677

Last week, the cryptocurrency market saw a significant volume, which made Bitcoin recover about 20% (from $4500) to reach a high of $6929. However, Bitcoin dropped back and closed around $5800 for the week. Following the latest price actions, Bitcoin is currently trading around $5845 with 6% loss overnight. We can expect a decent recovery if Bitcoin can reclaim $6000. Otherwise, a slow drop may roll BTC back to $5000.

Key resistance levels: $6200, $6900

Key support levels: $5677, $5000

Bitcoin (BTC) Price Analysis: Weekly Chart – Neutral

Looking at the weekly chart, we can see that Bitcoin showed some respect to the symmetrical triangle pattern after dropping to an 8-month low ($4000) in the past weeks. Following a recent bounce from the triangle’s support, Bitcoin is slowly gaining momentum back.

If the market continues to show strength again, we can expect the price to reach the triangle’s resistance in no time. The first level of resistance is $6900, which is last week’s high. An increase above this level would allow more gains to $8000. In case of bearish extension, the support to look out for is $5000 and $4000 level, which is slightly below the triangle pattern.

Bitcoin (BTC) Price Analysis: Daily Chart – Bullish

Though Bitcoin has lost some value over the past few days but considering the previous lows, which is supported by a white diagonal support line, we can say that Bitcoin is still bullish on the daily chart. However, the bears might regain control if Bitcoin pulls back beyond this rising trend line.

If BTC closes below today’s low ($5677), the price is likely to roll back at $5000, which is beneath the white rising trend line. On the other hand, Bitcoin could bounce back to $6200 and $6900 (last week’s high) if the buyers turn active in the market.

BITCOIN BUY ORDER

Buy: $5750

TP: $6200

SL: $5700

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.