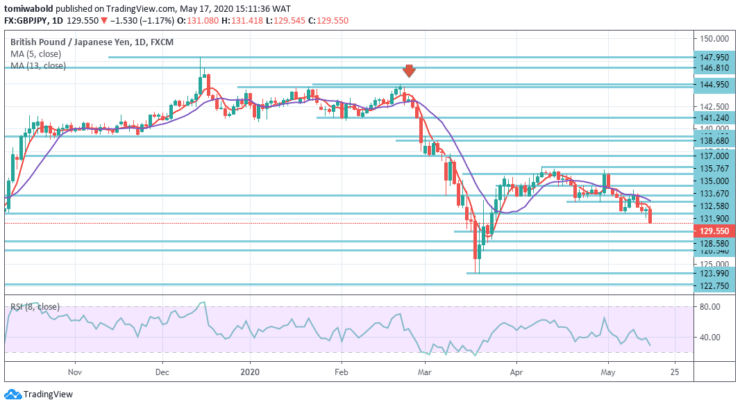

GBPJPY Prepares to Slide Further to Fresh May Lows Beneath the 130.00 Threshold

GBPJPY Price Analysis – May 17 GBPJPY turnaround from highs beyond 133.00 level earlier in the previous week has continued to slide further down to fresh May lows beneath the threshold of 130.00 where the FX pair may find buyers. At the end of the week, the pair depreciated about 1.17 percent, overwhelmed by investors concerning the effect of COVID–19 on the UK economy and fears of Brexit. Key LevelsResistance Levels: 147.95, 139.18, 135.76Support Levels: 128.58, 126.54, 123.99 GBPJPY Long term Trend: RangingIn the larger sense, 122.75 (low) level price activities are primarily a horizontal consolidation trend, which has been finished at level 147.95. The broader downward trend from level 195.86 (high) and that from level 251.09 (high) are anticipated to continue. A 122.75 level break may reach 195.86 to 122.75 levels with an estimate of 61.8 percent from 147.95 to 102.76 levels next. The trend may in some scenarios stay bearish as long as the resistance level of 147.95 remains intact.GBPJPY Short term Trend: BearishThe fall of GBPJPY continued last week to close at a level of 129.55 as seen on tradingview. The progression reinforced the perception that at 135.76 level corrective recovery from 123.99 level as seen on the daily chart has been finished. The initial bias remains on the downside this new week at 128.58 level for a 61.8 percent retracement from 123.99 to 135.76 levels. There the forceful split may also approach a low level 123.99 test. On the contrary, neutral intraday bias may first shift beyond the slight resistance level of 131.90. Bears stay in complete charge of GBPJPY and thus should anticipate more price weakness. Note: learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results Broker Benefits Min Deposit Score Visit Broker Award-winning Cryptocurrency trading platform $100 minimum deposit, FCA […]