Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Market Analysis – January 23

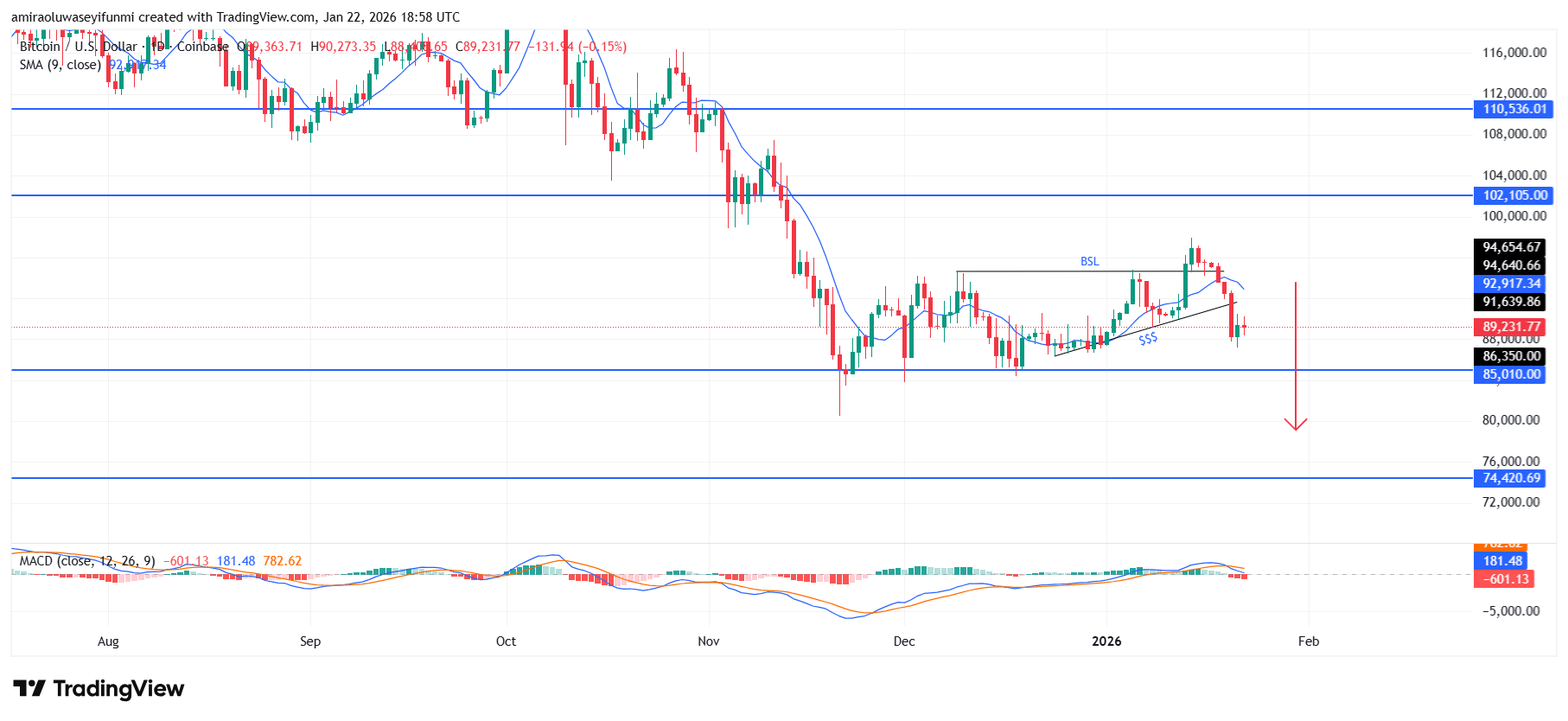

BTCUSD remains within a clearly defined bearish environment, with both trend direction and momentum indicators continuing to reinforce downside dominance. Price action stays firmly below the 9-day moving average near $92,930, highlighting sustained short-term control by sellers. The MACD remains positioned beneath the equilibrium line with an expanding negative histogram, signaling ongoing downside pressure rather than a temporary corrective move. Repeated failures to reclaim dynamic resistance levels confirm that recovery attempts are being actively sold into, reinforcing a defensive market tone.

BTCUSD Key Levels

Supply Levels: $102,110, $110,540

Demand Levels: $85,010, $74,420

BTCUSD Long-Term Trend: Bearish

Market structure continues to support this outlook, as price has maintained a consistent sequence of lower highs and lower lows since the rejection near $94,650. Upside attempts into this supply zone have repeatedly failed, unwinding quickly back toward the $89,300 region and signaling distribution-driven behavior. Former support around $92,900 has now flipped into a firm resistance band, with sustained acceptance below it reinforcing bearish control. Liquidity sweeps above short-term highs have lacked continuation, highlighting fragile and reactive buying interest.

From a projection standpoint, the technical landscape remains skewed toward further downside exploration. Sustained trading below $89,300 increases exposure to the next structural demand zone near $85,010, where a temporary reaction could emerge. A decisive breakdown below $85,010 would likely extend losses toward the $74,420 level, in line with the measured projection of the prior bearish impulse. Unless BTCUSD can reclaim and hold above $94,650 on a daily closing basis, downside scenarios remain dominant.

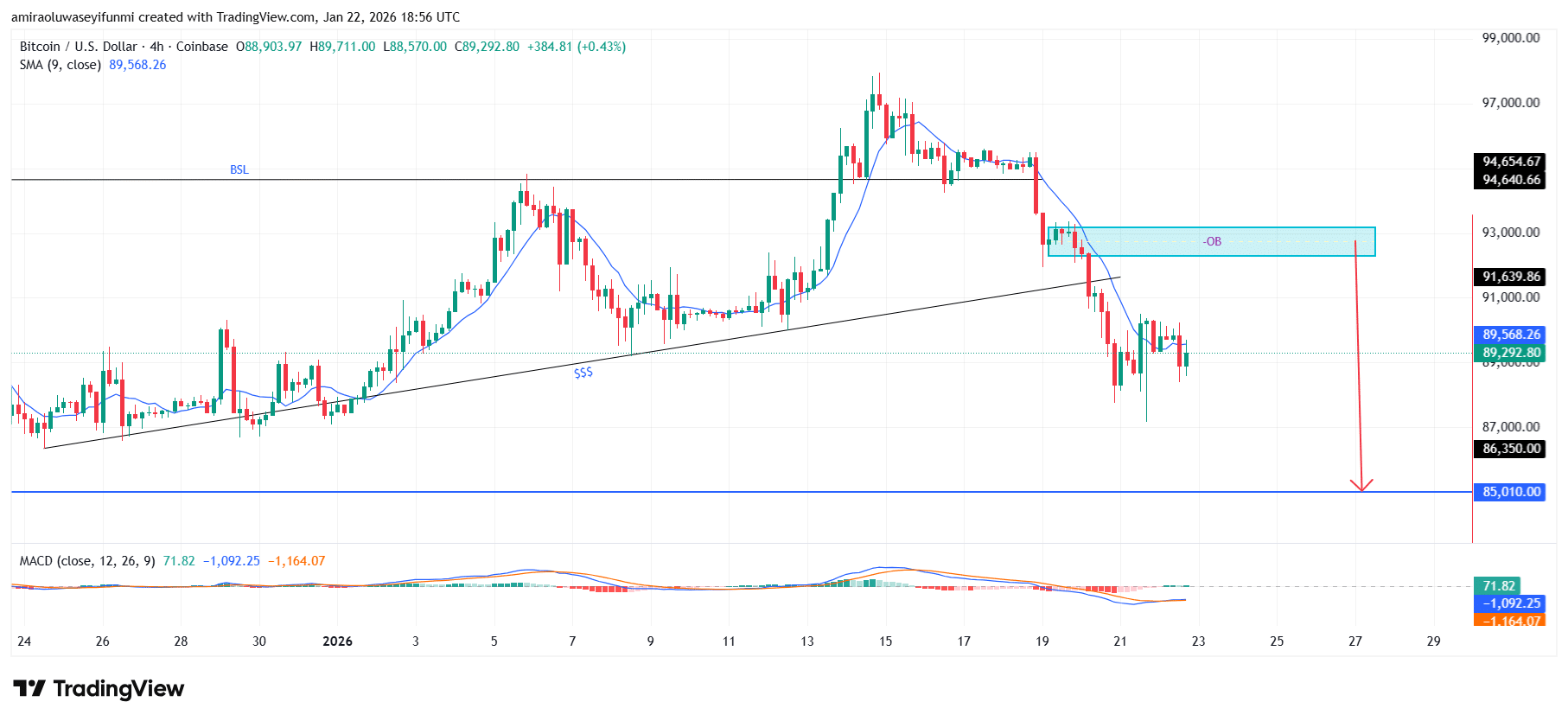

BTCUSD Short-Term Trend: Bearish

On the four-hour chart, BTCUSD maintains a bearish bias, with price trading below the 9-period moving average near $89,570 and MACD momentum remaining negative. The recent decline from the $94,650 area confirmed a lower high and reinforced downside control following rejection from the overhead supply zone around $93,000. Structurally, the break below trend support near $91,600 shifted control decisively toward sellers, while subsequent rebounds have shown limited buying commitment. As long as price remains capped below $93,000, downside pressure is likely to persist toward $86,350 and potentially the $85,010 demand zone, a scenario closely tracked through prevailing crypto signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.