Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Market Analysis – January 20

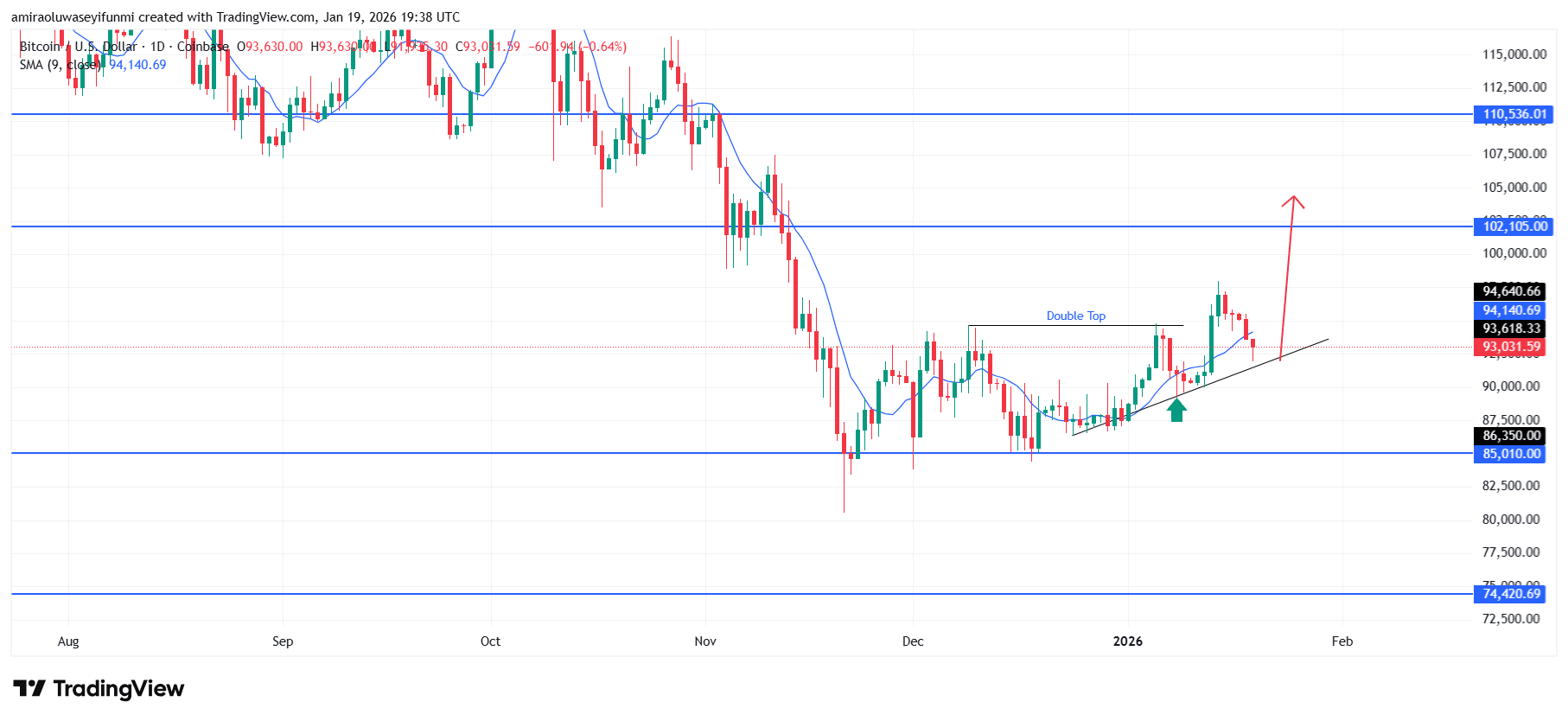

BTCUSD sustains a positive structural bias amid strengthening medium term momentum. Current daily chart behavior reflects a gradual shift back toward bullish control, supported by improving momentum conditions and a more orderly trend profile. BTCUSD is attempting to rotate above the 9-day moving average near $94,140, signaling that short-term demand is slowly reasserting itself following the corrective phase. Momentum dynamics indicate stabilization rather than exhaustion, as selling pressure has clearly diminished since the sharp pullback from the November highs. This price behavior suggests the market is transitioning from distribution into a rebuilding phase.

BTCUSD Key Levels

Supply Levels: $102,110, $110,540

Demand Levels: $85,010, $74,420

BTCUSD Long-Term Trend: Bullish

From a structural perspective, the formation of a higher low above the $85,010 support zone strengthens the validity of the developing bullish framework. The ascending trendline originating from late December remains intact, with a decisive buyer response observed within the $88,000–$89,000 region. Although supply previously surfaced near $94,600 following a double-top formation, price continues to trade above prior consolidation levels. Sustained acceptance above $93,000 helps preserve the integrity of the broader bullish structure.

From a continuation perspective, holding above $94,000 would likely facilitate a push toward the $102,100 resistance zone. A confirmed breakout beyond this level would open the door to further upside potential toward the $110,540 area over the medium term. Any corrective retracements are expected to remain shallow as long as price holds above $90,000, keeping directional control firmly with buyers. In this environment, BTCUSD remains favorably positioned for additional upside development following consolidation.

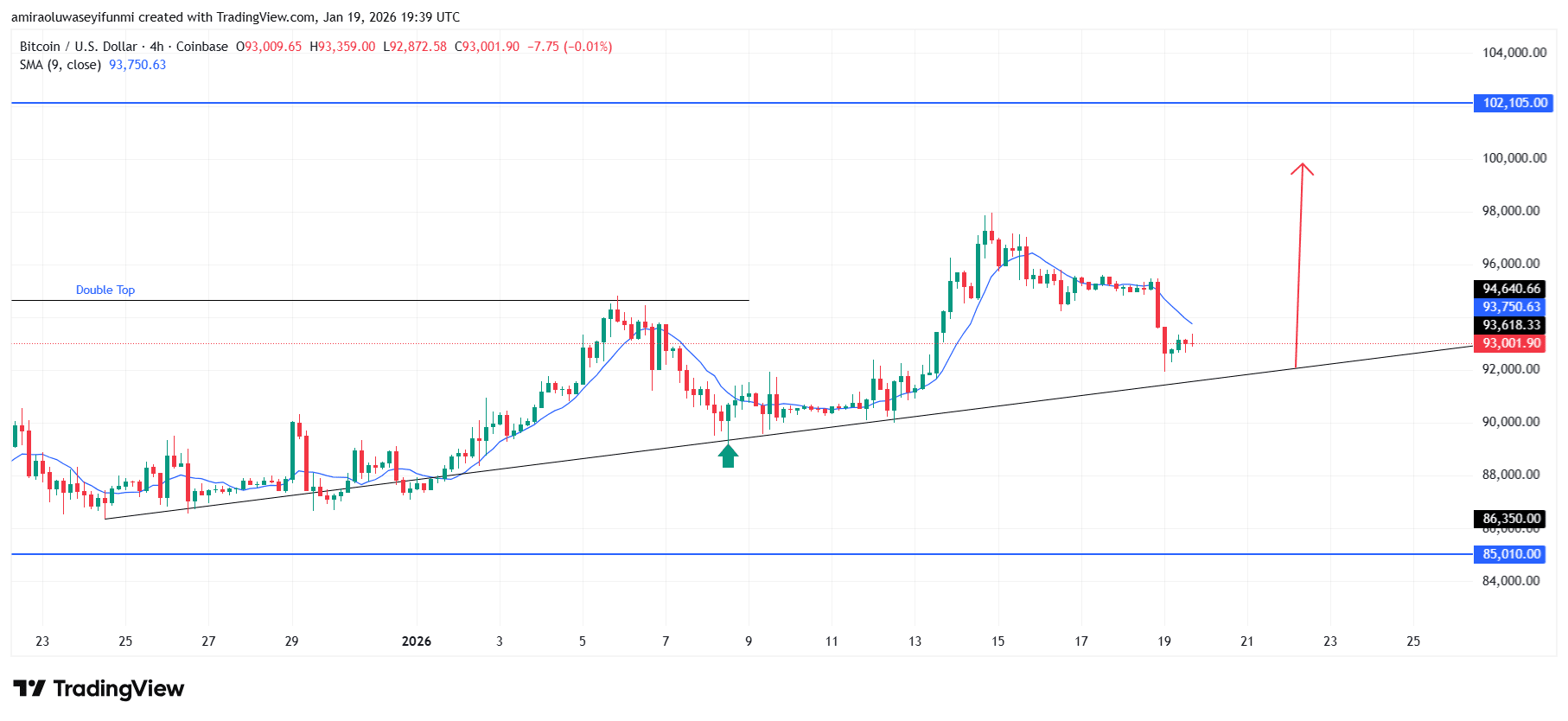

BTCUSD Short-Term Trend: Bullish

BTCUSD maintains a bullish bias on the four-hour chart, with price continuing to respect the rising trendline and hold above key structural support. The recent retracement toward the $93,000 region appears corrective, as buyers continue to defend the ascending structure rather than capitulate. While price is temporarily trading below the short-term moving average near $93,750, downside momentum remains contained, and a sustained rebound could initially target the $96,000 level, with further extension toward $102,100 if bullish momentum strengthens, aligning with prevailing crypto signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.