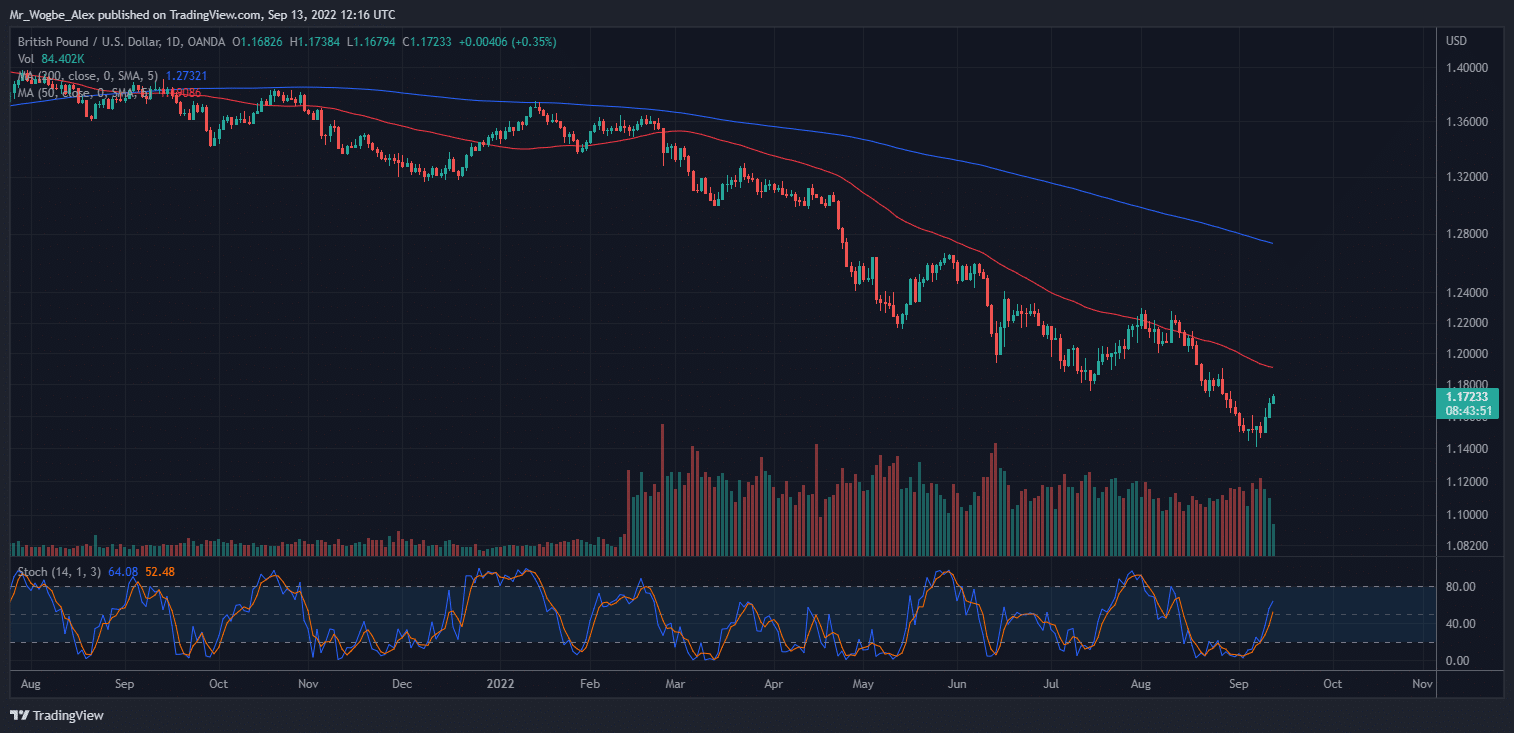

The British pound (GBP) continued its bullish recovery against the US dollar (USD) on Tuesday, despite recent economic data showing Britain’s employment boom was slowing. This was likely due to the perceived weakness in the dollar ahead of updates on US inflation later today, which could determine the US Federal Reserve’s course of action.

The recent dollar weakness opened a window for recovery for the pound, which has suffered notable declines in recent months from a mixture of domestic political crisis, faltering economy, worsening inflation, and energy crisis.

Data from the Office of National Statistics showed that Britain’s jobless count reached its lowest point since 1974. While this seemed like a positive factor at face value, it instead showed that the UK’s workforce was shrinking as the economy continued to exhibit instability.

The statistics department also noted that the amount of the UK population neither in a job nor looking for one was up due to the rising case of people falling into the “long-term sick” classification and fewer students than normal moving into the workforce. The report echoed another publication from September 12 that showed the UK’s economy was growing less than expected in July, as the surge in energy prices slashed demand.

That said, new Prime Minister Liz Truss has shown effort to get the problem under control by announcing a cap on domestic energy tariffs, although at a costly addition of £100 billion ($117.2 billion) to Britain’s already stretched finances.

British Pound Traders to Take Cue from Upcoming US CPI

The pound is up 0.38% in the mid-London session on Tuesday and has tapped a monthly high of 1.1738. All eyes now turn to the US CPI coming shortly, where the US Fed will pick a cue to either tighten efforts even more or loosen its quantitative tightening campaign and slow Interest rate hike measures. This could exert additional pressure on the greenback, paving the way for more gains in the Sterling.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.