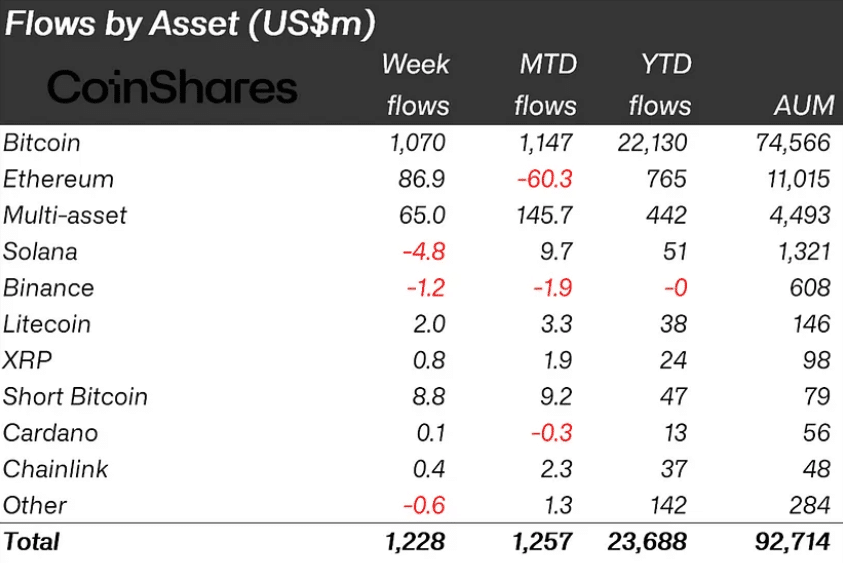

Digital asset investment products have recorded their third consecutive week of crypto inflows, totaling $1.2 billion, according to the latest CoinShares report. This significant influx of capital is largely attributed to growing investor expectations of a more dovish monetary policy from the U.S. Federal Reserve.

The approval of options for certain U.S.-based investment products has likely contributed to the positive sentiment in the market. However, it’s worth noting that trading volumes have not seen a corresponding increase, with a slight decline of 3.1% week-over-week.

Bitcoin Records Highest Crypto Inflows Across Board, Ethereum Breaks Negative Streak

Bitcoin continued to dominate the inflows, attracting $1 billion in new investments. This substantial inflow also coincided with an $8.8 million increase in short-bitcoin investment products, suggesting some investors are hedging their positions or speculating on potential price corrections.

Ethereum, on the other hand, broke its five-week negative streak with inflows of $87 million. This marks the first significant inflow for Ethereum products since early August, potentially signaling a shift in investor sentiment towards the asset.

The altcoin market showed mixed results. Solana faced outflows of $4.8 million, while Litecoin and XRP saw modest inflows of $2 million and $0.8 million, respectively. Binance Coin and Stacks experienced minor outflows of $1.2 million and $0.9 million.

U.S. Spot Bitcoin ETFs Extend Inflow Streak

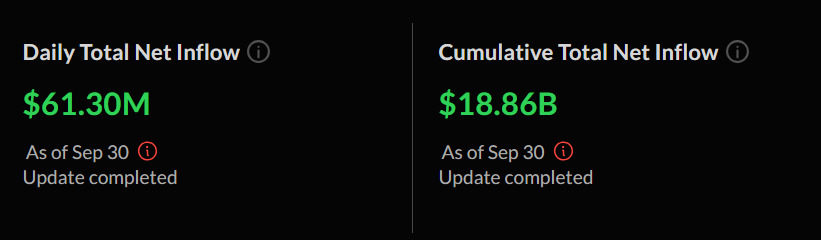

In a related development, U.S. spot Bitcoin ETFs have extended their streak of positive flows to eight consecutive days, with $61.3 million in net inflows recorded on Monday. BlackRock’s IBIT led this trend with $72.15 million in new investments, while Fidelity’s FBTC attracted $8.32 million.

However, not all Bitcoin ETFs shared in this success. Ark and 21Shares’ ARKB experienced $9.5 million in net outflows, a stark contrast to its significant inflows of $203.07 million the previous Friday. Bitwise’s BITB also saw outflows of $9.67 million.

Grayscale’s GBTC, which had previously recorded rare inflows of $26.15 million, reported zero flows on Monday, along with seven other spot Bitcoin ETFs.

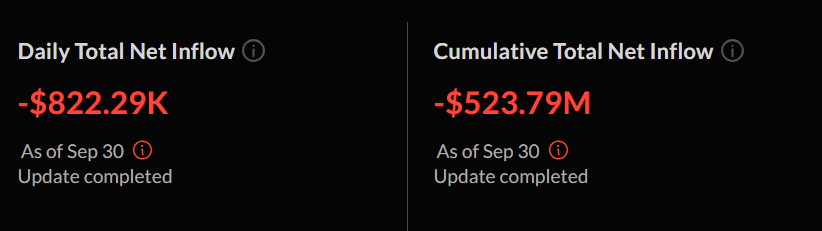

While Bitcoin products flourished, spot Ethereum ETFs in the U.S. recorded net outflows of $822,290 on Monday, following inflows of $58.65 million the previous Friday.

The Grayscale Ethereum Trust (ETHE) continued to experience outflows, with $11.81 million exiting the fund. However, BlackRock’s ETHA bucked this trend, recording net inflows of $10.99 million and marking its fifth consecutive day of positive flows.

Market Implications and Outlook

These substantial inflows into digital asset investment products, particularly in Bitcoin and Ethereum, suggest a growing institutional interest in the crypto market. The ongoing inflow trend, coupled with the approval of new investment vehicles, may signal a broader acceptance of digital assets in mainstream investment portfolios.

Interested In Trading The Market With A Trustworthy Partner? Try LonghornFX Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.