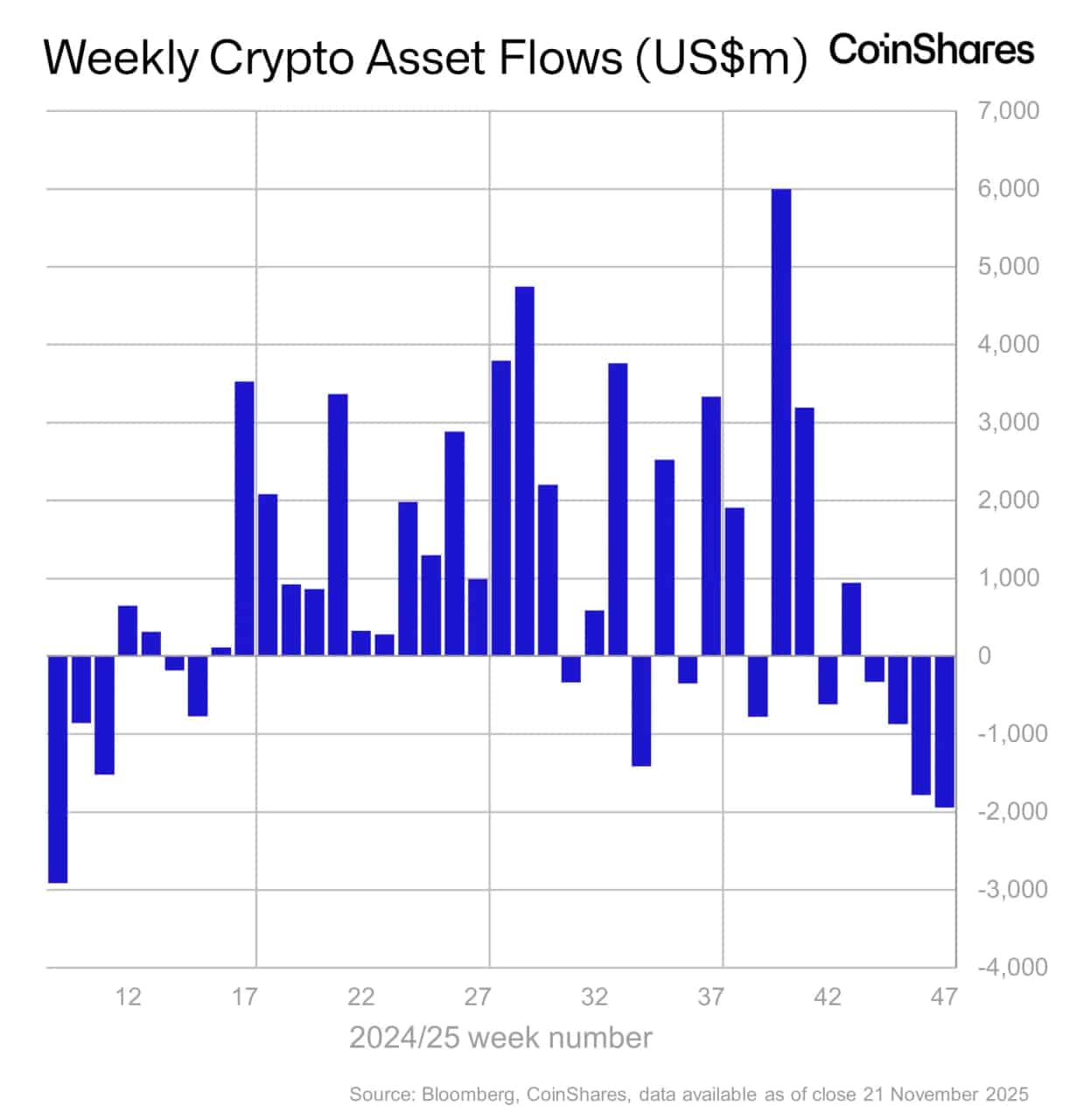

Bitcoin and the broader crypto market experienced significant selling pressure last week, with digital asset investment products recording $1.94 billion in outflows. This marks the fourth consecutive week of withdrawals, bringing the total to $4.92 billion over the past month.

The recent exodus represents roughly 3% of total assets under management across crypto funds. According to CoinShares data, this outflow streak ranks as the third-largest since 2018, trailing only the massive sell-offs in March 2025 and February 2018.

The combined impact of investor withdrawals and price declines has pushed total assets down 36% from recent peaks.

Bitcoin ETFs Show Mixed Signals

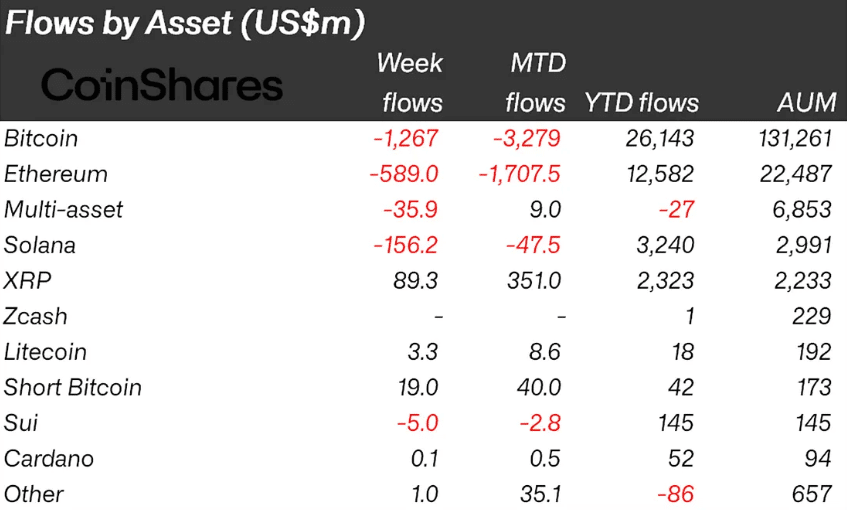

Bitcoin-focused products bore the brunt of the selling, with $1.27 billion in outflows last week alone. However, Friday’s trading session offered a glimmer of hope, as Bitcoin funds attracted $225 million in fresh capital after seven straight days of redemptions.

This tentative reversal suggests some investors may be viewing current price levels as buying opportunities.

BlackRock’s IBIT Bitcoin ETF, which manages nearly $70 billion in assets, continues to dominate the spot ETF market. The fund’s size has caught Wall Street’s attention, prompting major banks to develop new investment products tied to its performance.

Meanwhile, JPMorgan recently filed paperwork with the SEC for a structured note linked to IBIT. The complex instrument offers investors capped returns if Bitcoin prices remain stable or rise within the next year, with potential for 1.5x gains if prices surge by 2028.

The product includes downside protection of up to 30%, though losses beyond that threshold fall entirely on investors.

Altcoin Performance Varies Widely

While Bitcoin struggled, other digital assets showed diverging trends. Ethereum funds faced even steeper outflows of $589 million, representing 7.3% of their total assets. Solana also took a hit with $156 million in withdrawals.

However, XRP bucked the broader trend, pulling in $89.3 million during the same period.

Despite the rough month, year-to-date inflows remain strong at $44.4 billion, suggesting long-term investor confidence hasn’t completely eroded. The coming weeks will test whether Friday’s turnaround signals a genuine shift in sentiment or just a temporary pause in selling.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.