Digital asset investment products are bleeding capital, with crypto outflows reaching $2 billion last week—the steepest weekly decline since February.

This marks three consecutive weeks of negative flows, totaling $3.2 billion in withdrawn funds as uncertainty around monetary policy and large-scale selling by crypto holders shake market confidence.

According to the latest CoinShares report, the selloff has been harsh. Total assets under management in digital asset exchange-traded products dropped from $264 billion in early October to $191 billion—a 27% decline that reflects growing caution among institutional investors.

US Market Bears the Brunt of Crypto Outflows

American investors led the exodus, accounting for 97% of total crypto outflows at $1.97 billion. Switzerland and Hong Kong followed with $39.9 million and $12.3 million in withdrawals, respectively.

Germany stood out as the lone bright spot, seeing $13.2 million in inflows as some investors viewed the price drops as buying opportunities.

Bitcoin took the hardest hit with $1.38 billion in outflows, representing 2% of its total assets under management over this three-week period. Ethereum fared worse proportionally, losing $689 million—roughly 4% of its AuM.

Smaller assets like Solana and XRP also saw modest outflows of $8.3 million and $15.5 million.

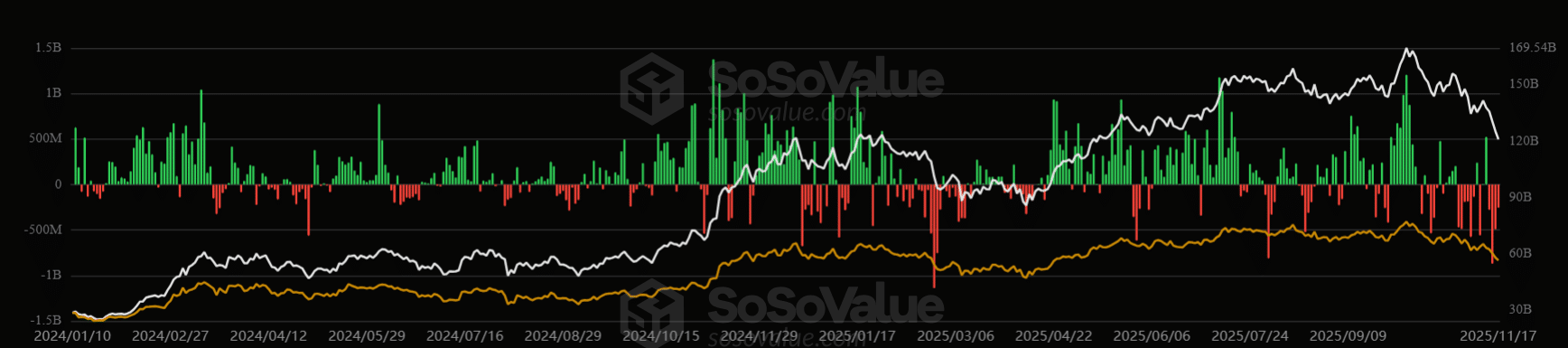

Bitcoin and Ethereum ETFs Continue Negative Streak

Monday’s trading session extended the pain. Bitcoin spot ETFs recorded $254.5 million in outflows, with BlackRock’s IBIT fund alone shedding $145.5 million. This marked the fourth straight day of losses, bringing the four-day total to nearly $1.9 billion.

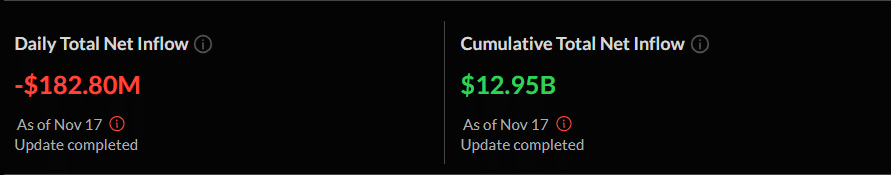

Ethereum spot ETFs weren’t spared either, posting $182.8 million in outflows led by BlackRock’s ETHA. The asset has now experienced five consecutive days of withdrawals, totaling $911.4 million.

Market analysts point to several factors driving these crypto outflows:

- Elevated interest rates

- Fiscal uncertainty

- Bitcoin dropping below $90,000 to its seven-month lows

The combination has eroded the “store of value” narrative that previously attracted institutional money.

Interestingly, newly launched altcoin ETFs bucked the trend. XRP ETFs pulled in $25.41 million, Litecoin ETFs added $2 million, and Solana ETFs gained $8.26 million. This suggests some investors are rotating into alternative digital assets rather than exiting crypto entirely.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.