Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Most of us have at least thought about investing in cryptocurrencies. The fact is that many people are put off by the lack of regulation, and horror stories of wallets being hacked by cryptojackers.

Our Crypto Signals

1-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

12-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime Subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioThe good news is that there are places to turn – so in this guide, we talk about what makes a good crypto platform.

We also review the best platforms to buy cryptocurrency online and offer a simple four-step walkthrough of how to sign up and access the markets.

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card

Best Platform to Buy Cryptocurrency Today: Sneak Preview

No time to read our full guide today but keen to get started? You will see below a sneak preview of the best platforms to buy cryptocurrency in 2023:

- No 1: AvaTrade – Overall Best Platform to Buy Cryptocurrency 2023

- No 2: LonghornFX – Best Platform to Buy Cryptocurrency With High Leverage (Up To 1:500)

All the above platforms are able to offer heaps of cryptocurrency markets, low fees, and safe transactions when buying and selling.

Your capital is at risk when trading CFD assets with this provider.

Best Platform to Buy Cryptocurrency Today!

For those who want the full report – see below the best platform to buy cryptocurrency today!

1. AvaTrade – Overall Best Platform to Buy Cryptocurrency 2023

AvaTrade is a top-rated CFD brokerage, licensed by six regulatory bodies - inclusive of respected authority ASIC of Australia. As such, this platform promises safe cryptocurrency purchases and will segregate your trading funds from company money. Leverage of up to 1:500 is available here - although limits depend on where you live and the specific asset class.

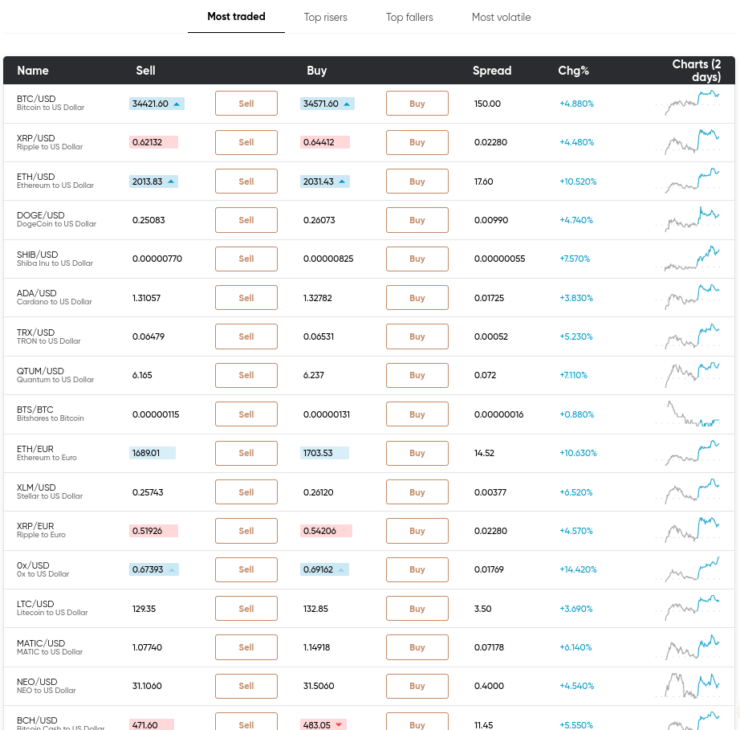

There is no shortage of variety at this brokerage, as you can trade crypto against fiat currencies like USD or alternative digital assets. To give you an idea of what's listed on this platform, this guide found IOTA, Ripple, Dogecoin, Bitcoin, Stellar, Litecoin, Dash, Chainlink, and many more. You will also find assets such as forex, commodities, stocks, and ETFs.

All of which are commission-free to buy and sell. In terms of crypto-to-fiat pairs - popular examples include NEO/USD, BTC/USD, BTC/EUR, and BTC/JPY. The spread is competitive and varies between 0.25% and 2% over-the-market. Furthermore, you will have options regarding trading platforms with this crypto provider.

This includes MetaTrader 4 and 5, AvaSocial, DupliTrade, AvaTradeGO, and more. The latter enables hands-off trading, such as the ability to invest in and copy another person, without having to perform technical analysis. When connecting your AvaTrade account to MT4, you will also be able to use the free demo trading facility.

This will come with paper practice funds which can be helpful for thinking up strategy ideas and learning technical analysis - there are plenty of tools on MT4. If you won't wish to download software, WebTrader is a simple alternative, and also compatible. There is also educational content for any beginners, including trading videos, economic indicators, and more.

We found the AvaTrade website super simple to use and like that there are multiple platform options. Signing up takes hardly any time at all and there are various deposit methods to choose from when the time comes to fund your account. This includes e-wallets such as Skrill and Neteller. Alternatively, you can use a credit or debit card, or a bank transfer.

- Wide variety of crypto assets and tight spreads

- Regulated and licensed by ASIC, FSCA, FSA and others

- Trade crypto CFDs with no commission fees payable

- Admin and inactivity fee following 12 months without trading

2. VantageFX – Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

3. LonghornFX – Best Platform to Buy Cryptocurrency With High Leverage (Up To 1:500)

LonghornFX might sound like a forex broker, but this is the best platform to buy cryptocurrency with high leverage up to 1:500. This provider follows CFT and AML procedures and only requires a minimum deposit of $10. Furthermore, you can also access forex and commodities.

This guide found cryptocurrencies listed here to comprise NEO, Dash, Ethereum, IOTA, Bitcoin Cash, and more. The spread is tight across the majority of digital assets. For instance, crypto-fiat pair BTC/USD comes with a spread of approximately 0.2% This is not a commission-free cryptocurrency platform. With that said, we found it to be super competitive at $6 per 1 BTC traded.

The best way to make the most out of everything this broker has to offer is to connect your LonghornFX account to MT4. As we have said before, MT4 provides access to a ton of advanced charts, drawing tools, and indicators - to aid you with trying to profit from rising or falling prices. You can also take advantage of passive tools such as trading signals, and copy trading. For any newbies, we had a look at educational material.

CFD broker LonghornFX has a section dedicated to learning resources. This includes video tutorials on things like making a deposit, MT4, and webinars. This guide also found a daily serving of technical analysis which includes price breakout and trend indicators and much more. When you are ready to hit the markets, you can deposit using Bitcoin, credit or debit card, or bank transfer. This cryptocurrency broker promises same-day withdrawals and 24-hour customer support via phone call, email, or live chat. The latter is usually the most convenient way to access help.

- Buy cryptocurrency with super high leverage - up to 1:500

- Low commission and tight spreads

- Same-day withdrawals and plenty of crypto-assets

- Platform favors Bitcoin deposits

4.Currency.com – Best Platform to Buy Cryptocurrency via Tokenized Assets

Currency.com is the best platform to buy cryptocurrency as a tokenized asset. For those in the dark about what this is, it is a form of derivative trading. It allows you to speculate and trade based on the increase or decrease of an underlying cryptocurrency, of course, meaning you can go short if you wish.

Each token simply represents a specific quantity (or portion) of the asset it tracks. As such, you can buy and sell tokenized versions of markets that interest you. Much like with CFDs, this means you can buy a fraction of a digital cryptocurrency. Furthermore, you can still add leverage.

Currency.com offers leverage up to 1:500, depending on the aforementioned factors. This is one of the best crypto exchanges in the space, and lists over 2,000 tokenized markets. We found this to include Ethereum, Dogecoin, Augur, OMG, SuchiSwap. Digital-fiat pairs include BTC/EUR, XRP/EUR, LTC/USD.

To give you an idea of the spread - popular pair BTC/USD averages 0.001%. You can also merge cryptocurrencies with exotic markets such as the Russian ruble, Turkish lira, Belarusian ruble, and Costa Rica colon - to name a handful. For future reference, you will also find tokenized bonds, forex, shares, commodities, and indices.

Features include a section dedicated to learning to trade. This includes trading guides, dictionaries, jargon-busters, online lessons, and more. This crypto exchange has a free mobile application, so that you can buy and sell on the move - as well as examine historical price data. Furthermore, there is no need to swap your digital funds for fiat.

Currency.com marries cryptocurrencies with the aforementioned markets perfectly by enabling Bitcoin and Ethereum deposits. There is no official minimum deposit stipulated, but unless you fund your account with at least $10, you won't be able to do an awful lot. If you are yet to buy cryptocurrencies, you can opt to fund your account with a credit/debit card or bank transfer.

- Buy and sell cryptocurrency pairs with competitive spreads

- Low commission fees and high leverage up to 1:500

- Same-day withdrawals and multiple tokenized markets

- Bitcoin and Ethereum deposits are preferred by this crypto exchange

Tips for Seeking out the Best Platform to Buy Cryptocurrency Today!

Although we have offered reviews of the best platforms to buy cryptocurrencies – it’s always wise to understand what separates the good from the mediocre.

The Best Crypto Exchanges are Regulated

Regulated cryptocurrency platforms offer investors and traders a safety net from shady companies offering brokerage services. If an exchange isn’t licensed – it literally answers to no one and can therefore do as it pleases.

Furthermore, there is little to no chance of a licensed platform using any of your trading funds. Most regulatory bodies enforce client fund segregation – meaning your money has to be held separately in a different bank account to the exchange.

This is just one of the many reasons many believe that the best crypto exchanges are regulated. Not only that, but licensed providers often offer the lowest fees and tightest spreads to buy cryptocurrencies.

Low Crypto Exchange Fees

It’s crucial to avoid brokers with hefty fees as they can quickly eat away at your gains.

See below a list of commonly charged fees to be mindful of:

- Commissions: One of the main charges to look out for is the commission. What you have to pay will depend on your chosen crypto exchange. Some charge 0%, others charge a fixed fee, and some a variable – in the form of a percentage of your position. Always check what you might be liable for before you begin.

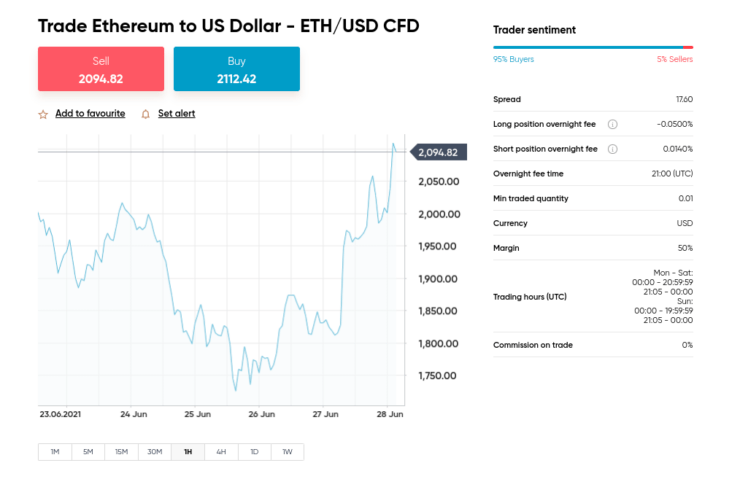

- Spread: This is an indirect fee to be aware of. In case you aren’t sure what the spread is – it’s the gap between the bid and ask price. If you go long on say EOS/USD, and the spread on offer is 2% – you need to make gains of 2% to break even. Anything over that amount will be profit. All the platforms we reviewed today offer tight spreads on cryptocurrencies.

- Overnight Financing: Another small fee that can add up is overnight financing, otherwise called a rollover or swap – depending on the CFD trading platform. This is comparable to an interest fee. For those unaware, it is a charge you must pay for each day a CFD trade is left open overnight. Most crypto exchanges make this charge very clear when you are placing an order.

- Withdrawal and Deposit: Deposit and withdrawal fees aren’t uncommon at platforms providing access to cryptocurrencies, especially if it’s on a specific payment method like credit cards. Of course, some are more reasonable than others – and there are also many that charge nothing at all.

As you can see, there are a few fees to check out before committing to a cryptocurrency platform. This way, you can weigh up your options to figure out the best option for your own best interest.

Crypto Markets and Beyond

After regulation and fees, it’s good to make sure you can access a good mixed bag of cryptocurrencies – and beyond. For instance, you might want to know how to buy TRON now – but later learn how to trade ETFs.

Having heaps of assets in one place makes life much easier, if or when you decide to branch out. For instance, you might decide to buy and sell in contrasting market conditions – as many traders and investors do.

As such, look out for a wide range of cryptocurrencies – but also assets covering major, minor, and emerging fiat currencies – as well as indices, commodities, and shares.

Consider Cryptocurrency Storage

This guide found that the best platform to buy cryptocurrencies will use two-factor authentication – meaning you have to log in twice (in different ways). SSL encryption is another safety measure often adopted by regulated providers to protect your personal information.

Onto the storage of your cryptocurrency purchases – when buying and selling CFDs – you do not own the asset the financial instrument mimics. This means you do not need to worry about storage. Instead, the contract’s value simply fluctuates along with the asset in question.

As such, by accessing the digital currency market via a regulated space, you will often be trading financial instruments such as CFDs – which will see you speculating on the crypto-asset’s rise or fall in value.

Plus, as we mentioned, depending on which jurisdiction you fall under – the cryptocurrency platform will safely hold any trading equity you have in a separate account to the exchange. This saves you from downloading a wallet and keeping your coins secure.

Cryptocurrency Platform Navigation

It might seem obvious but it’s wise to ensure that you can easily find your way around any platform when looking to buy cryptocurrencies. If searching for your preferred asset in a hurry is awkward – you could miss trading opportunities.

Accepted Deposit Types

If you have a specific payment method in mind or are limited to what you can use – check what’s accepted. For instance, if you would like to make a deposit using a digital currency like Ethereum, you must make sure this is an option for you.

It’s much better to check now than to go through the sign-up process first. The best brokers will accept everything from credit and debit cards to e-wallets, wire transfers – and in some cases Bitcoin and Ethereum.

The Best Crypto Exchanges Have Extra Features

Whilst we have covered the most important aspect of what makes a good cryptocurrency platform – there are other things to consider!

See below some extra features that people buying cryptocurrencies might look for.

Short Sell Cryptocurrencies

Look out for crypto exchanges that offer CFDs, like the ones we have talked about today.

For any complete novices reading:

- Place a buy order if you think its value will rise – this is ‘going long’

- Place a sell order if you think the price will fall – this is ‘going short’

As we said – this means you can make gains on an asset falling in value as well as rising. Of course, first, you have to be correct in your hypothesis.

Technical Analysis

This brings us neatly onto the subject of technical analysis tools – which, as you likely know, is super important for predicting the market sentiment on digital currencies. This is fairly simple – some platforms have it, some don’t.

Mirror Trader Compatibility

If you fancy trying a passive way of buying cryptocurrencies – how about trying a mirror trader strategy, also called copy trader? This is a tool some platforms have that enables you to take your hands off the wheel and removes the need to study the aforementioned charts and such.

For anyone unversed, let’s say you invest $1,000 in MirrorTrader123. That person allocates 5% of their account capital to a TRON/USD long position and also goes short on NEO/USD with the equivalent of 3%.

In this scenario, you automatically see $50 of your investment has been allocated to a TRON/USD long order – as well as a $30 sell order on NEO/USD. If this sounds like something you are interested in – the best platform to buy cryptocurrency on our list today – AvaTrade, is compatible with both MT4 and DupliTrade.

Best Platform to Buy Cryptocurrency Today: Sign up in Five Steps

To get started and gain access to cryptocurrencies, you need to first create an account with a suitable platform.

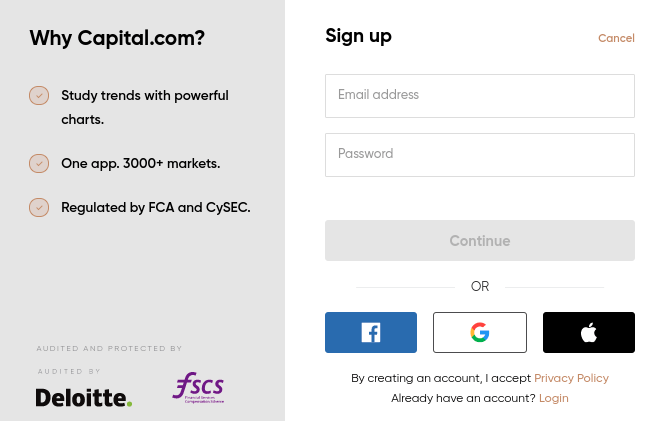

Step 1: Choose a Platform and Sign up

Head over to the best platform for your needs and look for the link to sign up. You will need to enter your name and choose a password at this stage, to tell the provider who you are.

Most cryptocurrency platforms will require additional details such as your date of birth, home address, and tax number.

To buy cryptocurrency, the platform might also ask some questions about your trading experience and income too. This is all standard practice amongst regulated crypto exchanges.

To buy cryptocurrency, the platform might also ask some questions about your trading experience and income too. This is all standard practice amongst regulated crypto exchanges.

Your capital is at risk when trading CFDs at this provider

Step 2: Upload Identification Documents

The cryptocurrency platform will also need you to upload a copy of an official ID – such as a driving license or a passport.

So that the platform is able to validate your address, you can upload a utility bill or bank statement. This must contain your name, address, and a date (usually within the last 6 months). Some brokers also accept landline bills.

Step 3: Make a Deposit

Once you have received an email confirming that the platform has set your new account up, you can add some funds to buy cryptocurrency.

This part is usually super easy. Enter the amount of money you would like to deposit into your new account – select a method to use – and confirm. The money will appear as trading equity within your portfolio.

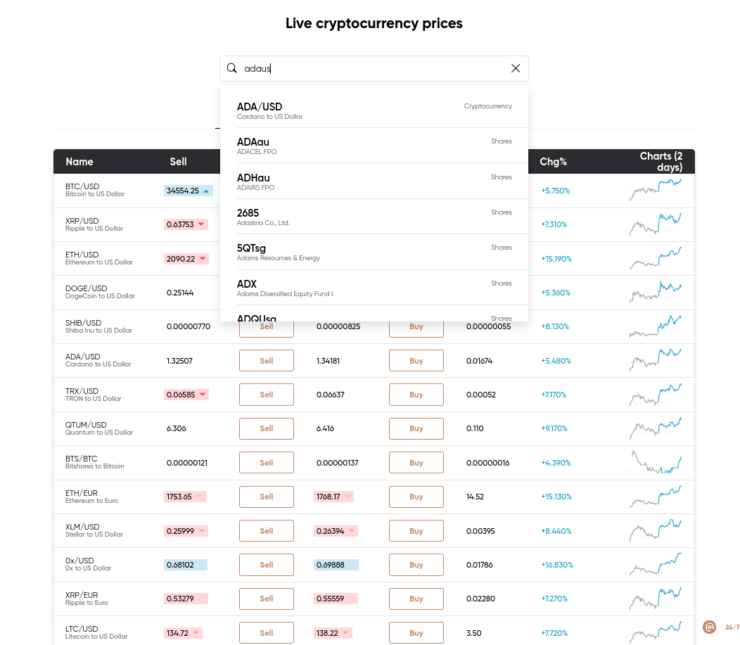

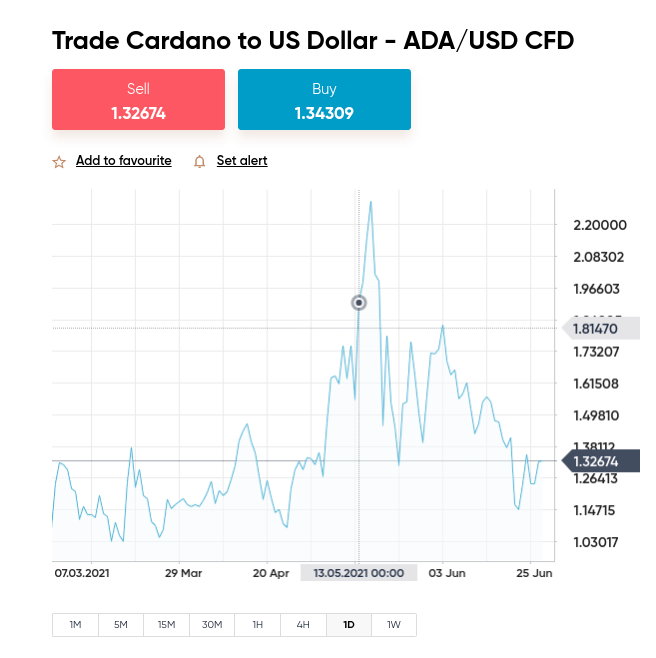

Step 4: Choose a Crypto-Asset to Buy

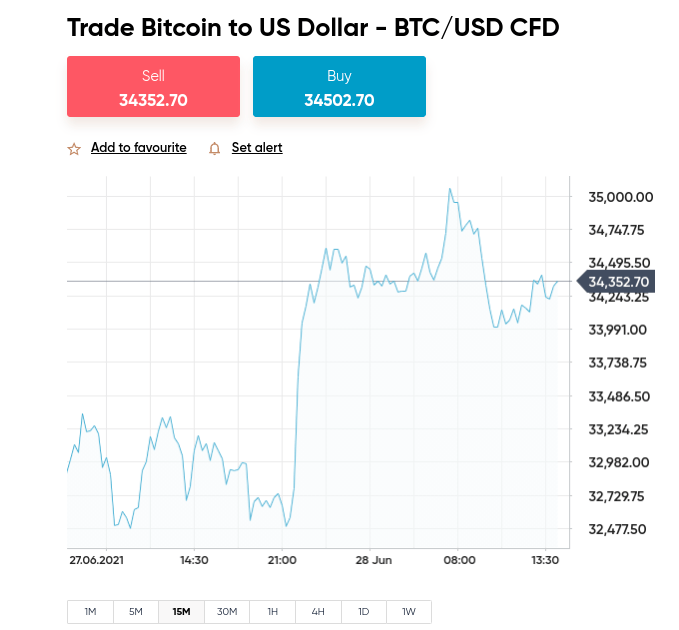

Here we are looking to place a buy order on Cardano against US dollars. If you know what you are looking for, type it in the search bar at your chosen crypto exchange.

Step 5: Place an Order

Confirm your choice and fill in the order box presented to you. As we said, most cryptocurrency platforms allow both buy and sell orders – the latter used if you predict a falling market.

Best Platform to Buy Cryptocurrency Today: To Conclude

The best platform to buy cryptocurrencies is one you feel comfortable placing orders at. It should also offer you tons of digital markets with super low fees! Furthermore, think about investigating which markets are listed – before committing.

For example, you might try trading crypto-assets against fiat currencies like the US dollar or the Japanese yen. Or, you might want to trade crypto-cross pairs – such as BTC/ETH or XRP/EOS.

After in-depth research and ticking a long checklist of requirements – heavily regulated AvaTrade was revealed as the overall best platform to buy cryptocurrencies. Runners up include Capital.com, LonghornFX, and Currency.com. All keep fees to a minimum and offer a diverse range of markets.

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card